- Japan

- /

- Marine and Shipping

- /

- TSE:9104

Evaluating Mitsui O.S.K. Lines (TSE:9104) Valuation After Major Leadership Reshuffle and New CEO Appointment

Reviewed by Simply Wall St

Mitsui O.S.K. Lines (TSE:9104) just unveiled a sweeping leadership reshuffle, putting Jotaro Tamura in the CEO seat and moving Takeshi Hashimoto to Chairman, a shift investors will be watching closely.

See our latest analysis for Mitsui O.S.K. Lines.

The leadership reshuffle lands after a choppy stretch, with the share price currently at ¥4,503 and a year to date share price return of minus 20.2 percent. Even so, the five year total shareholder return of 591.79 percent still underlines a powerful longer term story, suggesting momentum has cooled while long horizon gains remain intact.

If this management shake up has you rethinking your watchlist, it could be a good time to explore fast growing stocks with high insider ownership for other stocks where leadership and ownership are closely aligned.

With the stock down this year yet still trading around an 18 percent discount to analyst targets, is Mitsui O.S.K. Lines now underappreciated by the market, or are investors already pricing in the next leg of its growth?

Most Popular Narrative: 15.5% Undervalued

With Mitsui O.S.K. Lines last closing at ¥4,503 versus a narrative fair value near ¥5,327, the current price sits below the story driving that estimate.

Ongoing expansion and investment in energy logistics including LNG dual fuel VLCCs, long term LNG charter contracts, and entry into offshore wind projects poise Mitsui O.S.K. Lines to capture new high margin revenue streams from the global transition to decarbonization and renewable energy, supporting long term revenue growth and margin resilience.

Curious how shrinking earnings, flatter revenues, and pressured margins can still justify a richer future earnings multiple and higher value than today? The full narrative unpacks the specific profit path, share count shift, and required re rating that have to line up almost perfectly to make this pricing blueprint work.

Result: Fair Value of ¥5,327 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak freight rates and high green capex needs could squeeze margins and delay the expected earnings recovery that investors are counting on.

Find out about the key risks to this Mitsui O.S.K. Lines narrative.

Another View: Market Ratios Paint a Different Picture

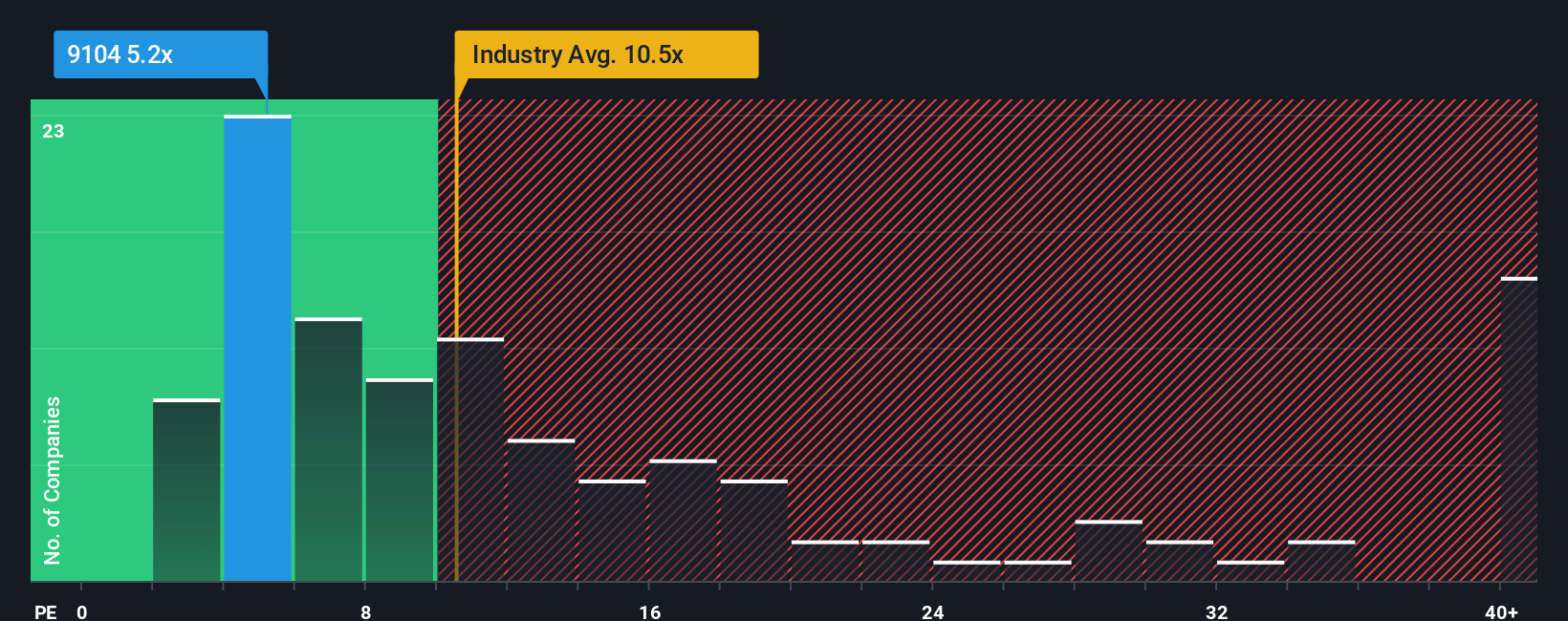

While the narrative fair value implies upside, the current price to earnings ratio of 5.2 times is far below peers at 7.4 times and an even higher fair ratio of 12.3 times. This suggests the market may be heavily discounting Mitsui O.S.K. Lines future earnings power, or spotting risks that others are downplaying.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mitsui O.S.K. Lines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mitsui O.S.K. Lines Narrative

If the narrative here does not fully reflect your own view, you can dive into the numbers yourself and craft a custom story in minutes, Do it your way.

A great starting point for your Mitsui O.S.K. Lines research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at a single opportunity. You can scan fresh ideas in minutes, and your future returns may benefit from taking action today.

- Capture potential mispricings early by reviewing these 913 undervalued stocks based on cash flows that strong cash flows suggest the market is still overlooking.

- Consider structural growth trends by targeting these 24 AI penny stocks positioned at the heart of the artificial intelligence boom.

- Seek reliable income streams by focusing on these 13 dividend stocks with yields > 3% that can help support long term returns through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9104

Mitsui O.S.K. Lines

Provides marine transportation and vessel chartering services in Japan, North America, Europe, Singapore, rest of Asia, and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion