Japan Airlines (TSE:9201) Net Profit Margin Tops Last Year, Reinforcing Value Narrative Despite Dividend Risk

Reviewed by Simply Wall St

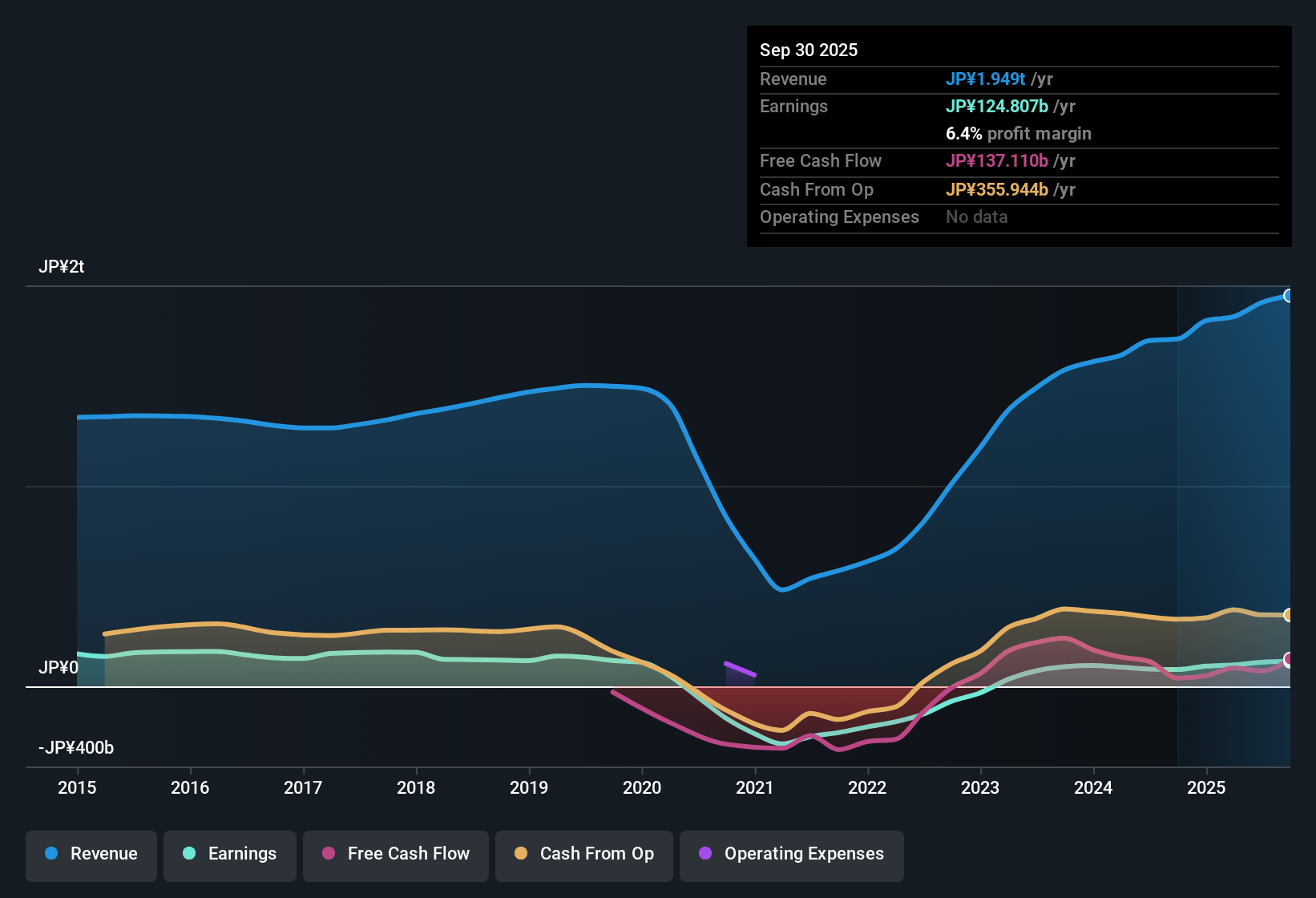

Japan Airlines (TSE:9201) posted a net profit margin of 6.3%, topping last year’s 5%, and sustained its trend of profitability by growing earnings 39% over the past year. However, this pace lagged its powerful 69.5% five-year annual average. Looking ahead, revenue and earnings are expected to expand at 3.7% per year, slowing compared to the wider Japanese market’s 4.5% and 7.9% growth forecasts. With margins continuing to improve and the company trading below analyst price targets, investors are weighing ongoing gains against slower growth expectations and a flagging dividend outlook.

See our full analysis for Japan Airlines.Next, we’ll see how this performance matches up with the current narratives around Japan Airlines, highlighting where the numbers back up the story and where they might pose a challenge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margin Outpaces Industry

- Japan Airlines reported a net profit margin of 6.3%, now matching the Asian Airlines industry average but improving upon last year’s 5% margin.

- Current profitability strengthens the view that Japan Airlines is executing a successful recovery by aligning with broader sector trends in margin expansion.

- Average annual earnings growth over the past five years reached 69.5%, a sign of durable turnaround potential even as growth rates moderate.

- Some industry watchers highlight that the alignment of margins with peers signals normalization, but Japan Airlines' ability to maintain this advantage during slower growth will be a critical focus moving forward.

Dividend Sustainability Questioned as a Risk

- The only major risk flagged is doubt over the sustainability of Japan Airlines’ dividend, as noted in filings and risk commentary, rather than a cut already being announced.

- Critics highlight that with future annual earnings growth forecast at 3.7%, well below the prior five-year run rate, there is increased pressure on management to support ongoing dividends.

- The risk of slower growth, especially versus peers with sector earnings projected to rise 7.9% per year, intensifies scrutiny of payout stability.

- For income-focused investors, market attention will likely center on how Japan Airlines balances investment in growth with dividends amid these headwinds.

Value Narrative Gets a Reality Check

- While Japan Airlines trades at a P/E ratio of 10.1x, below the peer average of 14x and under the consensus analyst price target of 3627.27, the current share price of 2776.00 sits above its DCF fair value estimate of 1747.12.

- The value case is nuanced: Investors see the valuation as attractive versus peers, yet the price premium to DCF fair value suggests optimism may already be priced in.

- This tension between analyst targets being higher and the DCF benchmark being lower presents both opportunity and risk for those hoping for further upside.

- Sector dynamics, such as a 4.5% revenue growth outlook for the broader Japanese market, provide context that Japan Airlines is not alone in facing a slower expansion period.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Japan Airlines's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Japan Airlines faces slower growth prospects and ongoing uncertainty about sustaining its dividend, which raises concerns for income-focused investors.

If dependable payouts matter to you, check out these 2003 dividend stocks with yields > 3% to discover companies offering strong dividend yields and a more reliable income stream.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9201

Japan Airlines

Provides scheduled and non-scheduled air transport services in Japan, Asia, Oceania, the Americas, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives