- Japan

- /

- Electric Utilities

- /

- TSE:9508

Kyushu Electric Power Company, Incorporated (TSE:9508) Stocks Shoot Up 27% But Its P/S Still Looks Reasonable

Despite an already strong run, Kyushu Electric Power Company, Incorporated (TSE:9508) shares have been powering on, with a gain of 27% in the last thirty days. The annual gain comes to 115% following the latest surge, making investors sit up and take notice.

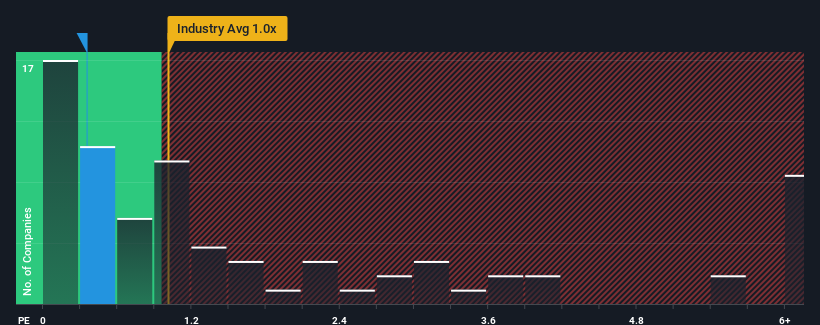

Although its price has surged higher, you could still be forgiven for feeling indifferent about Kyushu Electric Power Company's P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Electric Utilities industry in Japan is also close to 0.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Kyushu Electric Power Company

How Has Kyushu Electric Power Company Performed Recently?

Kyushu Electric Power Company's revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

Keen to find out how analysts think Kyushu Electric Power Company's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Kyushu Electric Power Company would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.8% last year. The latest three year period has also seen a 8.8% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 2.2% per annum during the coming three years according to the five analysts following the company. Meanwhile, the industry is forecast to moderate by 2.8% each year, which suggests the company won't escape the wider industry forces.

In light of this, it's understandable that Kyushu Electric Power Company's P/S sits in line with the majority of other companies. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There is still potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Its shares have lifted substantially and now Kyushu Electric Power Company's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Kyushu Electric Power Company's analyst forecasts revealed that its equally shaky outlook against the industry is keeping its P/S in line with the industry too. Right now, shareholders are comfortable with the P/S as they have faith that future revenue will not uncover any unpleasant surprises. Although, we are somewhat concerned whether the company can maintain this level of performance under these tough industry conditions. It seems that unless there's a drastic change, it's hard to imagine that the share price will deviate much from current levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Kyushu Electric Power Company, and understanding them should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Kyushu Electric Power Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9508

Kyushu Electric Power Company

Engages in the power generation, transmission, distribution, and retail in Japan and internationally.

Second-rate dividend payer low.

Market Insights

Community Narratives