How Investors Are Reacting To SG Holdings (TSE:9143) Dividend Announcement and Upgraded Earnings Outlook

Reviewed by Sasha Jovanovic

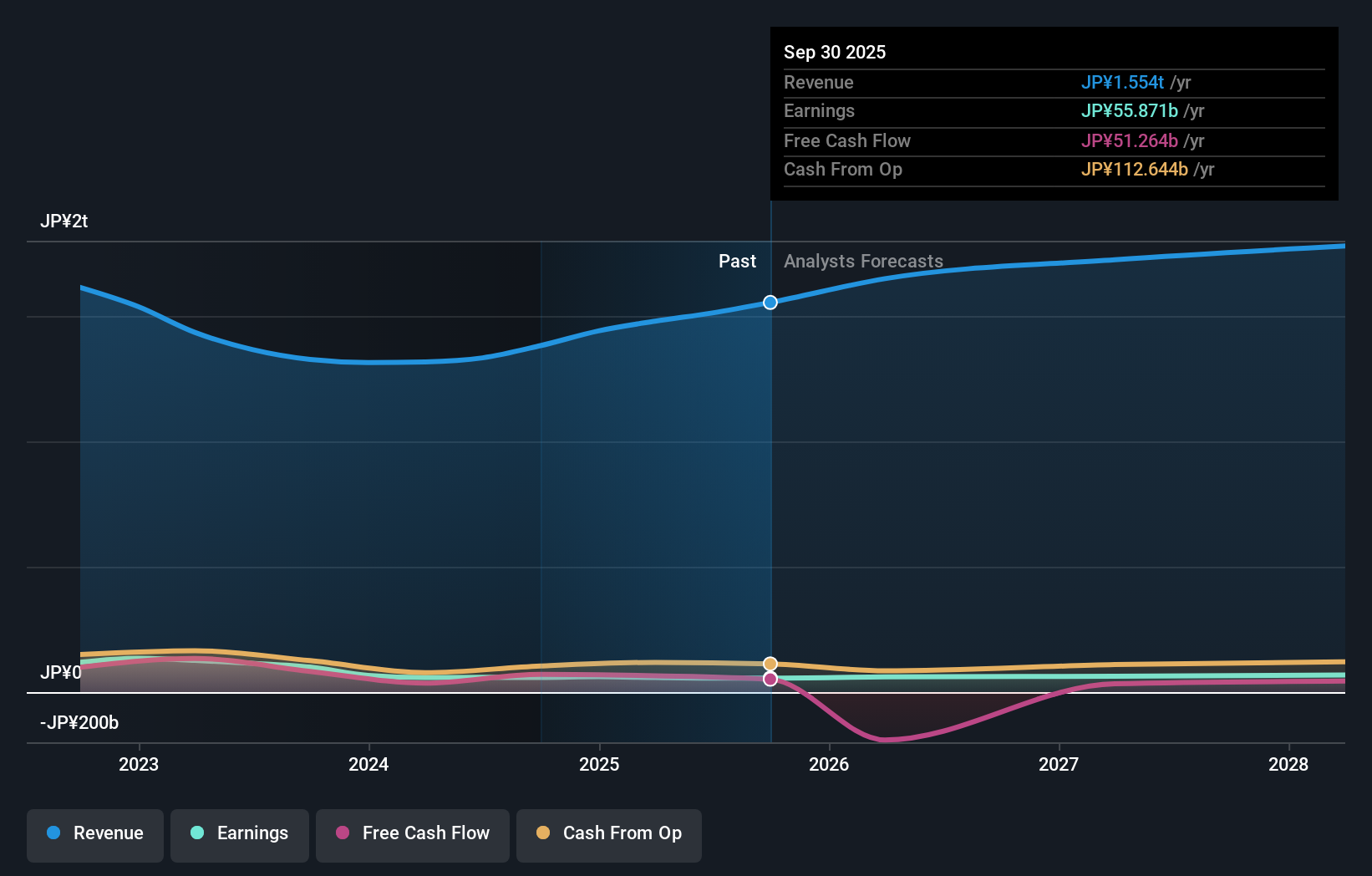

- On November 7, 2025, SG Holdings Co., Ltd. announced a second-quarter dividend of ¥26.00 per share and revised its consolidated earnings guidance for the fiscal year ending March 2026, expecting operating revenue of ¥1.64 trillion and net income of ¥59.00 billion.

- The dividend affirmation and updated guidance, confirmed in a recent board meeting, reflect management’s positive outlook based on current operational performance.

- Next, we’ll explore how the updated earnings outlook shapes SG Holdings’ investment narrative, underscoring the company’s confidence in ongoing profitability.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is SG HoldingsLtd's Investment Narrative?

To be a shareholder in SG Holdings right now, you need conviction in the company's ability to sustain earnings growth and shareholder returns despite slower industry momentum and competitive pressure. The recent dividend affirmation and upward revision to profit guidance for the year signal regained management confidence and could act as a short-term catalyst by encouraging investor optimism and potentially supporting the share price. However, key fundamental risks remain, including high debt levels and questions about the relatively inexperienced management team, which are particularly relevant given persistent margin pressure and sector underperformance versus peers. The latest guidance does help address concerns about earnings stability, but with SG Holdings’ recent financial delivery mixed and board changes fresh, near-term volatility is not off the table. This news gives comfort, yet core operational and market headwinds remain close at hand.

But with a new management team, uncertainty in execution is something investors should not overlook. SG HoldingsLtd's shares are on the way up, but they could be overextended by 8%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on SG HoldingsLtd - why the stock might be worth as much as 12% more than the current price!

Build Your Own SG HoldingsLtd Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SG HoldingsLtd research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free SG HoldingsLtd research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SG HoldingsLtd's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9143

SG HoldingsLtd

Through its subsidiaries, is involved in the delivery, logistics, real estate, and other businesses in Japan and internationally.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives