- South Korea

- /

- Auto Components

- /

- KOSE:A000300

If You Had Bought Dayou PlusLtd's (KRX:000300) Shares Five Years Ago You Would Be Down 29%

Ideally, your overall portfolio should beat the market average. But even the best stock picker will only win with some selections. So we wouldn't blame long term Dayou Plus Co.,Ltd (KRX:000300) shareholders for doubting their decision to hold, with the stock down 29% over a half decade. Unhappily, the share price slid 4.9% in the last week.

Check out our latest analysis for Dayou PlusLtd

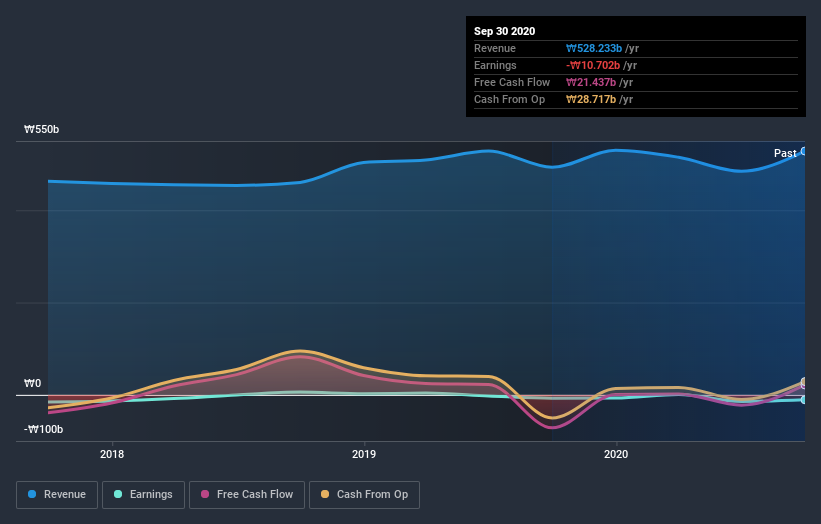

Given that Dayou PlusLtd didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over five years, Dayou PlusLtd grew its revenue at 2.3% per year. That's far from impressive given all the money it is losing. Given the weak growth, the share price fall of 5% isn't particularly surprising. The key question is whether the company can make it to profitability, and beyond, without trouble. It could be worth putting it on your watchlist and revisiting when it makes its maiden profit.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Dayou PlusLtd's financial health with this free report on its balance sheet.

A Different Perspective

Dayou PlusLtd shareholders are up 9.7% for the year. But that was short of the market average. But at least that's still a gain! Over five years the TSR has been a reduction of 5% per year, over five years. It could well be that the business is stabilizing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for Dayou PlusLtd you should be aware of.

But note: Dayou PlusLtd may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade Dayou PlusLtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A000300

Dayou PlusLtd

Engages in the automobile parts, information and communication, and home appliance businesses in South Korea, China, Mexico, and internationally.

Overvalued with weak fundamentals.

Market Insights

Community Narratives