- Japan

- /

- Gas Utilities

- /

- TSE:1663

K&O Energy Group Inc. (TSE:1663) May Have Run Too Fast Too Soon With Recent 26% Price Plummet

To the annoyance of some shareholders, K&O Energy Group Inc. (TSE:1663) shares are down a considerable 26% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 22% share price drop.

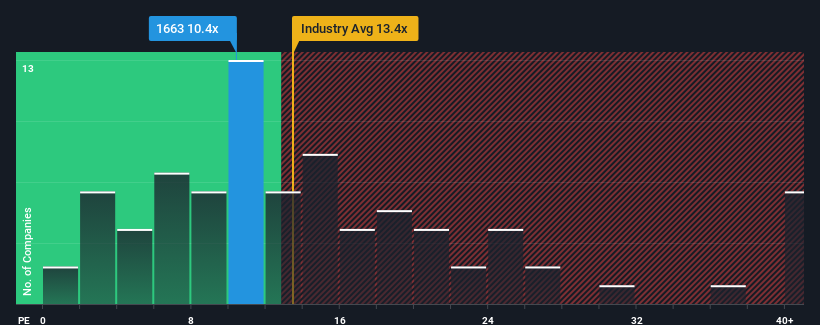

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about K&O Energy Group's P/E ratio of 10.4x, since the median price-to-earnings (or "P/E") ratio in Japan is also close to 12x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

K&O Energy Group could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Check out our latest analysis for K&O Energy Group

Does Growth Match The P/E?

In order to justify its P/E ratio, K&O Energy Group would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 4.7% decrease to the company's bottom line. Even so, admirably EPS has lifted 116% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the one analyst covering the company suggest earnings growth is heading into negative territory, declining 35% over the next year. Meanwhile, the broader market is forecast to expand by 10%, which paints a poor picture.

In light of this, it's somewhat alarming that K&O Energy Group's P/E sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

What We Can Learn From K&O Energy Group's P/E?

With its share price falling into a hole, the P/E for K&O Energy Group looks quite average now. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that K&O Energy Group currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for K&O Energy Group that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if K&O Energy Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:1663

K&O Energy Group

Engages in the development, production, supply, and sale of natural gas and iodine in Japan.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success