- Japan

- /

- Marine and Shipping

- /

- TSE:9104

MOL (TSE:9104): Examining Valuation After Dividend Hike and Lowered Profit Outlook

Reviewed by Simply Wall St

Mitsui O.S.K. Lines (TSE:9104) just raised its annual dividend forecast to ¥200 per share, even as it lowered its consolidated profit outlook for the fiscal year. This mix of higher payouts and reduced earnings sheds light on the company’s evolving capital allocation approach.

See our latest analysis for Mitsui O.S.K. Lines.

After a bruising year-to-date 20.7% decline in its share price, Mitsui O.S.K. Lines has shown some signs of stabilization, with a 2% gain over the past month following the latest board meeting and dividend announcement. While short-term momentum has faded, the long-term picture remains impressive. Total shareholder return still stands at a staggering 728.9% over five years, underscoring the company's underlying resilience even as market risk perception shifts.

If this dividend-driven rebound has you curious about other moves in the market, consider broadening your perspective and discover fast growing stocks with high insider ownership

The question remains: with profits softening but payouts rising, is Mitsui O.S.K. Lines trading at a bargain, or has the market already factored in the company’s next phase of growth?

Most Popular Narrative: 16.6% Undervalued

With the narrative’s fair value at ¥5,364, Mitsui O.S.K. Lines’ last close at ¥4,474 reflects a notable valuation gap based on current analyst expectations. This sets the stage for what underpins the latest bullish sentiment.

*“Robust global demand for vehicle transport and continued expansion in the vehicle transport business, as evidenced by upward revisions to shipping volumes and profits, position Mitsui O.S.K. Lines to benefit from increasing international trade flows and industrial growth, directly bolstering top-line revenues.”*

Want to peek inside analysts’ thinking on why growth projections remain high, even as profits slip? The narrative hints at surging demand, ambitious fleet investments, and a surprising forward-looking multiple. The next move: Follow the trail to understand why the price target stands apart from today’s realities.

Result: Fair Value of ¥5,364 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent global trade tensions and vessel oversupply could erode profits. This casts doubt on whether current valuations reflect all potential headwinds.

Find out about the key risks to this Mitsui O.S.K. Lines narrative.

Another View: The Multiples Perspective

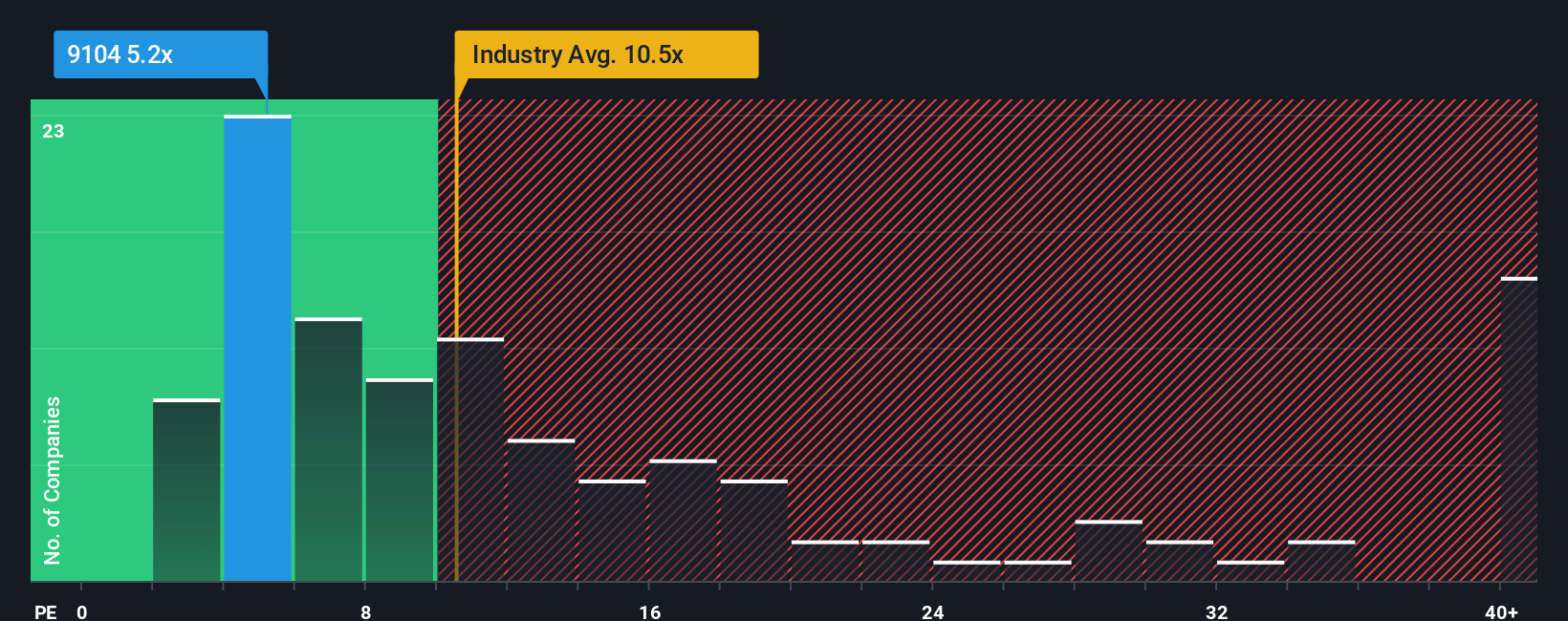

While fair value estimates point to Mitsui O.S.K. Lines being undervalued, the company's price-to-earnings ratio stands out as well. At just 5.2x, it is attractively lower than both peer (7.1x), industry (10.7x), and even the fair ratio of 12x. That suggests a valuation gap the market could close. However, the question remains: is this a true opportunity or a value trap?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mitsui O.S.K. Lines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 857 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mitsui O.S.K. Lines Narrative

If you’re inclined to dig into the numbers and draw your own conclusions, you can assemble a personal Mitsui O.S.K. Lines narrative in just a few minutes, so why not Do it your way

A great starting point for your Mitsui O.S.K. Lines research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Level up your portfolio with smart picks you might not have considered. Simply Wall Street’s screener brings fresh opportunities into focus, so don’t let them pass you by.

- Capture rapid growth by targeting companies tapped into artificial intelligence. Jump in with these 25 AI penny stocks making headlines for their innovation.

- Secure reliable income streams when you check out these 15 dividend stocks with yields > 3%, featuring firms with high-yield payouts above 3%.

- Ride the momentum in digital finance by looking at these 82 cryptocurrency and blockchain stocks, highlighting companies set to benefit from blockchain and cryptocurrency trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9104

Mitsui O.S.K. Lines

Provides marine transportation and vessel chartering services in Japan, North America, Europe, Singapore, rest of Asia, and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives