- South Korea

- /

- Auto Components

- /

- KOSE:A017370

Wooshin Systems Co., Ltd.'s (KRX:017370) Stock Retreats 27% But Earnings Haven't Escaped The Attention Of Investors

Wooshin Systems Co., Ltd. (KRX:017370) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 36% in that time.

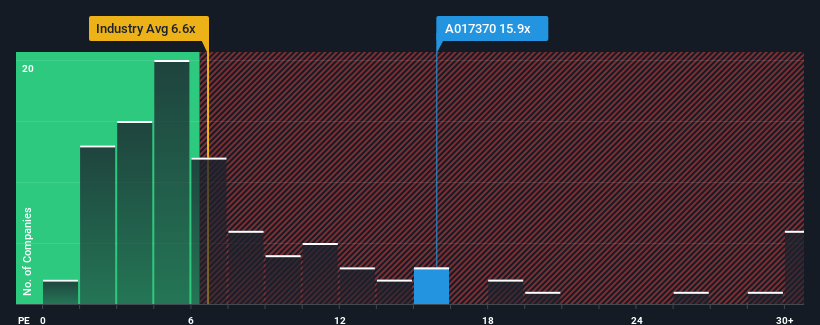

Although its price has dipped substantially, Wooshin Systems' price-to-earnings (or "P/E") ratio of 15.9x might still make it look like a sell right now compared to the market in Korea, where around half of the companies have P/E ratios below 11x and even P/E's below 6x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Recent times haven't been advantageous for Wooshin Systems as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Wooshin Systems

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Wooshin Systems' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 42%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 71% each year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 20% each year, which is noticeably less attractive.

With this information, we can see why Wooshin Systems is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Wooshin Systems' P/E?

There's still some solid strength behind Wooshin Systems' P/E, if not its share price lately. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Wooshin Systems' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for Wooshin Systems you should be aware of, and 1 of them is potentially serious.

If you're unsure about the strength of Wooshin Systems' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Wooshin Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A017370

Wooshin Systems

Develops, manufactures, and sells automotive body assembly systems and body parts in South Korea and internationally.

Undervalued with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success