- South Korea

- /

- Auto Components

- /

- KOSDAQ:A024120

Does KB Autosys Co., Ltd. (KOSDAQ:024120) Have A Place In Your Dividend Stock Portfolio?

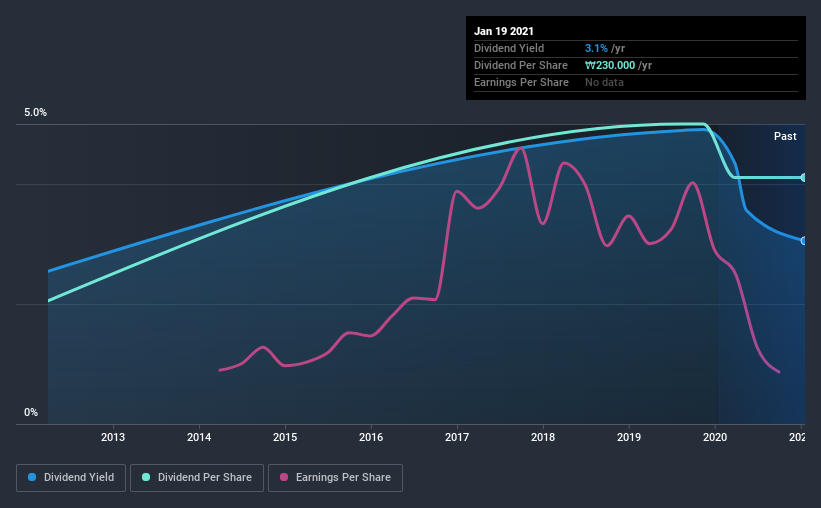

Dividend paying stocks like KB Autosys Co., Ltd. (KOSDAQ:024120) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

With a goodly-sized dividend yield despite a relatively short payment history, investors might be wondering if KB Autosys is a new dividend aristocrat in the making. It sure looks interesting on these metrics - but there's always more to the story. Some simple analysis can reduce the risk of holding KB Autosys for its dividend, and we'll focus on the most important aspects below.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. KB Autosys paid out 83% of its profit as dividends, over the trailing twelve month period. It's paying out most of its earnings, which limits the amount that can be reinvested in the business. This may indicate limited need for further capital within the business, or highlight a commitment to paying a dividend.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. The company paid out 76% of its free cash flow as dividends last year, which is adequate, but reduces the wriggle room in the event of a downturn. It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Consider getting our latest analysis on KB Autosys' financial position here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. The first recorded dividend for KB Autosys, in the last decade, was nine years ago. It's good to see that KB Autosys has been paying a dividend for a number of years. However, the dividend has been cut at least once in the past, and we're concerned that what has been cut once, could be cut again. During the past nine-year period, the first annual payment was ₩115 in 2012, compared to ₩230 last year. This works out to be a compound annual growth rate (CAGR) of approximately 8.0% a year over that time. KB Autosys' dividend payments have fluctuated, so it hasn't grown 8.0% every year, but the CAGR is a useful rule of thumb for approximating the historical growth.

A reasonable rate of dividend growth is good to see, but we're wary that the dividend history is not as solid as we'd like, having been cut at least once.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? Over the past five years, it looks as though KB Autosys' EPS have declined at around 11% a year. A sharp decline in earnings per share is not great from from a dividend perspective, as even conservative payout ratios can come under pressure if earnings fall far enough.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. KB Autosys' is paying out more than half its income as dividends, but at least the dividend is covered by both reported earnings and cashflow. Earnings per share have been falling, and the company has cut its dividend at least once in the past. From a dividend perspective, this is a cause for concern. In summary, KB Autosys has a number of shortcomings that we'd find it hard to get past. Things could change, but we think there are likely more attractive alternatives out there.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 3 warning signs for KB Autosys that you should be aware of before investing.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

When trading KB Autosys or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if KB Autosys might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A024120

KB Autosys

Manufactures and sells brake pads for the automobile industry in South Korea and internationally.

Second-rate dividend payer with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026