- South Korea

- /

- Auto Components

- /

- KOSDAQ:A065500

Can You Imagine How Jubilant Orient Precision Industries' (KOSDAQ:065500) Shareholders Feel About Its 270% Share Price Gain?

It might be of some concern to shareholders to see the Orient Precision Industries Inc (KOSDAQ:065500) share price down 18% in the last month. Despite this, the stock is a strong performer over the last year, no doubt about that. During that period, the share price soared a full 270%. So we think most shareholders won't be too upset about the recent fall. Investors should be wondering whether the business itself has the fundamental value required to continue to drive gains.

View our latest analysis for Orient Precision Industries

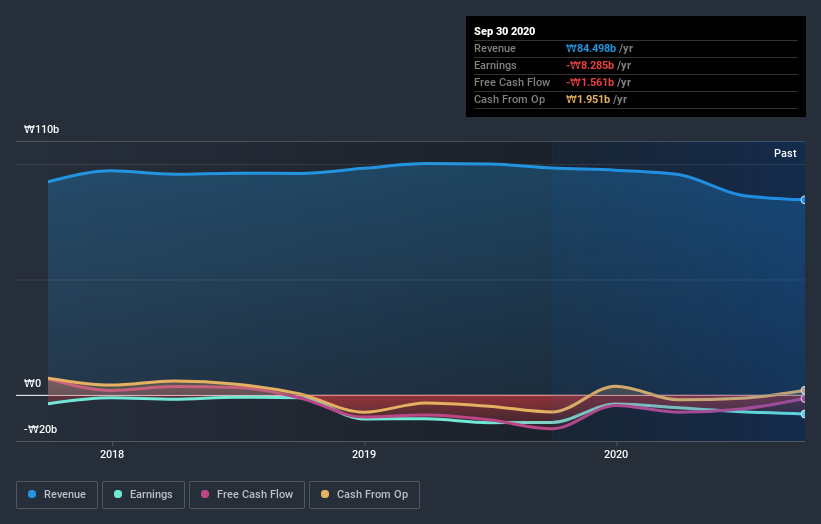

Because Orient Precision Industries made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Orient Precision Industries saw its revenue shrink by 14%. So we would not have expected the share price to rise 270%. It just goes to show the market doesn't always pay attention to the reported numbers. It's quite likely the revenue fall was already priced in, anyway.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Orient Precision Industries' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Orient Precision Industries shareholders have received a total shareholder return of 270% over one year. That gain is better than the annual TSR over five years, which is 2%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Orient Precision Industries better, we need to consider many other factors. Take risks, for example - Orient Precision Industries has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

Of course Orient Precision Industries may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade Orient Precision Industries, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A065500

Orient Precision Industries

Manufactures and sells automobile parts in South Korea and internationally.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives