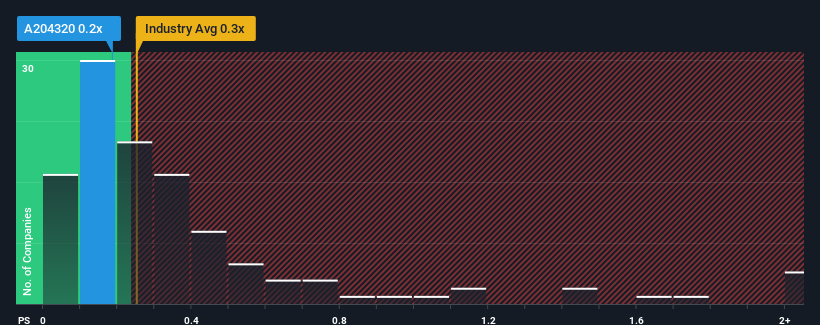

There wouldn't be many who think HL Mando Corporation's (KRX:204320) price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S for the Auto Components industry in Korea is similar at about 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for HL Mando

How HL Mando Has Been Performing

HL Mando's revenue growth of late has been pretty similar to most other companies. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

Keen to find out how analysts think HL Mando's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For HL Mando?

In order to justify its P/S ratio, HL Mando would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 19%. The strong recent performance means it was also able to grow revenue by 54% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 5.5% per year during the coming three years according to the analysts following the company. That's shaping up to be similar to the 4.1% per annum growth forecast for the broader industry.

With this information, we can see why HL Mando is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A HL Mando's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Auto Components industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

And what about other risks? Every company has them, and we've spotted 4 warning signs for HL Mando (of which 2 shouldn't be ignored!) you should know about.

If these risks are making you reconsider your opinion on HL Mando, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if HL Mando might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A204320

HL Mando

An electric vehicle and autonomous driving solutions company, provides automotive parts and services in Korea, China, the United States, India, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives