- Japan

- /

- Renewable Energy

- /

- TSE:1711

SDS HOLDINGS Co.,Ltd. (TSE:1711) Stock Rockets 33% But Many Are Still Ignoring The Company

SDS HOLDINGS Co.,Ltd. (TSE:1711) shares have had a really impressive month, gaining 33% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 6.8% isn't as attractive.

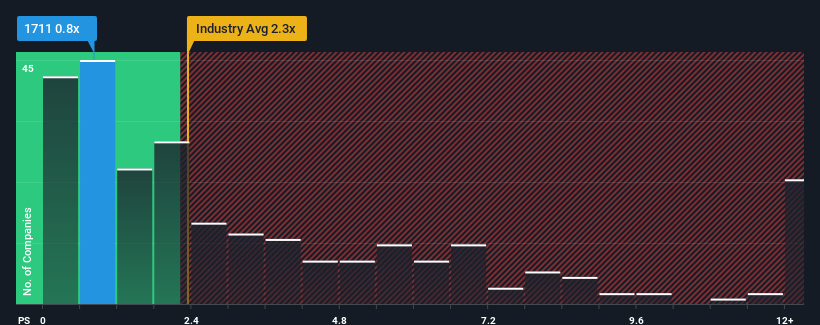

In spite of the firm bounce in price, there still wouldn't be many who think SDS HOLDINGSLtd's price-to-sales (or "P/S") ratio of 0.8x is worth a mention when the median P/S in Japan's Renewable Energy industry is similar at about 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for SDS HOLDINGSLtd

What Does SDS HOLDINGSLtd's P/S Mean For Shareholders?

SDS HOLDINGSLtd has been doing a decent job lately as it's been growing revenue at a reasonable pace. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

Although there are no analyst estimates available for SDS HOLDINGSLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For SDS HOLDINGSLtd?

In order to justify its P/S ratio, SDS HOLDINGSLtd would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 5.5% gain to the company's revenues. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, even though the last 12 months were fairly tame in comparison. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 13% shows it's noticeably more attractive.

With this information, we find it interesting that SDS HOLDINGSLtd is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Key Takeaway

SDS HOLDINGSLtd's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We didn't quite envision SDS HOLDINGSLtd's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with SDS HOLDINGSLtd, and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on SDS HOLDINGSLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:1711

SDS HOLDINGSLtd

Engages in renewable energy, energy saving, and facility solution businesses in Japan.

Low risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success