- Taiwan

- /

- Auto Components

- /

- TWSE:1319

Discover Banco Bilbao Vizcaya Argentaria And 2 Leading Dividend Stocks

Reviewed by Simply Wall St

In the wake of recent global market fluctuations, driven by political shifts and economic data releases, investors are navigating a complex landscape marked by sector-specific volatility and interest rate expectations. Amidst this backdrop, dividend stocks like Banco Bilbao Vizcaya Argentaria offer potential stability and income, making them appealing options for those seeking steady returns in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.14% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.13% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.74% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.38% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.33% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.73% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

Click here to see the full list of 1964 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

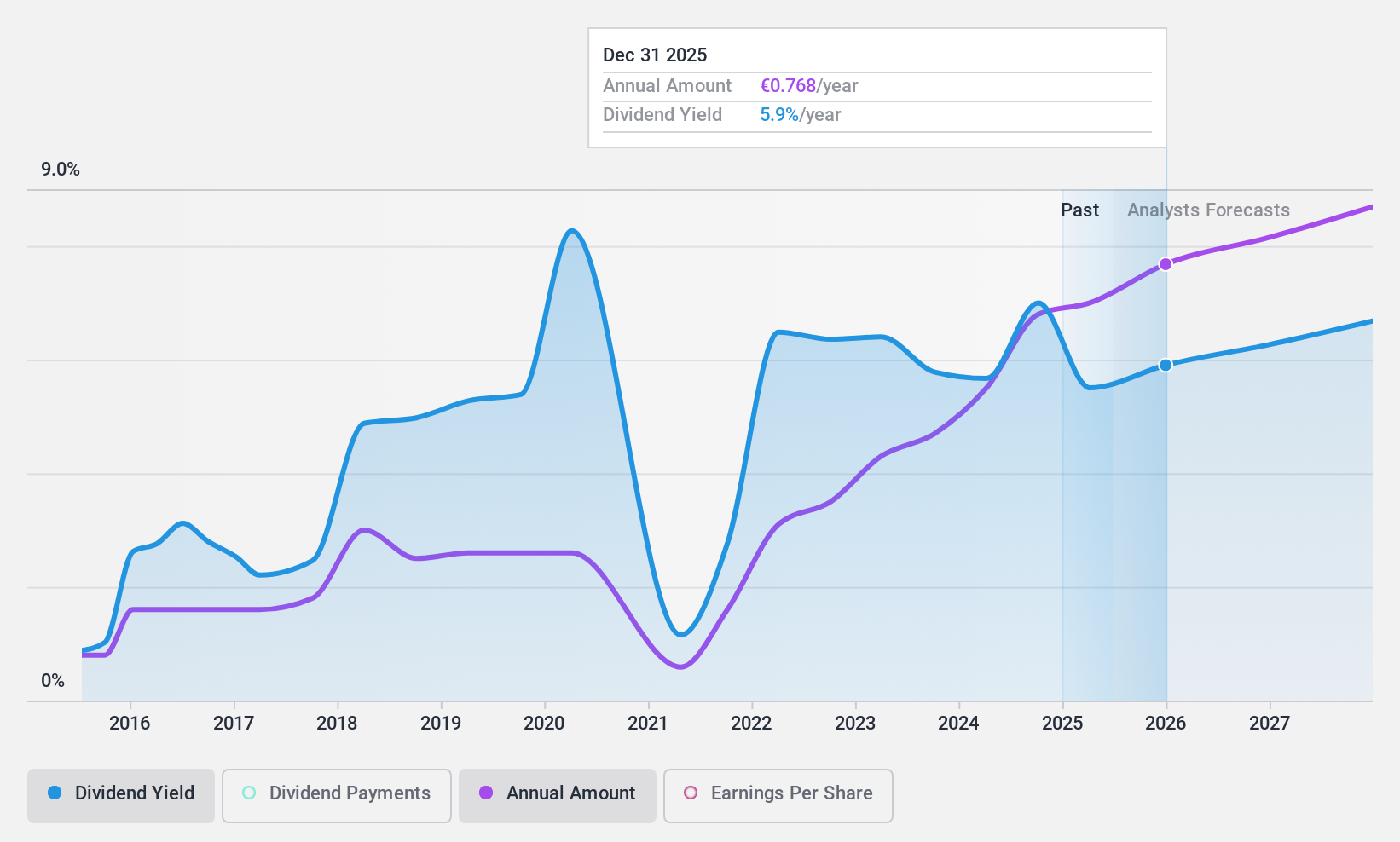

Banco Bilbao Vizcaya Argentaria (BME:BBVA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banco Bilbao Vizcaya Argentaria, S.A. is a financial institution offering retail banking, wholesale banking, and asset management services across the United States, Spain, Mexico, Turkey, South America, and internationally with a market cap of €54.34 billion.

Operations: Banco Bilbao Vizcaya Argentaria's revenue segments include €14.90 billion from Mexico, €3.26 billion from Turkey, €4.43 billion from South America, and €9.06 billion from Spain (including non-core real estate).

Dividend Yield: 7.2%

Banco Bilbao Vizcaya Argentaria's dividend yield is in the top 25% of Spanish market payers, supported by a low payout ratio of 42.2%, indicating sustainable coverage by earnings. Despite recent earnings growth and good relative value, its dividend history has been volatile and unreliable over the past decade. The recent interim dividend payment was €0.2349 per share, reflecting ongoing commitment despite challenges like high non-performing loans at 3.4%.

- Take a closer look at Banco Bilbao Vizcaya Argentaria's potential here in our dividend report.

- According our valuation report, there's an indication that Banco Bilbao Vizcaya Argentaria's share price might be on the cheaper side.

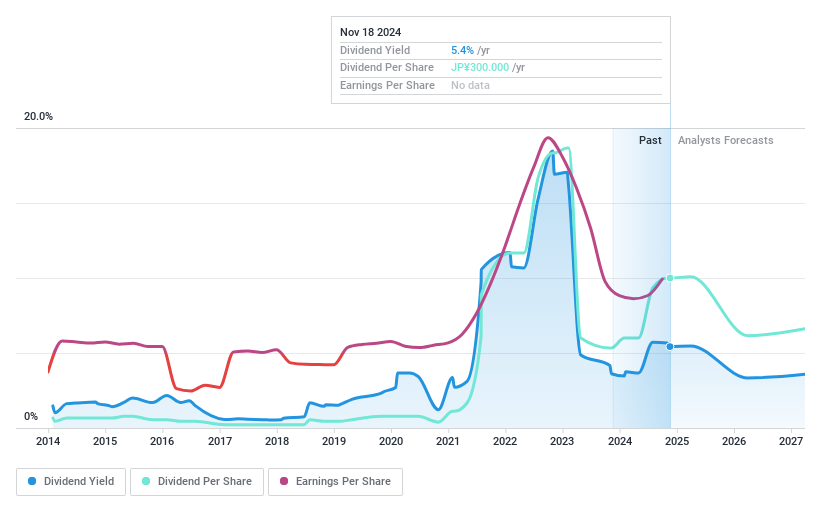

Mitsui O.S.K. Lines (TSE:9104)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mitsui O.S.K. Lines, Ltd. operates in the marine transportation industry both in Japan and globally, with a market capitalization of ¥2.01 trillion.

Operations: Mitsui O.S.K. Lines, Ltd.'s revenue segments include the Energy Business at ¥515.10 billion, Dry Bulk Business at ¥420.16 billion, Product Transport Business - Container Ships at ¥60.42 billion, Ferry· Coastal RORO Ship and Cruise Business at ¥66.69 billion, Connection Businesses (excluding Real Estate) at ¥88.02 billion, and Product Transport Business - Car Carriers, Terminal and Logistics, Ferries and Coastal Roro Ships at ¥579.82 billion.

Dividend Yield: 5.4%

Mitsui O.S.K. Lines offers a dividend yield in the top 25% of the Japanese market, supported by a low payout ratio of 29.4%, yet its dividends have been volatile over the past decade and are not covered by free cash flows. The company recently increased its annual dividend guidance to ¥300 per share due to revised earnings forecasts, despite high debt levels and expected earnings decline. A share buyback program aims to enhance shareholder returns and corporate value.

- Delve into the full analysis dividend report here for a deeper understanding of Mitsui O.S.K. Lines.

- Our comprehensive valuation report raises the possibility that Mitsui O.S.K. Lines is priced lower than what may be justified by its financials.

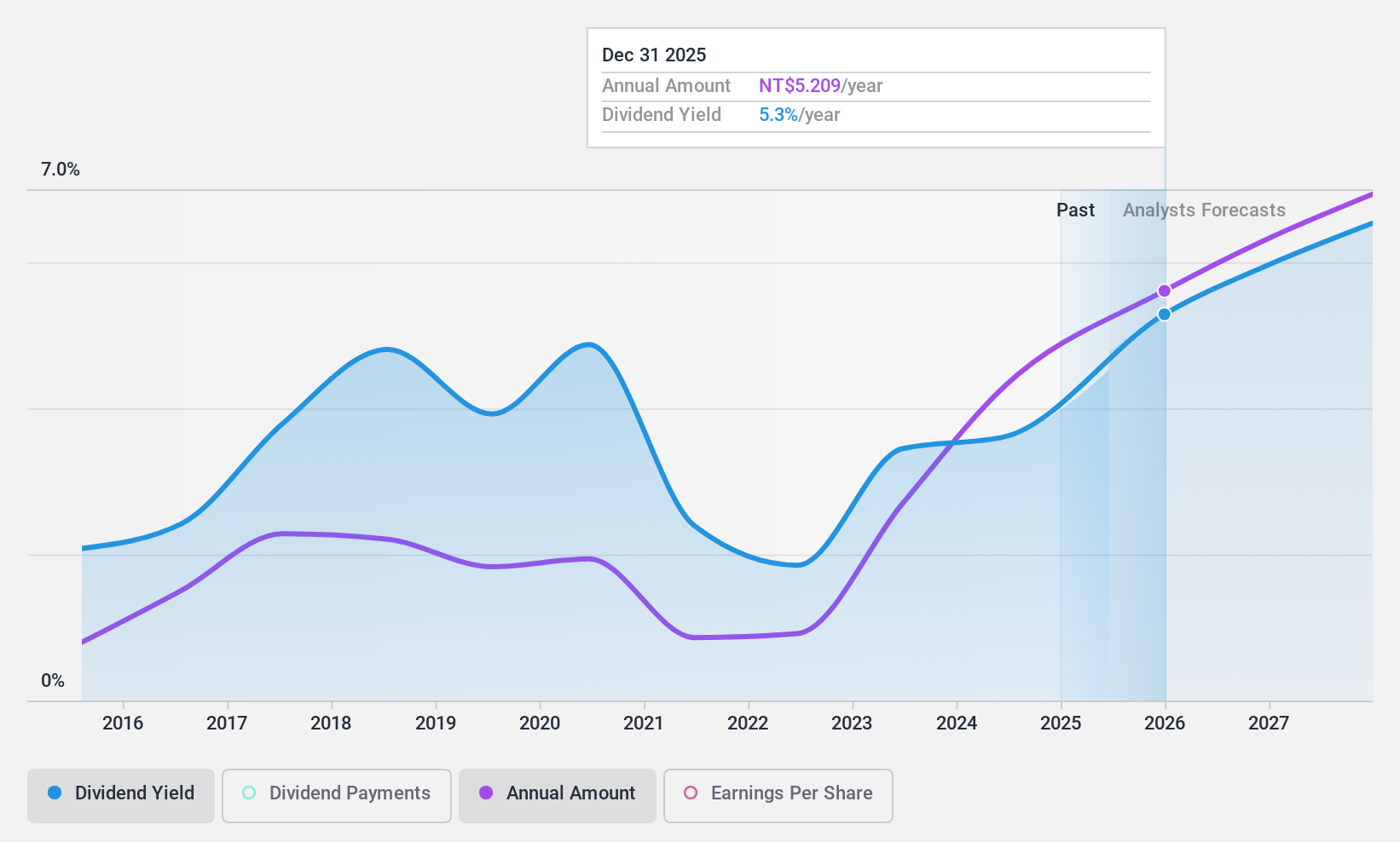

Tong Yang Industry (TWSE:1319)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tong Yang Industry Co., Ltd. manufactures and sells automobile and motorcycle parts, components, and models in Taiwan, China, the United States, and internationally with a market cap of NT$65.65 billion.

Operations: Tong Yang Industry Co., Ltd. generates revenue through the production and distribution of automotive and motorcycle parts, components, and models across Taiwan, China, the United States, and other international markets.

Dividend Yield: 3.6%

Tong Yang Industry's dividend payments are covered by earnings and cash flows, with payout ratios of 60.8% and 59%, respectively, but have been unreliable over the past decade due to volatility. Recent earnings growth of 51.7% year-over-year suggests improved financial health, though its dividend yield of 3.6% is below the top tier in Taiwan's market. The company's sales increased to TWD 18.68 billion for nine months ended September 2024, indicating robust revenue performance despite a slight dip in quarterly net income.

- Get an in-depth perspective on Tong Yang Industry's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Tong Yang Industry's current price could be quite moderate.

Make It Happen

- Embark on your investment journey to our 1964 Top Dividend Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tong Yang Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1319

Tong Yang Industry

Engages in the manufacture and sale of parts, components, and models for automobiles and motorcycles in Taiwan, China, the United States, and internationally.

Flawless balance sheet with solid track record and pays a dividend.