- South Korea

- /

- Auto Components

- /

- KOSE:A204320

HL Mando Corporation's (KRX:204320) Price Is Right But Growth Is Lacking After Shares Rocket 33%

The HL Mando Corporation (KRX:204320) share price has done very well over the last month, posting an excellent gain of 33%. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 8.7% over the last year.

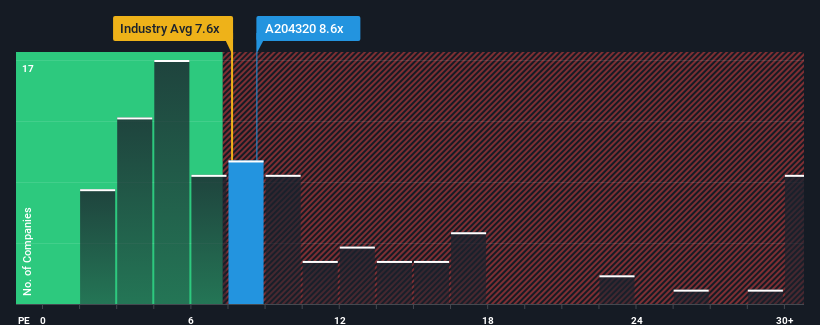

In spite of the firm bounce in price, HL Mando's price-to-earnings (or "P/E") ratio of 8.6x might still make it look like a buy right now compared to the market in Korea, where around half of the companies have P/E ratios above 14x and even P/E's above 27x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With its earnings growth in positive territory compared to the declining earnings of most other companies, HL Mando has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for HL Mando

How Is HL Mando's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like HL Mando's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 119% last year. The latest three year period has also seen an excellent 405% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 7.5% per annum as estimated by the analysts watching the company. With the market predicted to deliver 20% growth per year, the company is positioned for a weaker earnings result.

In light of this, it's understandable that HL Mando's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On HL Mando's P/E

The latest share price surge wasn't enough to lift HL Mando's P/E close to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of HL Mando's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with HL Mando (at least 1 which is potentially serious), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on HL Mando, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if HL Mando might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A204320

HL Mando

An electric vehicle and autonomous driving solutions company, provides automotive parts and services in Korea, China, the United States, India, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives