The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Kumho Tire Co., Inc. (KRX:073240) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Kumho Tire

What Is Kumho Tire's Debt?

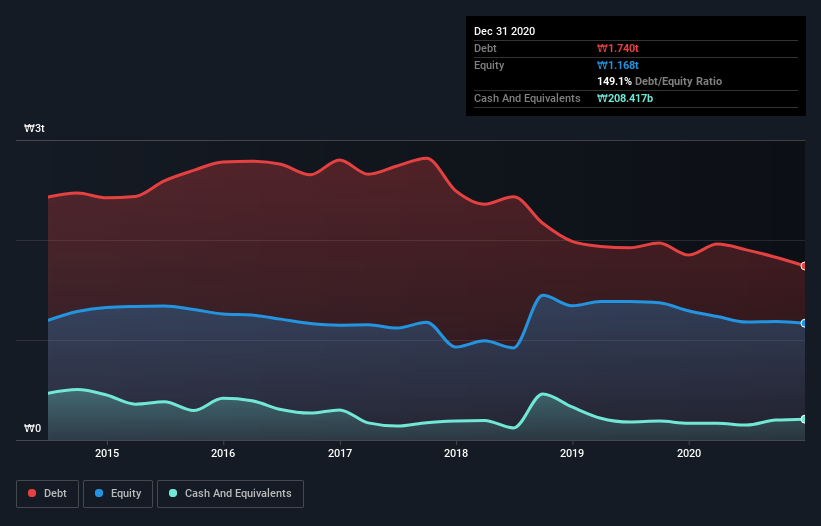

You can click the graphic below for the historical numbers, but it shows that Kumho Tire had ₩1.74t of debt in December 2020, down from ₩1.85t, one year before. However, it does have ₩208.4b in cash offsetting this, leading to net debt of about ₩1.53t.

A Look At Kumho Tire's Liabilities

According to the last reported balance sheet, Kumho Tire had liabilities of ₩950.4b due within 12 months, and liabilities of ₩1.73t due beyond 12 months. On the other hand, it had cash of ₩208.4b and ₩469.8b worth of receivables due within a year. So its liabilities total ₩2.00t more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the ₩1.15t company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Kumho Tire would probably need a major re-capitalization if its creditors were to demand repayment. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Kumho Tire can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Kumho Tire made a loss at the EBIT level, and saw its revenue drop to ₩2.2t, which is a fall of 8.4%. That's not what we would hope to see.

Caveat Emptor

Over the last twelve months Kumho Tire produced an earnings before interest and tax (EBIT) loss. Indeed, it lost ₩4.4b at the EBIT level. When we look at that alongside the significant liabilities, we're not particularly confident about the company. It would need to improve its operations quickly for us to be interested in it. It's fair to say the loss of ₩83b didn't encourage us either; we'd like to see a profit. And until that time we think this is a risky stock. For riskier companies like Kumho Tire I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kumho Tire might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A073240

Kumho Tire

Engages in the manufacture and sale of tires in South Korea, Europe, North America, Central and South America, Asia, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026