- South Korea

- /

- Auto Components

- /

- KOSDAQ:A019770

We Wouldn't Be Too Quick To Buy Seoyon Topmetal Co., Ltd. (KOSDAQ:019770) Before It Goes Ex-Dividend

Readers hoping to buy Seoyon Topmetal Co., Ltd. (KOSDAQ:019770) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. Investors can purchase shares before the 29th of December in order to be eligible for this dividend, which will be paid on the 14th of April.

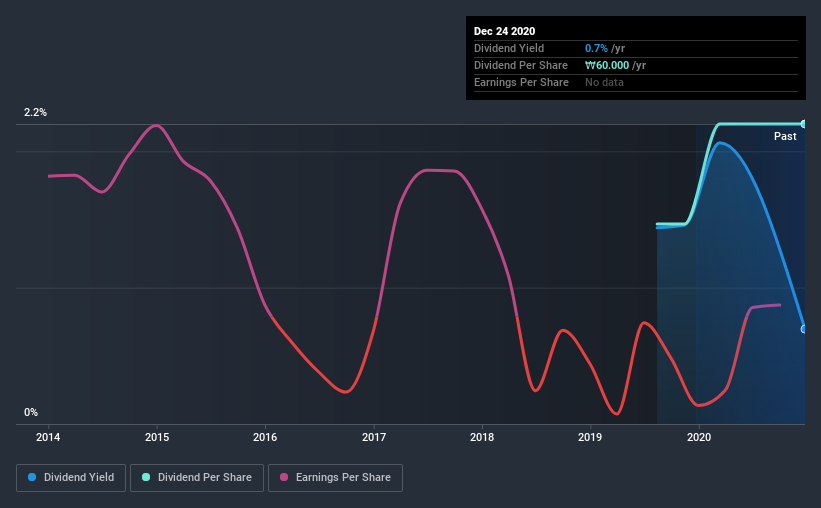

Seoyon Topmetal's next dividend payment will be ₩60.00 per share. Last year, in total, the company distributed ₩60.00 to shareholders. Looking at the last 12 months of distributions, Seoyon Topmetal has a trailing yield of approximately 0.7% on its current stock price of ₩8610. If you buy this business for its dividend, you should have an idea of whether Seoyon Topmetal's dividend is reliable and sustainable. So we need to check whether the dividend payments are covered, and if earnings are growing.

Check out our latest analysis for Seoyon Topmetal

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Seoyon Topmetal paid out 110% of its earnings, which is more than we're comfortable with, unless there are mitigating circumstances. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. It paid out 9.0% of its free cash flow as dividends last year, which is conservatively low.

It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and Seoyon Topmetal fortunately did generate enough cash to fund its dividend. Still, if the company repeatedly paid a dividend greater than its profits, we'd be concerned. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits.

Click here to see how much of its profit Seoyon Topmetal paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Seoyon Topmetal's earnings have collapsed faster than Wile E Coyote's schemes to trap the Road Runner; down a tremendous 43% a year over the past five years.

Unfortunately Seoyon Topmetal has only been paying a dividend for a year or so, so there's not much of a history to draw insight from.

Final Takeaway

Should investors buy Seoyon Topmetal for the upcoming dividend? It's not a great combination to see a company with earnings in decline and paying out 110% of its profits, which could imply the dividend may be at risk of being cut in the future. Yet cashflow was much stronger, which makes us wonder if there are some large timing issues in Seoyon Topmetal's cash flows, or perhaps the company has written down some assets aggressively, reducing its income. Overall it doesn't look like the most suitable dividend stock for a long-term buy and hold investor.

With that in mind though, if the poor dividend characteristics of Seoyon Topmetal don't faze you, it's worth being mindful of the risks involved with this business. Every company has risks, and we've spotted 4 warning signs for Seoyon Topmetal (of which 2 are a bit concerning!) you should know about.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Seoyon Topmetal or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A019770

Seoyon Topmetal

Produces and sells automobile body parts stamping tools, injection molds for interior parts, and excavator cabins in South Korea.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026