- South Korea

- /

- Auto Components

- /

- KOSE:A204320

HL Mando Corporation (KRX:204320) Could Be Riskier Than It Looks

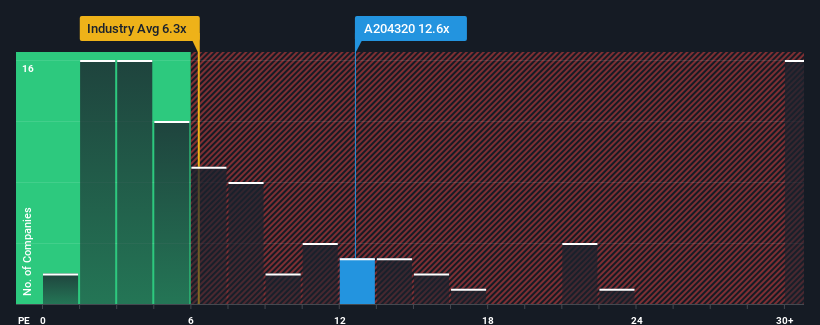

It's not a stretch to say that HL Mando Corporation's (KRX:204320) price-to-earnings (or "P/E") ratio of 12.6x right now seems quite "middle-of-the-road" compared to the market in Korea, where the median P/E ratio is around 11x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

While the market has experienced earnings growth lately, HL Mando's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for HL Mando

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like HL Mando's is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 4.2%. The last three years don't look nice either as the company has shrunk EPS by 22% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 32% each year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 18% each year, which is noticeably less attractive.

In light of this, it's curious that HL Mando's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From HL Mando's P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that HL Mando currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with HL Mando .

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if HL Mando might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A204320

HL Mando

An electric vehicle and autonomous driving solutions company, provides automotive parts and services in Korea, China, the United States, India, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives