- Japan

- /

- Gas Utilities

- /

- TSE:8174

A Fresh Look at Nippon Gas (TSE:8174) Valuation After Buyback, Dividend Boost, and New Earnings Guidance

Reviewed by Simply Wall St

Nippon Gas (TSE:8174) just set a strong tone for its shareholders, rolling out a plan to buy back up to 3.68% of its outstanding shares by next March. This move is intended to boost shareholder value and streamline the capital structure.

See our latest analysis for Nippon Gas.

The buyback news follows several bullish signals from Nippon Gas, including the start of share repurchases, a higher interim dividend, and upbeat earnings guidance for the year. While investor sentiment was already warming up, these moves have helped kick momentum into high gear. The share price has climbed 10.3% in the last month and achieved a year-to-date share price return of 36.9%. Long-term holders have fared even better, with a five-year total shareholder return nearing 100%.

If this streak of shareholder-friendly moves has you interested in other rising opportunities, it could be the perfect moment to discover fast growing stocks with high insider ownership

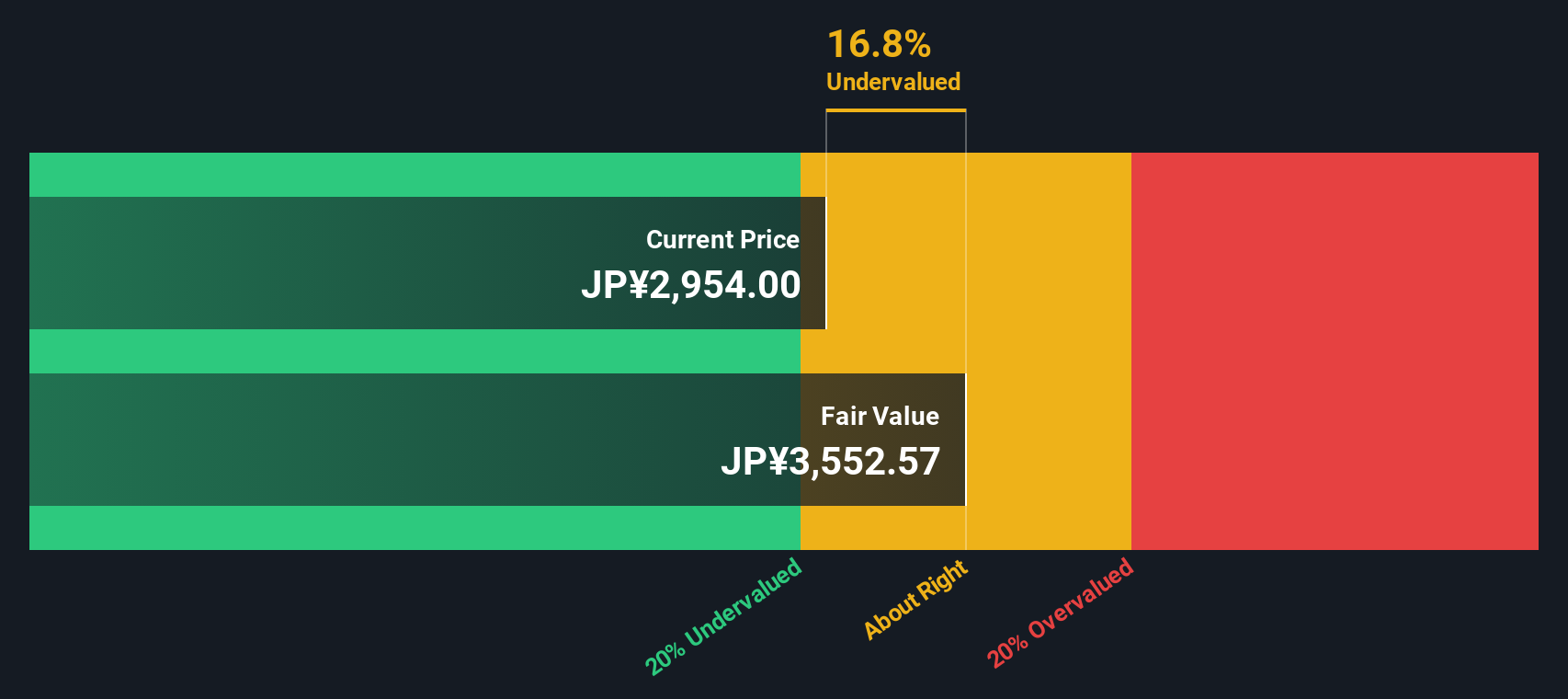

Yet with the share price rallying and a buyback underway, the big question for investors now is whether Nippon Gas remains undervalued at current levels or if the market has already priced in all the good news.

Price-to-Earnings of 24x: Is it justified?

Nippon Gas trades at a price-to-earnings ratio of 24x, significantly higher than both its industry peers and what models suggest it should be. With a recent close price of ¥2,954, this places Nippon Gas in the premium valuation zone compared to its sector.

The price-to-earnings multiple is a quick snapshot of how much investors are willing to pay for each yen of the company’s annual earnings. In defensive sectors like utilities, investors often look for steady and predictable earnings. A high multiple can signal the expectation of strong profit growth or deeper market confidence.

Currently, the company’s price-to-earnings ratio stands well above the Asian Gas Utilities industry average of 13.9x and the peer average of 11x. More strikingly, it is nearly triple the estimated fair price-to-earnings ratio of 8.3x, hinting at lofty market expectations or possible over-enthusiasm around recent performance. If the market readjusts toward the fair ratio, significant repricing is possible.

Explore the SWS fair ratio for Nippon Gas

Result: Price-to-Earnings of 24x (OVERVALUED)

However, slowing revenue growth and the stock’s existing rally could limit further upside if market enthusiasm fades in the months ahead.

Find out about the key risks to this Nippon Gas narrative.

Another View: SWS DCF Model Points to Opportunity

While the earnings multiple signals overvaluation, our DCF model tells a different story. According to this approach, Nippon Gas is trading below its estimated fair value by roughly 16.8%. This suggests that the market may be underestimating the company's future cash flows, not overpricing them. So which lens best captures reality? Market enthusiasm for earnings, or a more patient take on cash flow potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nippon Gas for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 861 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nippon Gas Narrative

If you have a different perspective or want to dig into the figures yourself, you can craft your own Nippon Gas narrative in just a few minutes. Do it your way.

A great starting point for your Nippon Gas research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Step ahead of the crowd by exploring exclusive stock ideas tailored for bold investors. Don’t wait for the headlines; seize your opportunity now.

- Unlock income potential and see which companies offer steady returns among these 17 dividend stocks with yields > 3% boasting yields above 3%.

- Fuel your curiosity about artificial intelligence and browse these 24 AI penny stocks redefining tomorrow with pioneering applications and disruptive technology.

- Tap into real value by scanning these 861 undervalued stocks based on cash flows where attractive fundamentals meet overlooked pricing opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Gas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8174

Nippon Gas

Engages in the supply and sale of LP gas and natural gas in Japan.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives