- South Korea

- /

- Auto Components

- /

- KOSDAQ:A065500

Orient Precision Industries Inc (KOSDAQ:065500) Shares Slammed 28% But Getting In Cheap Might Be Difficult Regardless

To the annoyance of some shareholders, Orient Precision Industries Inc (KOSDAQ:065500) shares are down a considerable 28% in the last month, which continues a horrid run for the company. The good news is that in the last year, the stock has shone bright like a diamond, gaining 136%.

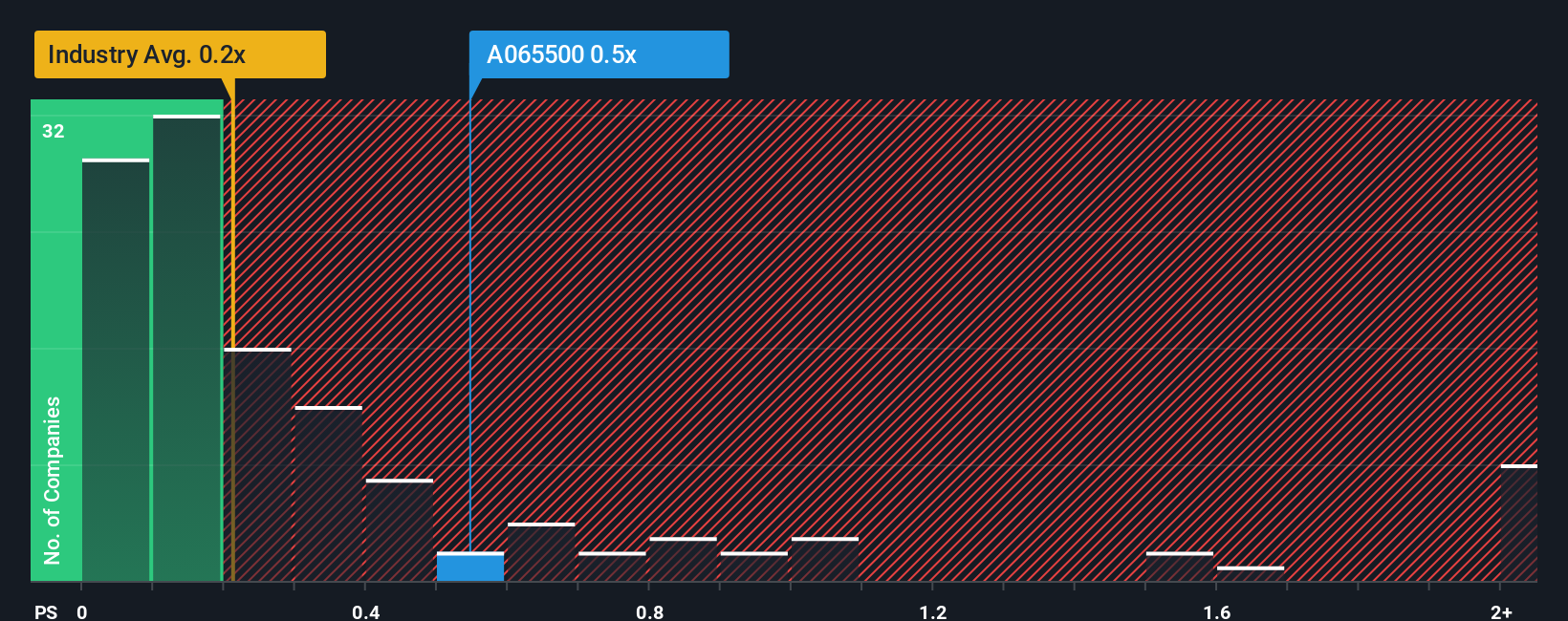

Even after such a large drop in price, there still wouldn't be many who think Orient Precision Industries' price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S in Korea's Auto Components industry is similar at about 0.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Orient Precision Industries

How Orient Precision Industries Has Been Performing

Revenue has risen at a steady rate over the last year for Orient Precision Industries, which is generally not a bad outcome. One possibility is that the P/S is moderate because investors think this good revenue growth might only be parallel to the broader industry in the near future. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

Although there are no analyst estimates available for Orient Precision Industries, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Orient Precision Industries' to be considered reasonable.

Retrospectively, the last year delivered a decent 4.4% gain to the company's revenues. The latest three year period has also seen an excellent 57% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

It's interesting to note that the rest of the industry is similarly expected to grow by 15% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Orient Precision Industries' P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Final Word

Following Orient Precision Industries' share price tumble, its P/S is just clinging on to the industry median P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It appears to us that Orient Precision Industries maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Orient Precision Industries (2 are a bit concerning) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A065500

Orient Precision Industries

Manufactures and sells automobile parts in South Korea and internationally.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives