- South Korea

- /

- Auto Components

- /

- KOSE:A012330

Hyundai Mobis Co.,Ltd's (KRX:012330) Shares Lagging The Market But So Is The Business

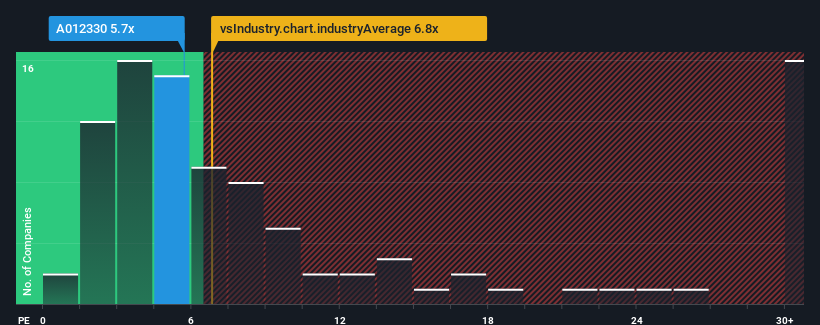

With a price-to-earnings (or "P/E") ratio of 5.7x Hyundai Mobis Co.,Ltd (KRX:012330) may be sending very bullish signals at the moment, given that almost half of all companies in Korea have P/E ratios greater than 13x and even P/E's higher than 26x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

We check all companies for important risks. See what we found for Hyundai MobisLtd in our free report.With earnings growth that's superior to most other companies of late, Hyundai MobisLtd has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Hyundai MobisLtd

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Hyundai MobisLtd's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 19%. The latest three year period has also seen an excellent 75% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 6.6% each year during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to expand by 19% per year, which is noticeably more attractive.

With this information, we can see why Hyundai MobisLtd is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Hyundai MobisLtd's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Hyundai MobisLtd with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Hyundai MobisLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hyundai MobisLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A012330

Hyundai MobisLtd

Engages in the auto parts business in Korea, China, the United States, Europe, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives