- South Korea

- /

- Auto Components

- /

- KOSE:A006660

Samsung Climate Control (KRX:006660) Strong Profits May Be Masking Some Underlying Issues

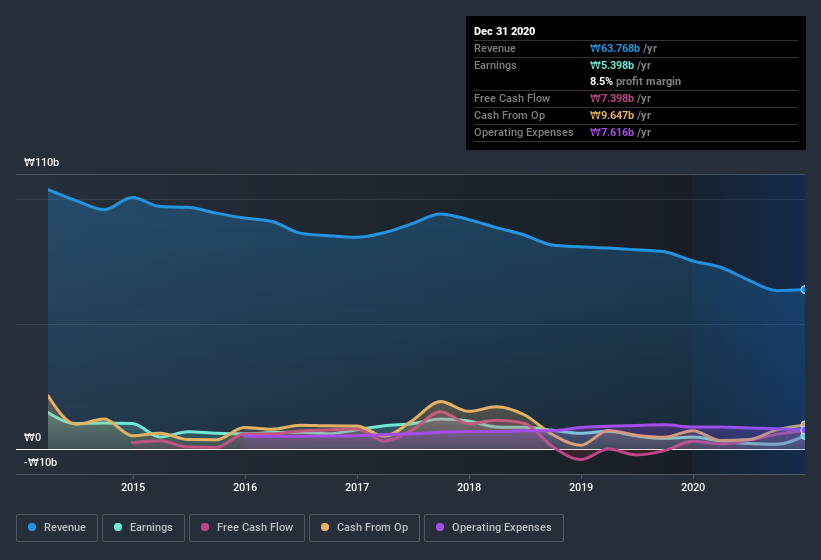

Samsung Climate Control Co., Ltd.'s (KRX:006660) healthy profit numbers didn't contain any surprises for investors. However the statutory profit number doesn't tell the whole story, and we have found some factors which might be of concern to shareholders.

See our latest analysis for Samsung Climate Control

The Impact Of Unusual Items On Profit

To properly understand Samsung Climate Control's profit results, we need to consider the ₩123m gain attributed to unusual items. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. If Samsung Climate Control doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Samsung Climate Control.

Our Take On Samsung Climate Control's Profit Performance

We'd posit that Samsung Climate Control's statutory earnings aren't a clean read on ongoing productivity, due to the large unusual item. Because of this, we think that it may be that Samsung Climate Control's statutory profits are better than its underlying earnings power. But at least holders can take some solace from the 14% EPS growth in the last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you want to do dive deeper into Samsung Climate Control, you'd also look into what risks it is currently facing. Case in point: We've spotted 3 warning signs for Samsung Climate Control you should be mindful of and 1 of them is potentially serious.

This note has only looked at a single factor that sheds light on the nature of Samsung Climate Control's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade Samsung Climate Control, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A006660

Samsung Climate Control

Manufactures and sells automotive parts in South Korea and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives