- South Korea

- /

- Auto Components

- /

- KOSE:A073240

Kumho Tire (KRX:073240) Has A Somewhat Strained Balance Sheet

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Kumho Tire Co., Inc. (KRX:073240) does use debt in its business. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Kumho Tire

What Is Kumho Tire's Debt?

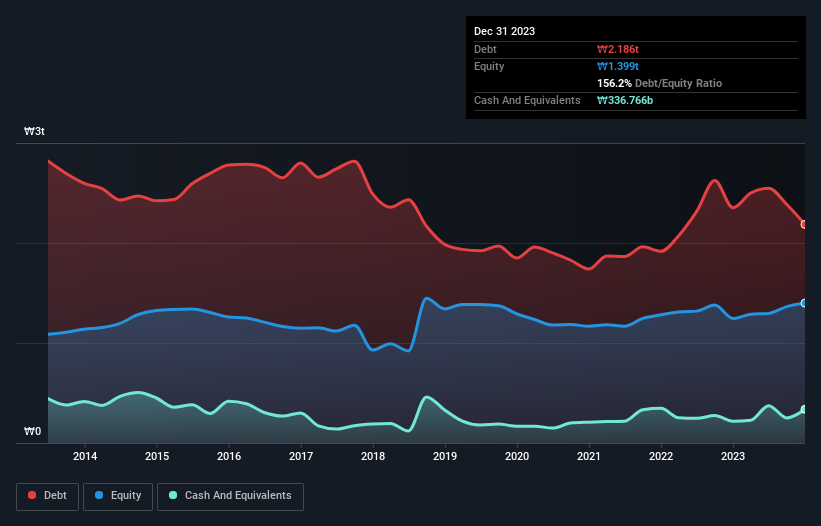

As you can see below, Kumho Tire had ₩2.19t of debt at December 2023, down from ₩2.35t a year prior. However, because it has a cash reserve of ₩336.8b, its net debt is less, at about ₩1.85t.

How Healthy Is Kumho Tire's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Kumho Tire had liabilities of ₩1.89t due within 12 months and liabilities of ₩1.55t due beyond that. Offsetting these obligations, it had cash of ₩336.8b as well as receivables valued at ₩883.6b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₩2.21t.

Given this deficit is actually higher than the company's market capitalization of ₩1.80t, we think shareholders really should watch Kumho Tire's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While we wouldn't worry about Kumho Tire's net debt to EBITDA ratio of 2.7, we think its super-low interest cover of 2.5 times is a sign of high leverage. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. However, it should be some comfort for shareholders to recall that Kumho Tire actually grew its EBIT by a hefty 1,650%, over the last 12 months. If it can keep walking that path it will be in a position to shed its debt with relative ease. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Kumho Tire can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last two years, Kumho Tire burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

We'd go so far as to say Kumho Tire's conversion of EBIT to free cash flow was disappointing. But on the bright side, its EBIT growth rate is a good sign, and makes us more optimistic. Overall, we think it's fair to say that Kumho Tire has enough debt that there are some real risks around the balance sheet. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 1 warning sign for Kumho Tire that you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Kumho Tire might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A073240

Kumho Tire

Engages in the manufacture and sale of tires in South Korea, Europe, North America, Central and South America, Asia, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026