Stock Analysis

- South Korea

- /

- Auto Components

- /

- KOSDAQ:A087260

Shareholders 29% loss in Mobile Appliance (KOSDAQ:087260) partly attributable to the company's decline in earnings over past three years

While not a mind-blowing move, it is good to see that the Mobile Appliance, Inc. (KOSDAQ:087260) share price has gained 29% in the last three months. But that cannot eclipse the less-than-impressive returns over the last three years. After all, the share price is down 29% in the last three years, significantly under-performing the market.

Although the past week has been more reassuring for shareholders, they're still in the red over the last three years, so let's see if the underlying business has been responsible for the decline.

Check out our latest analysis for Mobile Appliance

We don't think that Mobile Appliance's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last three years, Mobile Appliance saw its revenue grow by 9.4% per year, compound. That's a fairly respectable growth rate. Shareholders have seen the share price fall at 9% per year, for three years. So the market has definitely lost some love for the stock. However, that's in the past now, and it's the future is more important - and the future looks brighter (based on revenue, anyway).

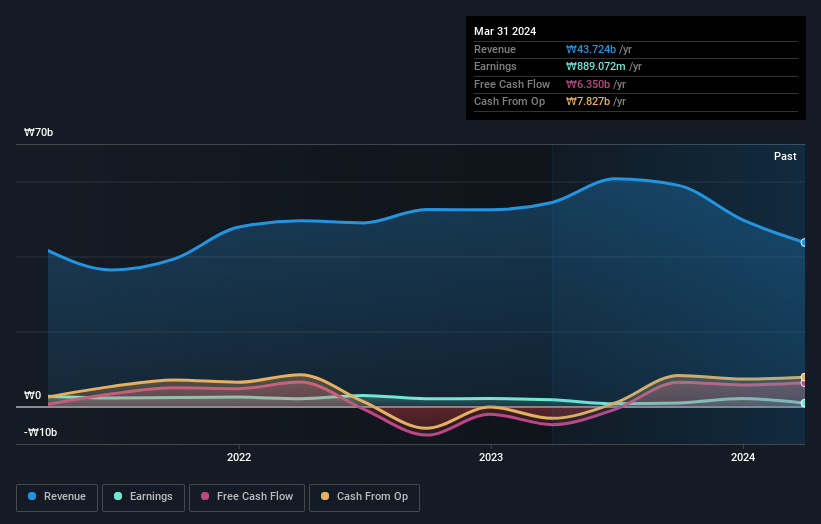

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Mobile Appliance stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Investors in Mobile Appliance had a tough year, with a total loss of 1.2%, against a market gain of about 5.7%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 3% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Mobile Appliance has 4 warning signs we think you should be aware of.

We will like Mobile Appliance better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Mobile Appliance is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Mobile Appliance is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A087260

Mobile Appliance

Develops, manufactures, and exports car safety devices in South Korea and internationally.

Excellent balance sheet with poor track record.