Even though KG Mobility Corp.'s (KRX:003620) recent earnings release was robust, the market didn't seem to notice. Our analysis suggests that investors might be missing some promising details.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. In fact, KG Mobility increased the number of shares on issue by 5.1% over the last twelve months by issuing new shares. As a result, its net income is now split between a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of KG Mobility's EPS by clicking here.

A Look At The Impact Of KG Mobility's Dilution On Its Earnings Per Share (EPS)

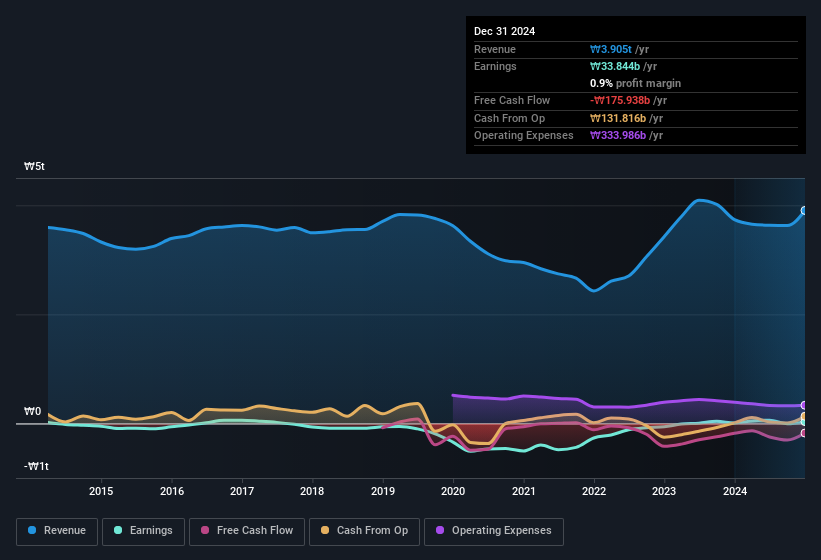

KG Mobility was losing money three years ago. On the bright side, in the last twelve months it grew profit by 279%. But EPS was less impressive, up only 266% in that time. And so, you can see quite clearly that dilution is influencing shareholder earnings.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So it will certainly be a positive for shareholders if KG Mobility can grow EPS persistently. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of KG Mobility.

How Do Unusual Items Influence Profit?

Alongside that dilution, it's also important to note that KG Mobility's profit suffered from unusual items, which reduced profit by ₩30b in the last twelve months. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's hardly a surprise given these line items are considered unusual. KG Mobility took a rather significant hit from unusual items in the year to December 2024. As a result, we can surmise that the unusual items made its statutory profit significantly weaker than it would otherwise be.

Our Take On KG Mobility's Profit Performance

To sum it all up, KG Mobility took a hit from unusual items which pushed its profit down; without that, it would have made more money. But on the other hand, the company issued more shares, so without buying more shares each shareholder will end up with a smaller part of the profit. Based on these factors, we think that KG Mobility's profits are a reasonably conservative guide to its underlying profitability. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. For example - KG Mobility has 1 warning sign we think you should be aware of.

Our examination of KG Mobility has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if KG Mobility might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A003620

KG Mobility

Manufactures and sells automobiles and parts in the South Korea and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives