- Japan

- /

- Gas Utilities

- /

- TSE:1663

What K&O Energy Group Inc.'s (TSE:1663) 27% Share Price Gain Is Not Telling You

K&O Energy Group Inc. (TSE:1663) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Looking back a bit further, it's encouraging to see the stock is up 37% in the last year.

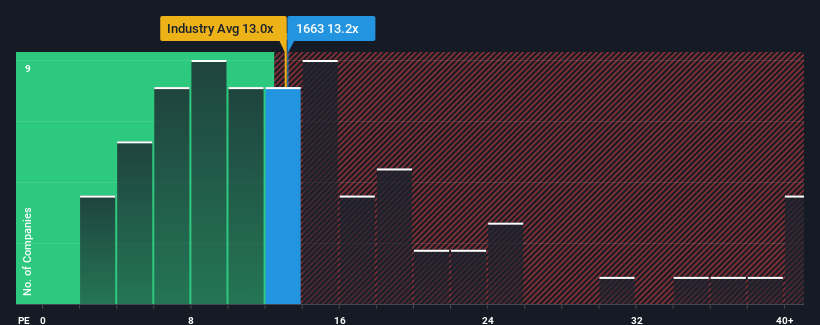

Even after such a large jump in price, there still wouldn't be many who think K&O Energy Group's price-to-earnings (or "P/E") ratio of 13.2x is worth a mention when the median P/E in Japan is similar at about 14x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's superior to most other companies of late, K&O Energy Group has been doing relatively well. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for K&O Energy Group

What Are Growth Metrics Telling Us About The P/E?

K&O Energy Group's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 22% last year. The strong recent performance means it was also able to grow EPS by 147% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 12% each year during the coming three years according to the one analyst following the company. Meanwhile, the broader market is forecast to expand by 9.4% each year, which paints a poor picture.

With this information, we find it concerning that K&O Energy Group is trading at a fairly similar P/E to the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Bottom Line On K&O Energy Group's P/E

Its shares have lifted substantially and now K&O Energy Group's P/E is also back up to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of K&O Energy Group's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You need to take note of risks, for example - K&O Energy Group has 2 warning signs (and 1 which is significant) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if K&O Energy Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:1663

K&O Energy Group

Engages in the development, production, supply, and sale of natural gas and iodine in Japan.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026