Stock Analysis

- South Korea

- /

- Banks

- /

- KOSE:A055550

Exploring Dividend Stocks On The KRX For July 2024

Reviewed by Simply Wall St

The South Korean market has shown promising growth, with a 1.3% increase over the last week and an impressive 5.8% rise over the past year, alongside forecasts predicting annual earnings growth of 30%. In such a buoyant environment, dividend stocks that offer consistent payouts can be particularly appealing to investors looking for both stability and potential income.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 4.53% | ★★★★★★ |

| LOTTE Fine Chemical (KOSE:A004000) | 4.40% | ★★★★★☆ |

| NH Investment & Securities (KOSE:A005940) | 6.38% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 7.03% | ★★★★★☆ |

| KT (KOSE:A030200) | 5.52% | ★★★★★☆ |

| Shinhan Financial Group (KOSE:A055550) | 4.24% | ★★★★★☆ |

| KB Financial Group (KOSE:A105560) | 3.68% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.09% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 4.85% | ★★★★★☆ |

| Cheil Worldwide (KOSE:A030000) | 6.01% | ★★★★☆☆ |

Click here to see the full list of 71 stocks from our Top KRX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Korean Reinsurance (KOSE:A003690)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Korean Reinsurance Company operates in Korea and internationally, offering life and non-life reinsurance products with a market capitalization of approximately ₩1.18 trillion.

Operations: Korean Reinsurance Company generates its revenue primarily from reinsurance services, totaling approximately ₩4.14 billion.

