- South Korea

- /

- Auto Components

- /

- KOSE:A092780

Does Dong Yang Piston's (KRX:092780) Share Price Gain of 25% Match Its Business Performance?

We believe investing is smart because history shows that stock markets go higher in the long term. But if when you choose to buy stocks, some of them will be below average performers. For example, the Dong Yang Piston Co., Ltd. (KRX:092780), share price is up over the last year, but its gain of 25% trails the market return. Dong Yang Piston hasn't been listed for long, so it's still not clear if it is a long term winner.

Check out our latest analysis for Dong Yang Piston

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over the last twelve months, Dong Yang Piston actually shrank its EPS by 87%.

This means it's unlikely the market is judging the company based on earnings growth. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

Unfortunately Dong Yang Piston's fell 4.6% over twelve months. So the fundamental metrics don't provide an obvious explanation for the share price gain.

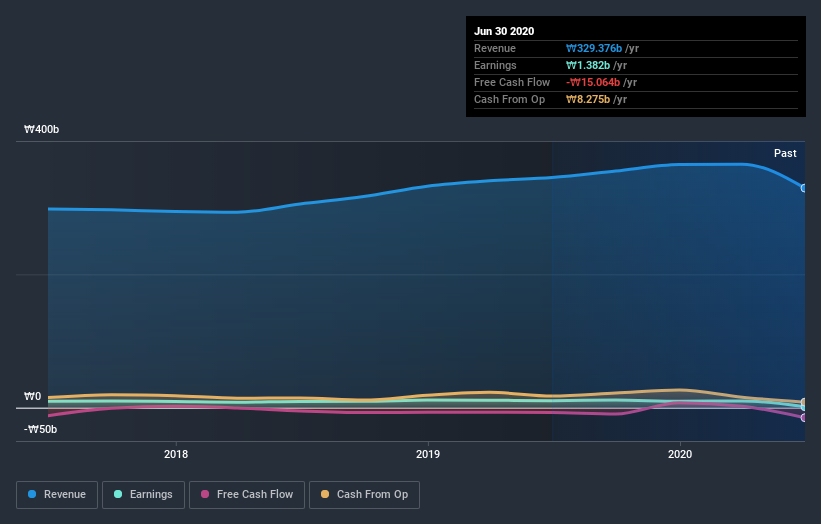

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Dong Yang Piston's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Dong Yang Piston, it has a TSR of 28% for the last year. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

In the last year the market returned about 28%, and Dong Yang Piston generated a TSR of 28% for its shareholders. And the stock has been on a nice little run lately, with the price climbing 26% higher in 90 days. It could be that word is spreading about its positive business attributes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 5 warning signs we've spotted with Dong Yang Piston (including 2 which is are a bit concerning) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade Dong Yang Piston, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A092780

DYPLtd

Manufactures and sells automobile parts in South Korea and internationally.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives