- Japan

- /

- Trade Distributors

- /

- TSE:8078

Top Three Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating corporate earnings and geopolitical tensions, investors are keenly observing the Federal Reserve's steady interest rate policy amidst persistent inflation concerns. While technology stocks have faced volatility due to competitive pressures from emerging AI technologies like DeepSeek, dividend stocks can offer stability and income potential in uncertain times. In this environment, selecting dividend stocks with strong fundamentals and consistent payout histories can be a prudent strategy for enhancing portfolio resilience.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.24% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 5.78% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.74% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.55% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.48% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.13% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.66% | ★★★★★★ |

| Archer-Daniels-Midland (NYSE:ADM) | 4.48% | ★★★★★★ |

Click here to see the full list of 1944 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

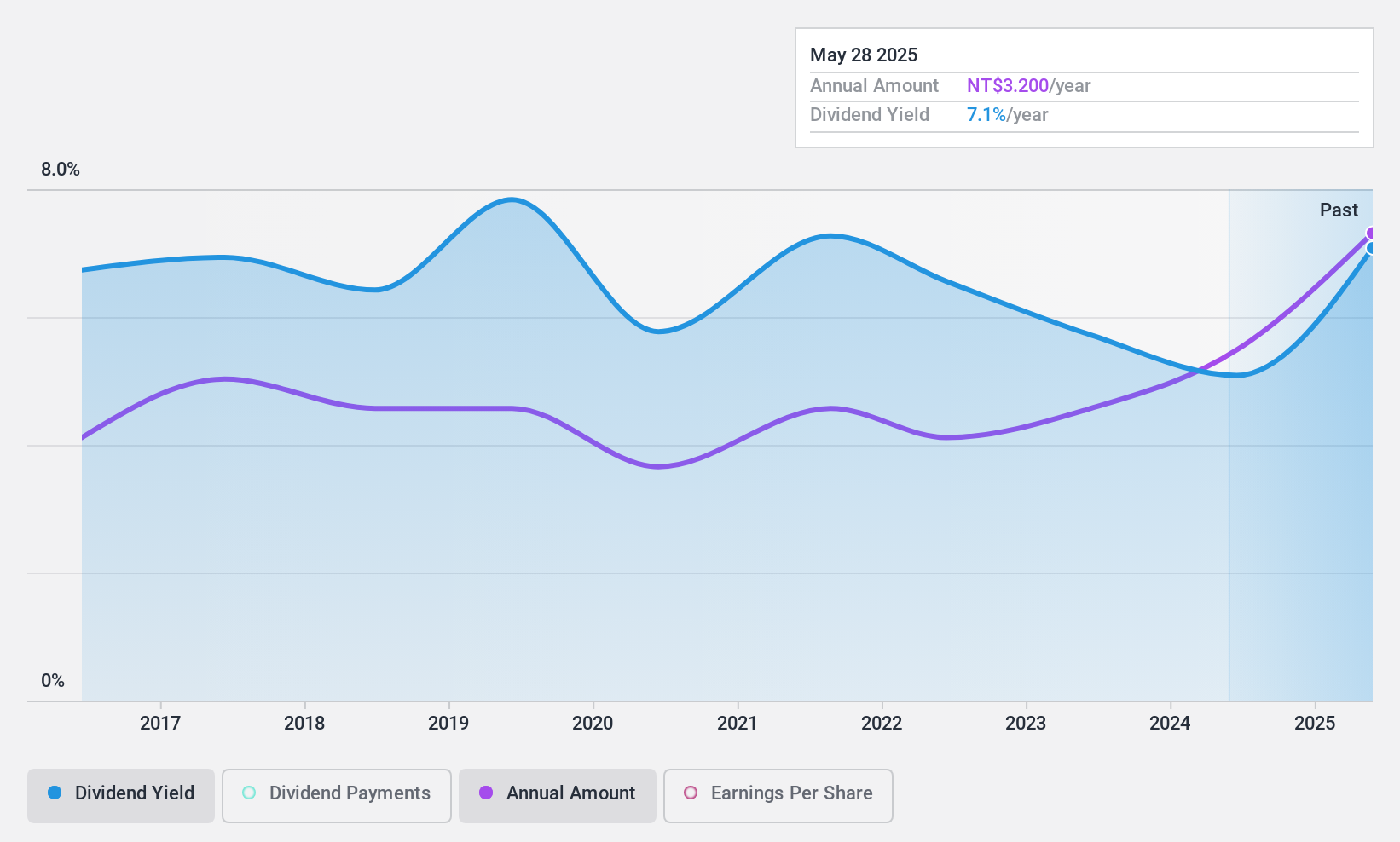

Kuen Ling Machinery Refrigerating (TPEX:4527)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kuen Ling Machinery Refrigerating Co., Ltd. operates in the machinery and refrigerating industry, with a market cap of NT$3.65 billion.

Operations: Kuen Ling Machinery Refrigerating Co., Ltd.'s revenue is primarily derived from the Taiwan Area at NT$3.51 billion, followed by the Mainland Area at NT$1.93 billion, and the Vietnam Region at NT$85.42 million.

Dividend Yield: 4.8%

Kuen Ling Machinery Refrigerating's dividend payments are supported by both earnings and cash flows, with payout ratios of 53.3% and 65.4%, respectively. Despite a volatile dividend history, recent earnings growth of 46.3% suggests improved financial health. The company's price-to-earnings ratio of 11.1x indicates good value compared to the TW market average of 21x, while its dividend yield ranks in the top quarter at 4.79%. Recent earnings reports show significant year-over-year improvements in sales and net income.

- Click here to discover the nuances of Kuen Ling Machinery Refrigerating with our detailed analytical dividend report.

- Our valuation report here indicates Kuen Ling Machinery Refrigerating may be overvalued.

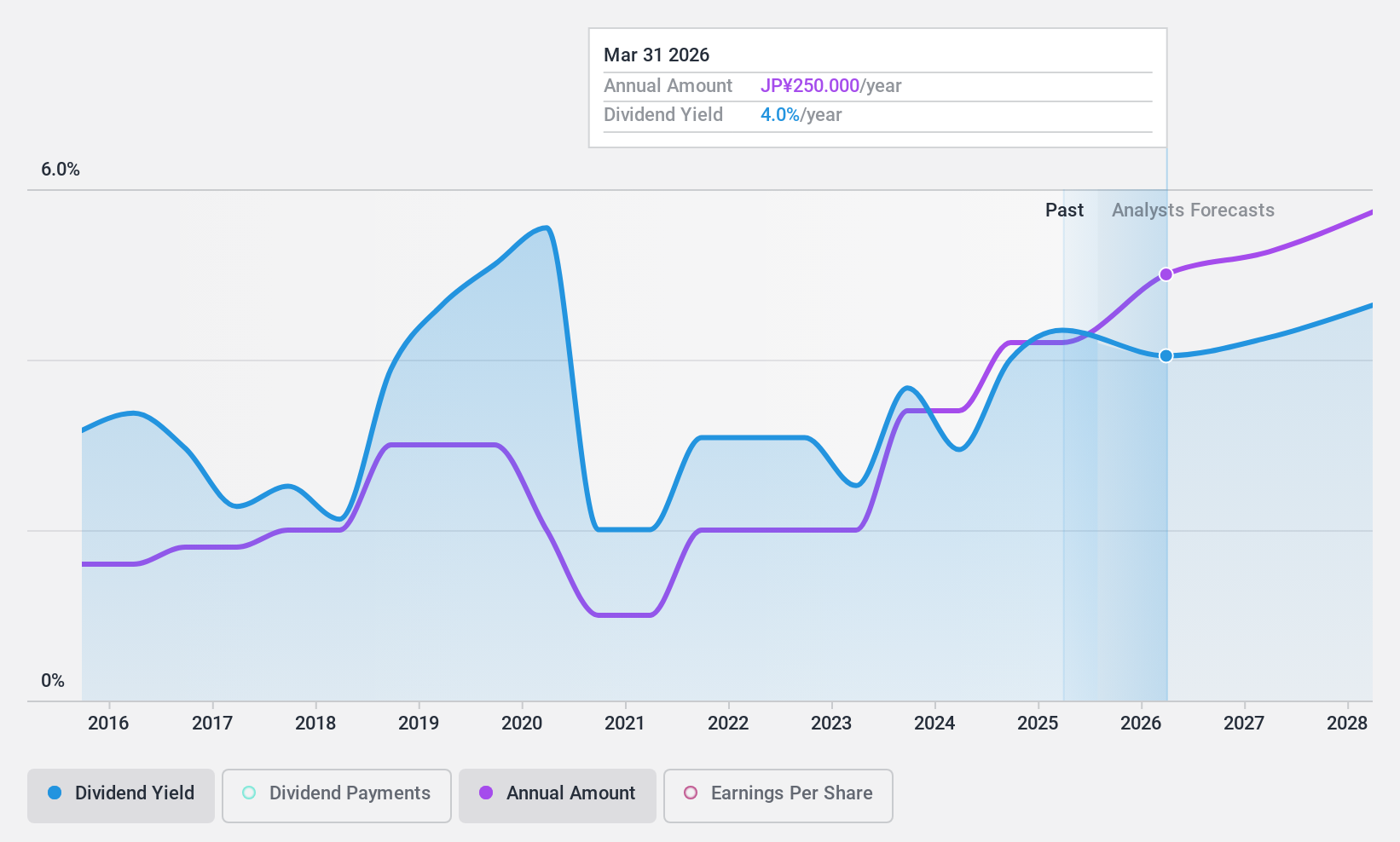

Hanwa (TSE:8078)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hanwa Co., Ltd. is a diversified trading company engaged in the trade of steel, metals and alloys, nonferrous metals, food products, petroleum and chemicals, lumber, machinery, and other products both in Japan and globally with a market cap of ¥193.87 billion.

Operations: Hanwa Co., Ltd.'s revenue is primarily derived from its Steel Business at ¥1.20 billion, followed by Energy and Household Materials at ¥380.72 million, Overseas Sales Subsidiary at ¥374.52 million, Primary Metal at ¥212.01 million, Metal Recycling at ¥167.68 million, and Foods at ¥127.50 million.

Dividend Yield: 4.2%

Hanwa's dividend payments are well-supported by earnings and cash flows, with payout ratios of 21% and 40.9%, respectively. Despite a history of volatility, recent increases in dividends suggest a positive trend, with the latest quarterly dividend rising from JPY 85.00 to JPY 105.00 per share year-over-year. Trading at good value compared to industry peers and offering a top-tier dividend yield of 4.21%, Hanwa's financial position is bolstered by significant earnings growth over the past year.

- Navigate through the intricacies of Hanwa with our comprehensive dividend report here.

- Our valuation report unveils the possibility Hanwa's shares may be trading at a discount.

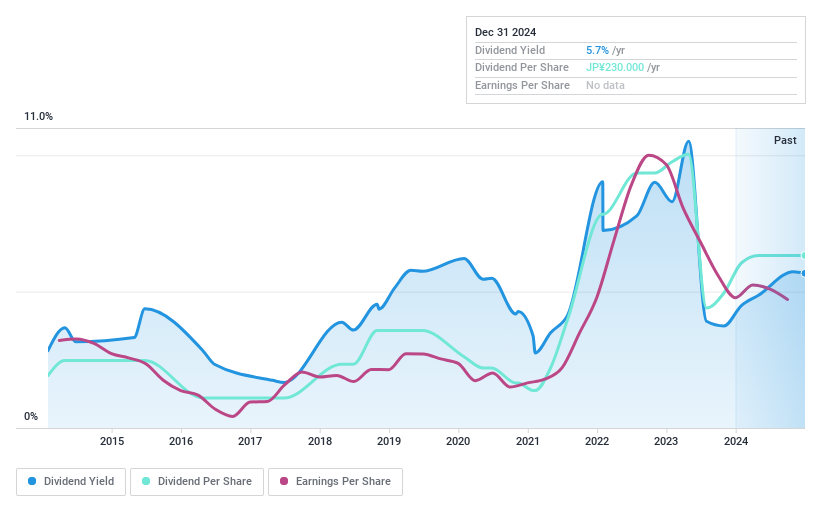

NS United Kaiun Kaisha (TSE:9110)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: NS United Kaiun Kaisha, Ltd. and its subsidiaries provide marine transportation services both in Japan and internationally, with a market cap of ¥94.62 billion.

Operations: NS United Kaiun Kaisha, Ltd. generates its revenue primarily from marine transportation services across both domestic and international markets.

Dividend Yield: 5.7%

NS United Kaiun Kaisha's dividend is well-supported by earnings and cash flows, with payout ratios of 33.9% and 39%, respectively. Despite a volatile dividend history over the past decade, dividends have grown overall. The stock trades at a significant discount to its estimated fair value, offering an appealing yield of 5.65%, placing it among the top dividend payers in Japan. However, the company's track record for stable dividends remains inconsistent.

- Get an in-depth perspective on NS United Kaiun Kaisha's performance by reading our dividend report here.

- The analysis detailed in our NS United Kaiun Kaisha valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Click through to start exploring the rest of the 1941 Top Dividend Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hanwa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8078

Hanwa

Trades in steel, metals and alloys, nonferrous metals, food products, petroleum and chemicals, lumber, machinery, and other products in Japan and internationally.

Undervalued with proven track record and pays a dividend.

Market Insights

Community Narratives