- South Korea

- /

- Auto Components

- /

- KOSDAQ:A066590

Shareholders Of Woosu AMSLtd (KOSDAQ:066590) Must Be Happy With Their 215% Total Return

Some Woosu AMS Co.,Ltd. (KOSDAQ:066590) shareholders are probably rather concerned to see the share price fall 30% over the last three months. But that scarcely detracts from the really solid long term returns generated by the company over five years. It's fair to say most would be happy with 155% the gain in that time. We think it's more important to dwell on the long term returns than the short term returns. Ultimately business performance will determine whether the stock price continues the positive long term trend.

See our latest analysis for Woosu AMSLtd

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Woosu AMSLtd's earnings per share are down 48% per year, despite strong share price performance over five years.

This means it's unlikely the market is judging the company based on earnings growth. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

We are not particularly impressed by the annual compound revenue growth of 0.8% over five years. So it seems one might have to take closer look at earnings and revenue trends to see how they might influence the share price.

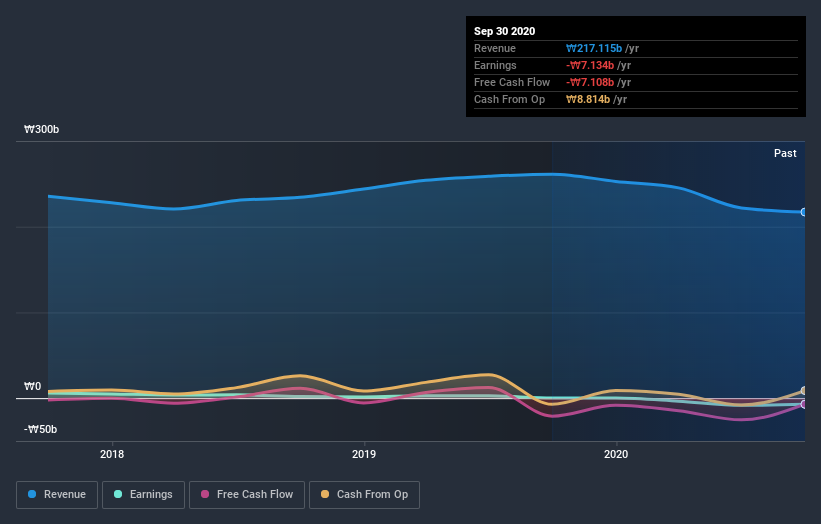

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Woosu AMSLtd's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We've already covered Woosu AMSLtd's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Woosu AMSLtd's TSR of 215% over the last 5 years is better than the share price return.

A Different Perspective

It's nice to see that Woosu AMSLtd shareholders have received a total shareholder return of 110% over the last year. That gain is better than the annual TSR over five years, which is 26%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Woosu AMSLtd better, we need to consider many other factors. Take risks, for example - Woosu AMSLtd has 4 warning signs (and 2 which are potentially serious) we think you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade Woosu AMSLtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Woosu AMSLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A066590

Woosu AMSLtd

Manufactures and sells automobile components in South Korea and internationally.

Imperfect balance sheet with very low risk.

Market Insights

Community Narratives