- South Korea

- /

- Auto Components

- /

- KOSE:A092780

Here's Why Dong Yang Piston (KRX:092780) Has A Meaningful Debt Burden

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Dong Yang Piston Co., Ltd. (KRX:092780) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Dong Yang Piston

What Is Dong Yang Piston's Net Debt?

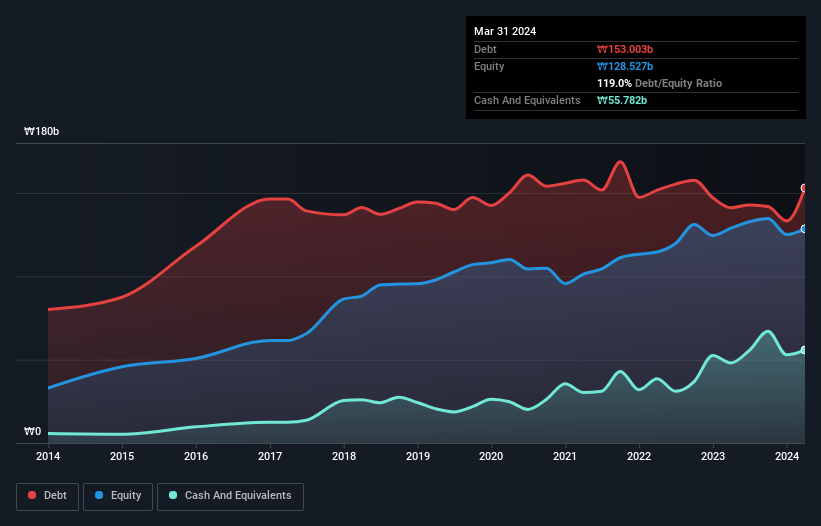

You can click the graphic below for the historical numbers, but it shows that as of March 2024 Dong Yang Piston had ₩153.0b of debt, an increase on ₩141.1b, over one year. However, it does have ₩55.8b in cash offsetting this, leading to net debt of about ₩97.2b.

How Healthy Is Dong Yang Piston's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Dong Yang Piston had liabilities of ₩205.1b due within 12 months and liabilities of ₩61.4b due beyond that. On the other hand, it had cash of ₩55.8b and ₩70.9b worth of receivables due within a year. So it has liabilities totalling ₩139.8b more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the ₩75.7b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, Dong Yang Piston would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Dong Yang Piston has a debt to EBITDA ratio of 3.0 and its EBIT covered its interest expense 2.7 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Looking on the bright side, Dong Yang Piston boosted its EBIT by a silky 52% in the last year. Like the milk of human kindness that sort of growth increases resilience, making the company more capable of managing debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is Dong Yang Piston's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Dong Yang Piston generated free cash flow amounting to a very robust 81% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Our View

While Dong Yang Piston's level of total liabilities has us nervous. For example, its conversion of EBIT to free cash flow and EBIT growth rate give us some confidence in its ability to manage its debt. We think that Dong Yang Piston's debt does make it a bit risky, after considering the aforementioned data points together. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 5 warning signs for Dong Yang Piston you should be aware of, and 2 of them are concerning.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A092780

DYPLtd

Manufactures and sells automobile parts in South Korea and internationally.

Proven track record with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion