- South Korea

- /

- Auto Components

- /

- KOSDAQ:A031510

Dividend Investors: Don't Be Too Quick To Buy Austem Company Ltd. (KOSDAQ:031510) For Its Upcoming Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Austem Company Ltd. (KOSDAQ:031510) is about to go ex-dividend in just three days. Ex-dividend means that investors that purchase the stock on or after the 29th of December will not receive this dividend, which will be paid on the 14th of May.

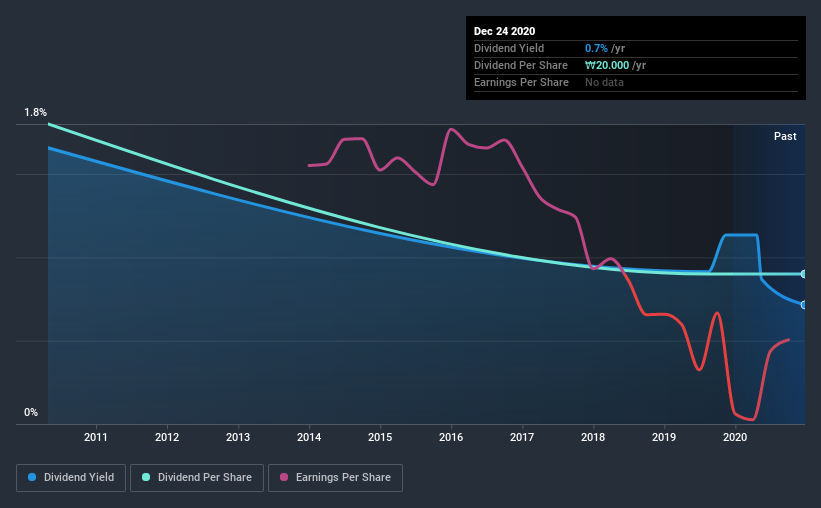

Austem's next dividend payment will be ₩20.00 per share. Last year, in total, the company distributed ₩20.00 to shareholders. Looking at the last 12 months of distributions, Austem has a trailing yield of approximately 0.7% on its current stock price of ₩2795. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to check whether the dividend payments are covered, and if earnings are growing.

View our latest analysis for Austem

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Austem reported a loss after tax last year, which means it's paying a dividend despite being unprofitable. While this might be a one-off event, this is unlikely to be sustainable in the long term. With the recent loss, it's important to check if the business generated enough cash to pay its dividend. If cash earnings don't cover the dividend, the company would have to pay dividends out of cash in the bank, or by borrowing money, neither of which is long-term sustainable. The good news is it paid out just 1.7% of its free cash flow in the last year.

Click here to see how much of its profit Austem paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Austem was unprofitable last year and, unfortunately, the general trend suggests its earnings have been in decline over the last five years, making us wonder if the dividend is sustainable at all.

We'd also point out that Austem issued a meaningful number of new shares in the past year. It's hard to grow dividends per share when a company keeps creating new shares.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Austem has seen its dividend decline 6.7% per annum on average over the past 10 years, which is not great to see. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

Remember, you can always get a snapshot of Austem's financial health, by checking our visualisation of its financial health, here.

Final Takeaway

Is Austem worth buying for its dividend? We're a bit uncomfortable with it paying a dividend while being loss-making. However, we note that the dividend was covered by cash flow. Bottom line: Austem has some unfortunate characteristics that we think could lead to sub-optimal outcomes for dividend investors.

Although, if you're still interested in Austem and want to know more, you'll find it very useful to know what risks this stock faces. We've identified 5 warning signs with Austem (at least 1 which is potentially serious), and understanding them should be part of your investment process.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Austem, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A031510

Austem

Manufactures and sells automotive parts in South Korea and internationally.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion