- Japan

- /

- Electric Utilities

- /

- TSE:9511

Okinawa Electric Power Company (TSE:9511) Strong Profits May Be Masking Some Underlying Issues

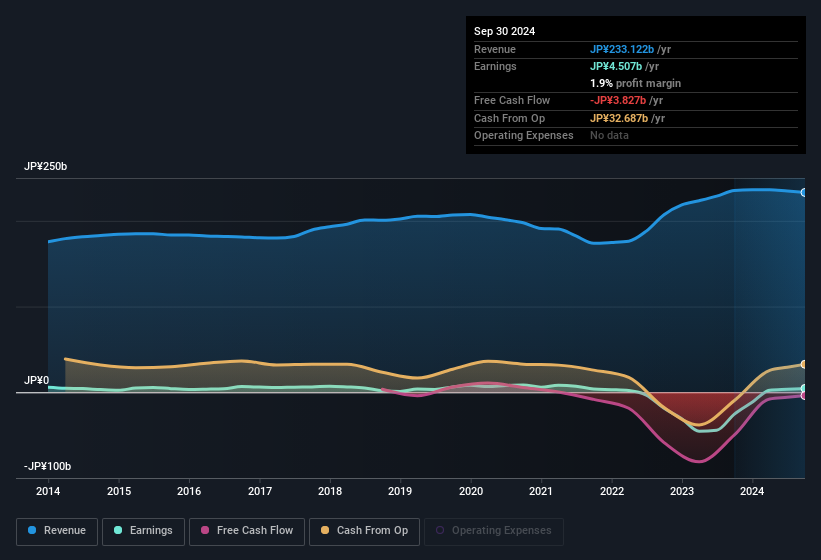

The Okinawa Electric Power Company, Incorporated's (TSE:9511) healthy profit numbers didn't contain any surprises for investors. We think this is due to investors looking beyond the statutory profits and being concerned with what they see.

View our latest analysis for Okinawa Electric Power Company

Operating Revenue Or Not?

Companies will classify their revenue streams as either operating revenue or other revenue. Oftentimes, non-operating revenue spikes are not repeated, so it makes sense to be cautious where non-operating revenue has made a very large contribution to total profit. However, we note that when non-operating revenue increases suddenly, it will sometimes generate an unsustainable boost to profit. Notably, Okinawa Electric Power Company had a significant increase in non-operating revenue over the last year. Indeed, its non-operating revenue rose from JP¥2.00m last year to JP¥16.9b this year. The high levels of non-operating revenue are problematic because if (and when) they do not repeat, then overall revenue (and profitability) of the firm will fall. Sometimes, you can get a better idea of the underlying earnings potential of a company by excluding unusual boosts to non-operating revenue.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Okinawa Electric Power Company's Profit Performance

Because Okinawa Electric Power Company's non-operating revenue spiked quite noticeably last year, you could argue that a focus on statutory profit would be too generous because profits may drop back in the future (when that non-operating revenue is not repeated). For this reason, we think that Okinawa Electric Power Company's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. The good news is that it earned a profit in the last twelve months, despite its previous loss. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. Every company has risks, and we've spotted 2 warning signs for Okinawa Electric Power Company (of which 1 can't be ignored!) you should know about.

This note has only looked at a single factor that sheds light on the nature of Okinawa Electric Power Company's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9511

Okinawa Electric Power Company

Engages in the generation, transmission, and distribution of electricity in Okinawa Prefecture, Japan.

Acceptable track record second-rate dividend payer.

Market Insights

Community Narratives