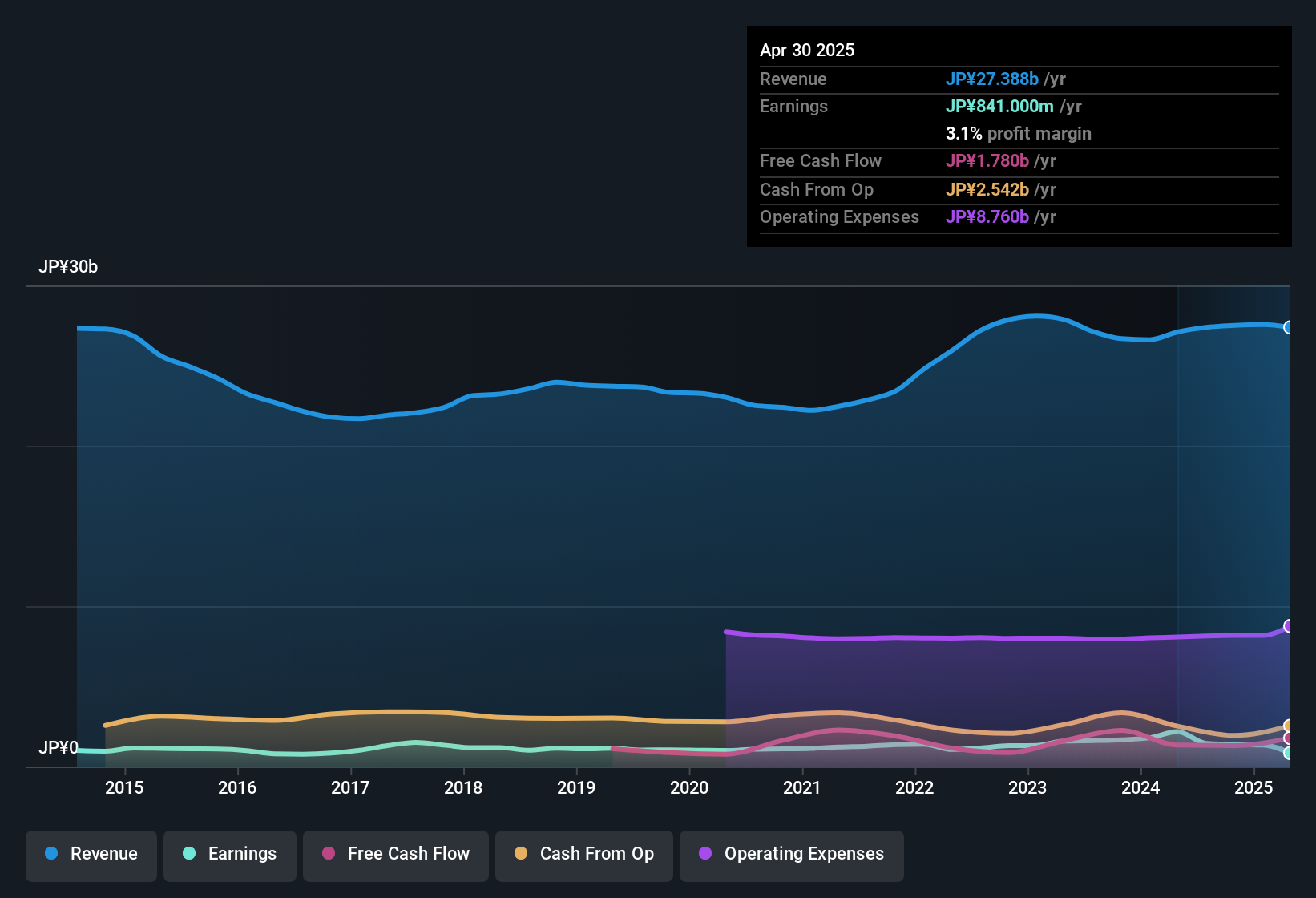

Shareholders appeared unconcerned with Toell Co.,Ltd.'s (TSE:3361) lackluster earnings report last week. We think that the softer headline numbers might be getting counterbalanced by some positive underlying factors.

The Impact Of Unusual Items On Profit

To properly understand ToellLtd's profit results, we need to consider the JP¥803m expense attributed to unusual items. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. In the twelve months to April 2025, ToellLtd had a big unusual items expense. As a result, we can surmise that the unusual items made its statutory profit significantly weaker than it would otherwise be.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of ToellLtd.

Our Take On ToellLtd's Profit Performance

As we discussed above, we think the significant unusual expense will make ToellLtd's statutory profit lower than it would otherwise have been. Because of this, we think ToellLtd's underlying earnings potential is as good as, or possibly even better, than the statutory profit makes it seem! Unfortunately, though, its earnings per share actually fell back over the last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. For example - ToellLtd has 2 warning signs we think you should be aware of.

Today we've zoomed in on a single data point to better understand the nature of ToellLtd's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if ToellLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3361

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success