- South Korea

- /

- Auto Components

- /

- KOSDAQ:A122350

Announcing: Samkee Automotive (KOSDAQ:122350) Stock Increased An Energizing 114% In The Last Year

It's been a soft week for Samkee Automotive Co., Ltd. (KOSDAQ:122350) shares, which are down 11%. But that doesn't detract from the splendid returns of the last year. We're very pleased to report the share price shot up 114% in that time. So it may be that the share price is simply cooling off after a strong rise. The real question is whether the business is trending in the right direction.

See our latest analysis for Samkee Automotive

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Samkee Automotive went from making a loss to reporting a profit, in the last year.

When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

We think that the revenue growth of 15% could have some investors interested. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

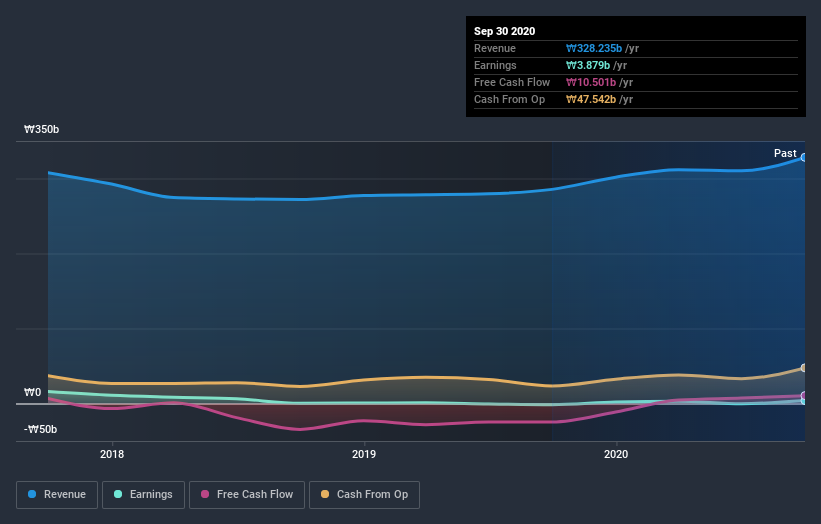

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Samkee Automotive stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's good to see that Samkee Automotive has rewarded shareholders with a total shareholder return of 114% in the last twelve months. That gain is better than the annual TSR over five years, which is 4%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 5 warning signs we've spotted with Samkee Automotive (including 2 which are potentially serious) .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading Samkee Automotive or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A122350

Samkee

Engages in the manufacturing and selling of automobile die-cast parts, aluminum smelting, and aluminum alloy production in South Korea, rest of Asia, Europe, and North America.

Slightly overvalued with very low risk.

Market Insights

Community Narratives