- Japan

- /

- Electric Utilities

- /

- TSE:9504

The Chugoku Electric Power Co., Inc.'s (TSE:9504) Shareholders Might Be Looking For Exit

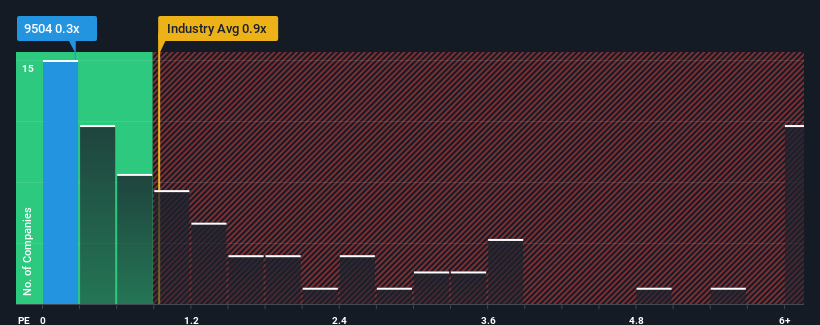

With a median price-to-sales (or "P/S") ratio of close to 0.3x in the Electric Utilities industry in Japan, you could be forgiven for feeling indifferent about The Chugoku Electric Power Co., Inc.'s (TSE:9504) P/S ratio, which comes in at about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Chugoku Electric Power

What Does Chugoku Electric Power's Recent Performance Look Like?

Chugoku Electric Power's negative revenue growth of late has neither been better nor worse than most other companies. Perhaps the market is expecting future revenue performance to continue matching the industry, which has kept the P/S in line with expectations. You'd much rather the company improve its revenue if you still believe in the business. At the very least, you'd be hoping that revenue doesn't accelerate downwards if your plan is to pick up some stock while it's not in favour.

Keen to find out how analysts think Chugoku Electric Power's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Chugoku Electric Power's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 3.9% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 25% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to plummet, contracting by 2.4% each year during the coming three years according to the four analysts following the company. With the rest of the industry predicted to shrink by 0.2% per annum, it's a sub-optimal result.

With this in mind, we find it intriguing that Chugoku Electric Power's P/S is similar to its industry peers. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. Maintaining these prices will be difficult to achieve as the weak outlook is likely to weigh down the shares eventually.

What Does Chugoku Electric Power's P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Chugoku Electric Power's analyst forecasts have revealed that its even shakier outlook against the industry isn't impacting its P/S as much as we would have predicted. Even though the company's P/S is on par with the rest of the industry, the fact that it's revenue outlook is poorer than an already struggling industry suggests that the P/S isn't justified. In addition, we would be concerned whether the company can even maintain this level of performance under these tough industry conditions. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Chugoku Electric Power (2 are significant!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Chugoku Electric Power, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9504

Chugoku Electric Power

Engages in generation, transmission, and distribution of electric power in Japan.

Solid track record and fair value.

Market Insights

Community Narratives