- Japan

- /

- Electric Utilities

- /

- TSE:9505

Hokuriku Electric Power Company's (TSE:9505) Popularity With Investors Is Clear

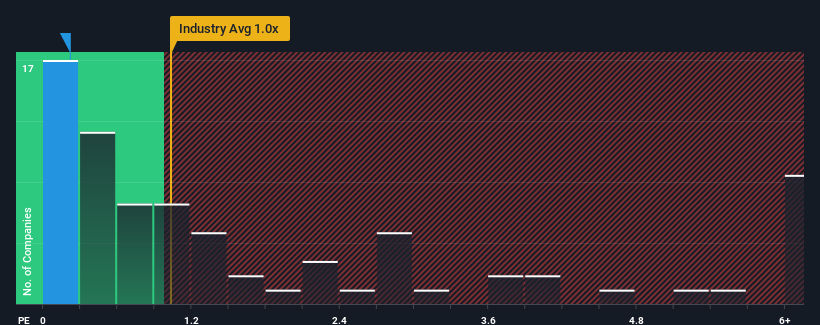

There wouldn't be many who think Hokuriku Electric Power Company's (TSE:9505) price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S for the Electric Utilities industry in Japan is similar at about 0.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Hokuriku Electric Power

How Has Hokuriku Electric Power Performed Recently?

Hokuriku Electric Power's revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hokuriku Electric Power.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Hokuriku Electric Power's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 7.5%. The latest three year period has also seen an excellent 34% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 2.8% each year as estimated by the three analysts watching the company. Although, this is simply shaping up to be in line with the broader industry, which is also set to decline 2.9% per year.

With this in consideration, it's clear to see why Hokuriku Electric Power's P/S stacks up closely with its industry peers. Nonetheless, with revenue going in reverse, it's not guaranteed that the P/S has found a floor yet. There is still potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

What Does Hokuriku Electric Power's P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our findings align with our suspicions - a closer look at Hokuriku Electric Power's analyst forecasts shows that the company's similarly unstable outlook compared to the industry is keeping its price-to-sales ratio in line with the industry's average. Right now, shareholders are comfortable with the P/S as they have faith that future revenue will not uncover any unpleasant surprises. However, we're slightly cautious about the company's ability to resist further pain to its business from the broader industry turmoil. For now though, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with Hokuriku Electric Power.

If you're unsure about the strength of Hokuriku Electric Power's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hokuriku Electric Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9505

Hokuriku Electric Power

Supplies electricity through power generation, transmission, and distribution systems in Japan.

Fair value with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026