- Japan

- /

- Transportation

- /

- TSE:9142

What Kyushu Railway (TSE:9142)'s Lower Earnings and Higher Dividend Payout Mean for Shareholders

Reviewed by Sasha Jovanovic

- Kyushu Railway Company recently revised its earnings forecasts downward for the fiscal year ending March 31, 2026, while simultaneously announcing an increase in interim dividends, with a payout of ¥57.50 per share and an ongoing policy to maintain a payout ratio of at least 35%.

- This decision presents a mix of lower expected profits but stronger shareholder returns, reflecting management's focus on dividend stability despite near-term earnings challenges.

- We'll explore how the commitment to a higher dividend payout shapes Kyushu Railway's investment narrative amid lowered earnings guidance.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

What Is Kyushu Railway's Investment Narrative?

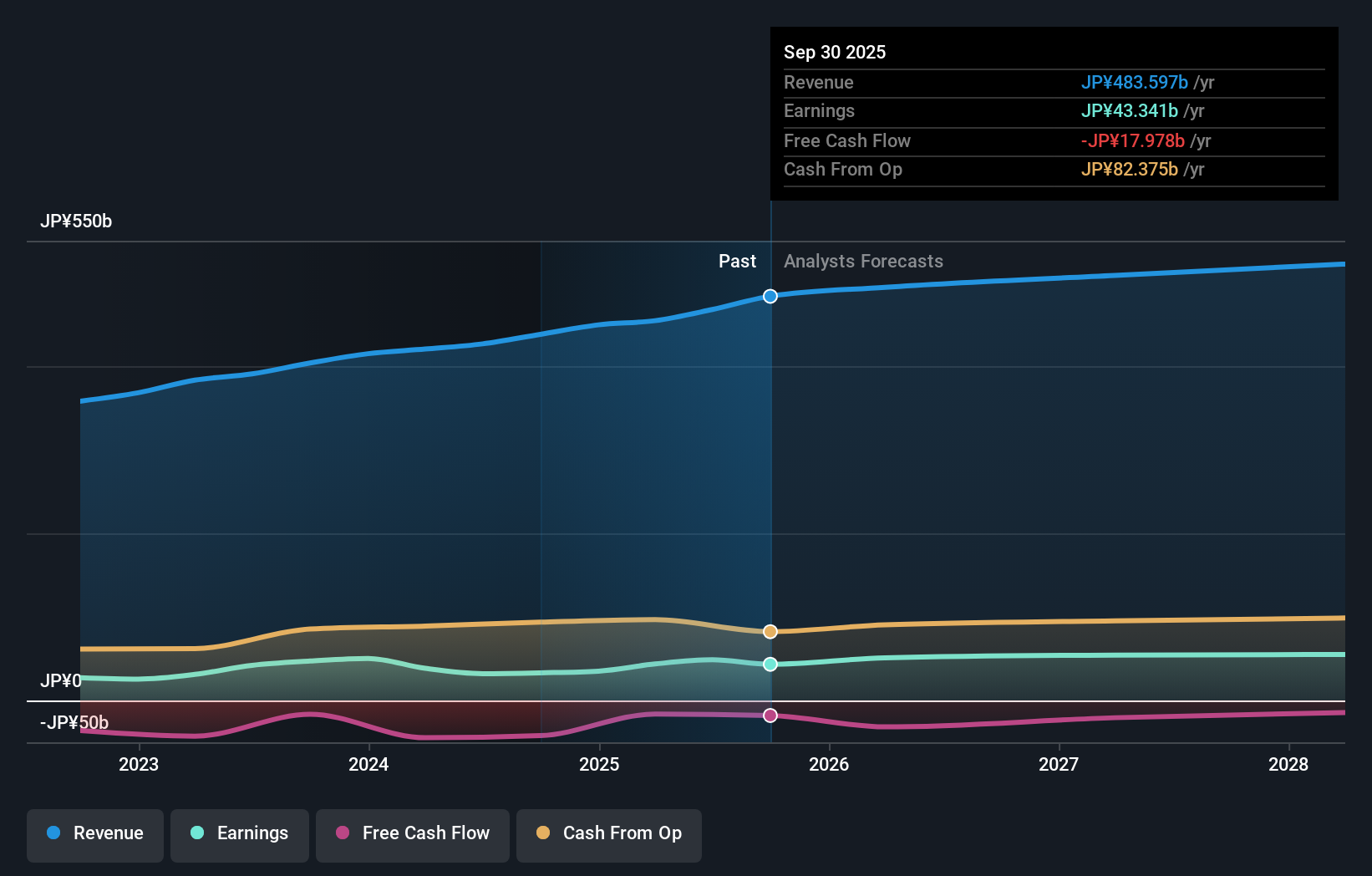

To be a shareholder in Kyushu Railway right now, you need to believe in the company's ability to balance reliable income with the realities of a slower growth profile. The latest guidance cut, showing reduced net profit forecasts for the coming year, introduces some fresh uncertainty to short-term catalysts, particularly as earnings growth was already expected to lag the broader Japanese market. However, the increased interim dividend and explicit commitment to a 35% payout ratio sends a strong signal of management's intent to prioritize shareholder returns even with near-term earnings pressure. For now, this move likely shifts the conversation from growth to income, with dividend stability taking center stage. It also softens some immediate downside risk that comes with a guidance downgrade, although questions remain about cash flow coverage and value alongside profitability concerns. Yet, with the focus swinging to dividends, investors should still factor in ongoing risks around cash flow coverage as they weigh the outlook.

Kyushu Railway's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore another fair value estimate on Kyushu Railway - why the stock might be worth as much as ¥2054!

Build Your Own Kyushu Railway Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kyushu Railway research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Kyushu Railway research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kyushu Railway's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyushu Railway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9142

Proven track record with imperfect balance sheet.

Market Insights

Community Narratives