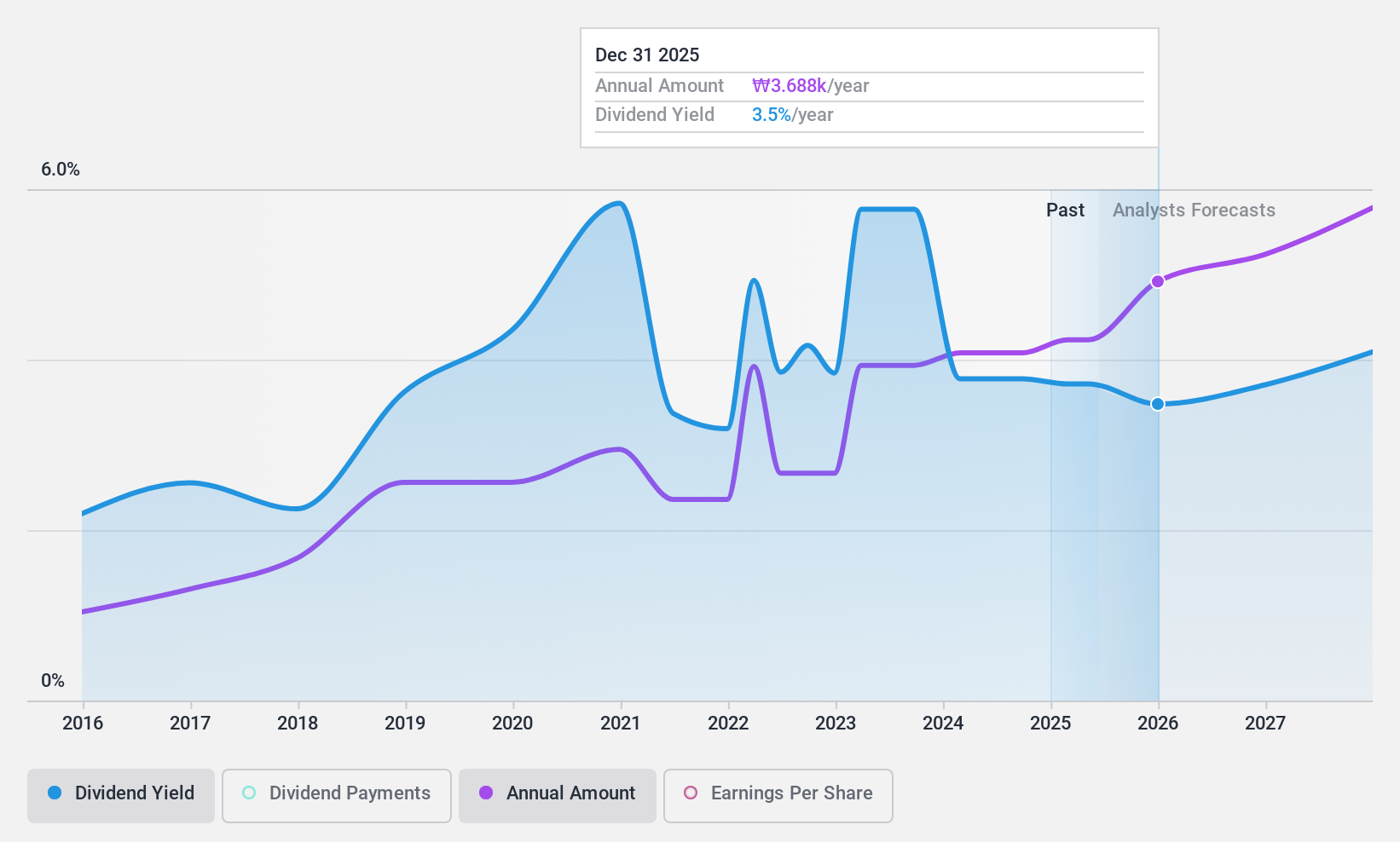

Dividend Yield: 6.7%

Korean Reinsurance reported a significant drop in Q1 earnings for 2024, with net income falling to ₩58 billion from ₩114 billion year-over-year. Despite this, the company's dividend yield of 6.72% ranks in the top 25% in the South Korean market. Analysts predict a potential stock price increase of 22.8%. Dividend sustainability is supported by a low payout ratio of 37.6% and an even lower cash payout ratio of 7.2%, indicating strong coverage by both earnings and cash flow despite less than a decade of dividend history and recent financial volatility influenced by large one-off items.

- Get an in-depth perspective on Korean Reinsurance's performance by reading our dividend report here.

- The analysis detailed in our Korean Reinsurance valuation report hints at an deflated share price compared to its estimated value.

Shinhan Financial Group (KOSE:A055550)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shinhan Financial Group Co., Ltd. operates as a provider of a diverse range of financial products and services both in South Korea and globally, with a market capitalization of approximately ₩25.21 trillion.

Operations: Shinhan Financial Group Co., Ltd. generates its revenue primarily from banking (₩8.67 billion), credit cards (₩2.02 billion), and securities (₩0.76 billion).

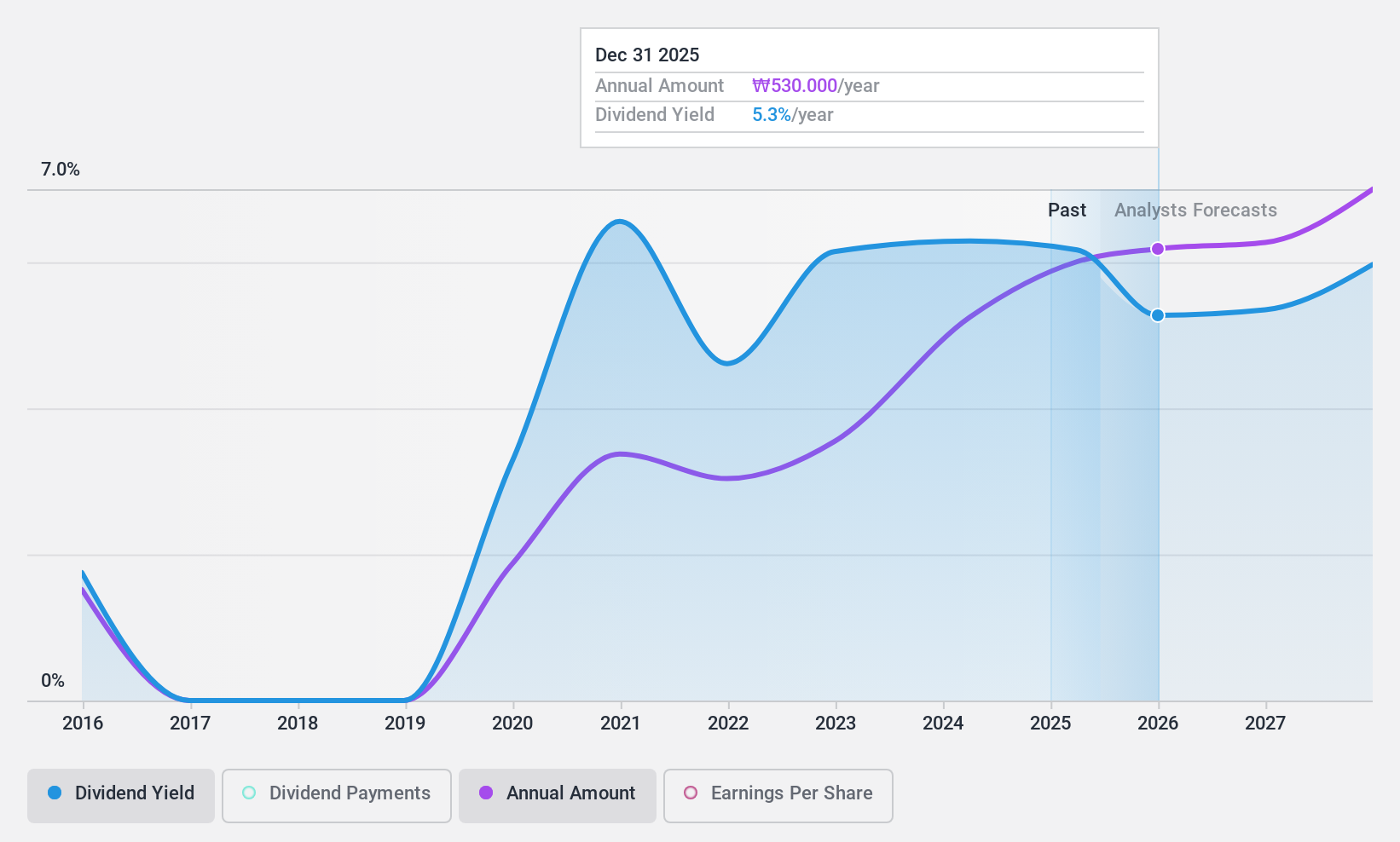

Dividend Yield: 4.2%

Shinhan Financial Group's current trading value is significantly under our fair value estimate by 60.1%. While the company's earnings are expected to grow annually by 7.52%, its dividend history over the past decade has been marked by volatility and inconsistency, with payments not showing stable growth. However, dividends have increased over these years and currently have a yield of 4.24%, placing it in the top quartile of Korean dividend payers. The dividends are well-covered by earnings with a payout ratio of 33% now and an even lower forecasted ratio of 23.4% in three years, suggesting improved sustainability ahead despite past fluctuations. Recent activities include a KRW 300 billion share repurchase program aimed at enhancing shareholder value, indicating proactive management steps towards financial stability and investor returns.

- Click here to discover the nuances of Shinhan Financial Group with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Shinhan Financial Group is priced lower than what may be justified by its financials.

KB Financial Group (KOSE:A105560)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: KB Financial Group Inc. operates as a comprehensive financial services provider, offering banking and related services to individuals and businesses in South Korea and several international markets, with a market capitalization of approximately ₩31.64 billion.

Operations: KB Financial Group Inc.'s revenue is generated primarily from its banking sector, which includes corporate finance (₩4.39 billion) and household finance (₩4.23 billion), along with contributions from the securities (₩1.59 billion), credit card (₩1.10 billion), and non-life insurance sectors (₩1.19 billion).

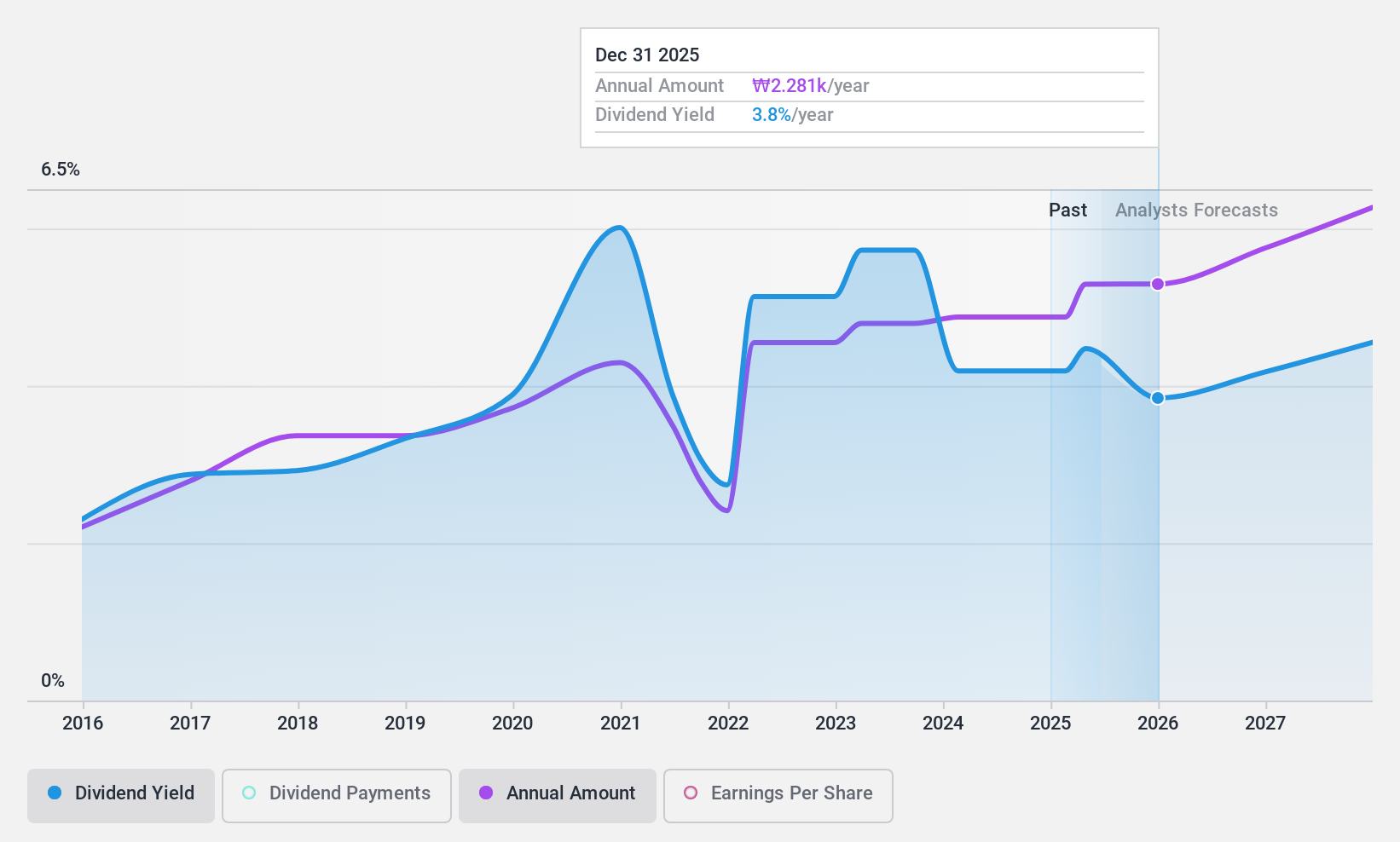

Dividend Yield: 3.7%

KB Financial Group's dividend yield of 3.68% positions it in the top 25% of South Korean dividend payers, though its history shows volatility in payments. Recent earnings have declined, with net income dropping to KRW 1,049 billion from KRW 1,509 billion year-over-year as of Q1 2024. Despite this, dividends are covered by earnings with a current payout ratio at 32%, and forecasted to remain sustainable at a ratio of 25.2% in three years. The firm actively returned value to shareholders through significant share buybacks totaling KRW 300 billion recently.

- Click here and access our complete dividend analysis report to understand the dynamics of KB Financial Group.

- Insights from our recent valuation report point to the potential undervaluation of KB Financial Group shares in the market.

Make It Happen

- Explore the 71 names from our Top KRX Dividend Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Shinhan Financial Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A055550

Shinhan Financial Group

Provides financial products and services in South Korea and internationally.

Flawless balance sheet established dividend payer.