- South Korea

- /

- Auto Components

- /

- KOSDAQ:A241690

Optimistic Investors Push UNITEKNO Co.,Ltd (KOSDAQ:241690) Shares Up 29% But Growth Is Lacking

UNITEKNO Co.,Ltd (KOSDAQ:241690) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 3.1% isn't as impressive.

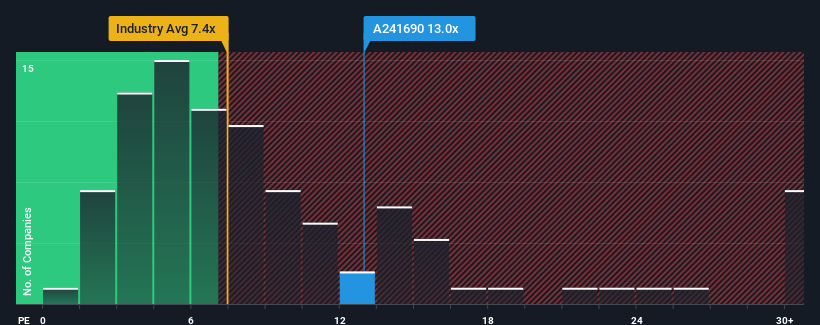

Even after such a large jump in price, it's still not a stretch to say that UNITEKNOLtd's price-to-earnings (or "P/E") ratio of 13x right now seems quite "middle-of-the-road" compared to the market in Korea, where the median P/E ratio is around 12x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings growth that's exceedingly strong of late, UNITEKNOLtd has been doing very well. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for UNITEKNOLtd

How Is UNITEKNOLtd's Growth Trending?

The only time you'd be comfortable seeing a P/E like UNITEKNOLtd's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 70%. Still, incredibly EPS has fallen 20% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 33% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we find it concerning that UNITEKNOLtd is trading at a fairly similar P/E to the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Bottom Line On UNITEKNOLtd's P/E

UNITEKNOLtd appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that UNITEKNOLtd currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

You always need to take note of risks, for example - UNITEKNOLtd has 2 warning signs we think you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A241690

UNITEKNOLtd

Engages in the manufacture and sale of automobile motor assembly parts in South Korea and internationally.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives