- Japan

- /

- Marine and Shipping

- /

- TSE:9119

Iino Kaiun Kaisha (TSE:9119) Margin Decline Challenges Bullish Narrative Despite Strong Revenue Outlook

Reviewed by Simply Wall St

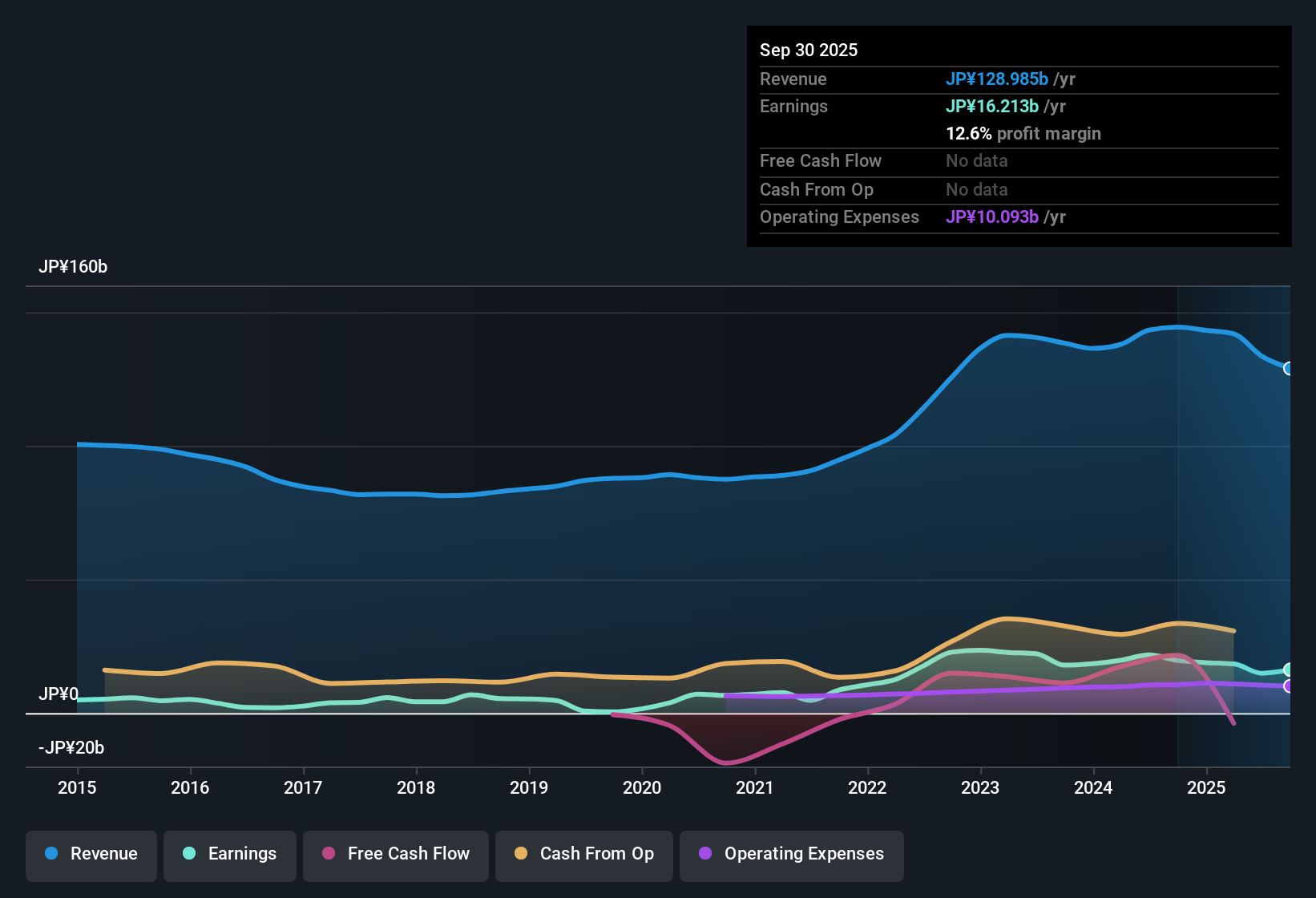

Iino Kaiun Kaisha (TSE:9119) is forecast to grow its revenue by 5.04% per year, which is higher than the Japanese market’s 4.5% average. However, EPS is expected to decline by 10.1% annually over the next three years, and the company’s net profit margin has slipped from 13.6% to 12.6%. Despite the mixed outlook, investors will note the historically strong five-year earnings growth of 16.2% per year. Current valuation metrics appear attractive relative to peers and industry averages, but are tempered by clear signals of softened profitability and operational risk.

See our full analysis for Iino Kaiun Kaisha.Up next, we’ll see how these results compare to the key community narratives and whether the new numbers are changing the story for Iino Kaiun Kaisha among investors.

Curious how numbers become stories that shape markets? Explore Community Narratives

Five-Year Earnings Outpaced Sector

- Over the last five years, Iino Kaiun Kaisha's annual earnings grew by 16.2% per year, a strong rate that stands out in the Japanese shipping sector.

- The prevailing view highlights that this longer-term track record for earnings expansion heavily supports the idea that Iino Kaiun offers operational reliability, even as its most recent period saw a reversal in that trend.

- Bulls may be drawn to the five-year average growth, but should note the shift to a negative result in the latest period as a point where past outperformance may not extend forward.

- This contrast between steady multi-year expansion and recent negative momentum positions Iino Kaiun as a company with established strengths that must now contend with headwinds familiar to the broader shipping sector.

Profit Margin Slides from Peak

- Net profit margin slipped from 13.6% to 12.6% on a trailing basis, reflecting a deterioration in the company’s efficiency at converting revenue to profit compared to the prior year.

- Contrary to arguments that Iino Kaiun represents a low-risk play within the sector, margin erosion reveals that even traditionally resilient operators are exposed to fluctuating operating costs and competitive dynamics.

- With profit margin contracting despite outpacing the industry in long-term growth, the ongoing challenge for management is to stabilize future profitability in a volatile environment.

- What is surprising is that the contraction comes as revenue is forecast to outgrow the market, which would typically support stable or higher margins, not a decrease.

Discounted P/E but Premium to DCF Fair Value

- Iino Kaiun trades at 8.2 times earnings, notably cheaper than peers (14.7x) and the Asian shipping industry (10.9x), yet its ¥1,257 share price sits over 30% above the DCF fair value estimate of ¥965.11.

- The prevailing view frames this as a classic value investor’s tension: while the market assigns Iino Kaiun a clear earnings multiple discount to its peers, the stock is not a "deep value" play when judged against its intrinsic worth.

- The modest multiple rewards value-seekers on a comparative basis, but the premium to calculated fair value hints at an embedded expectation for stability or future upside that is not captured by earnings alone.

- Investors must weigh whether the current market price represents relative sector opportunity or simply bakes in optimism that has yet to play out in tangible results.

See what the community is saying about Iino Kaiun Kaisha

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Iino Kaiun Kaisha's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Iino Kaiun Kaisha’s falling profit margins, negative earnings outlook, and premium to fair value indicate profitability and valuation risks, in spite of its historical growth.

Prefer companies trading below their intrinsic worth and offering stronger value propositions? Uncover fresh opportunities by screening with these 838 undervalued stocks based on cash flows now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9119

Iino Kaiun Kaisha

Engages in the shipping and real estate businesses in Japan and internationally.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives