- Japan

- /

- Marine and Shipping

- /

- TSE:9101

Assessing Nippon Yusen Kabushiki Kaisha (TSE:9101) Valuation After New U.S. Methanol Bunkering Partnership

Reviewed by Simply Wall St

Nippon Yusen Kabushiki Kaisha (TSE:9101) just took a fresh step into cleaner shipping, teaming up with ABS, ENEOS, and SEACOR to study commercial-scale methanol bunkering along the U.S. Gulf Coast.

See our latest analysis for Nippon Yusen Kabushiki Kaisha.

The deal comes after a softer patch for the shares, with the latest share price at ¥4,898 and a roughly 10 percent 3 month share price return decline. However, the 5 year total shareholder return near 900 percent still tells a powerful long term compounding story and suggests momentum has cooled recently rather than disappeared.

If this decarbonisation push has you thinking more broadly about transport and industrial trends, it is worth exploring fast growing stocks with high insider ownership as a way to uncover the next set of quietly compounding winners.

With earnings growth stalling and the share price lagging after huge multi year gains, does Nippon Yusen now offer attractively priced exposure to greener shipping, or is the market already baking in its next phase of growth?

Most Popular Narrative Narrative: 7.1% Undervalued

With Nippon Yusen Kabushiki Kaisha last closing at ¥4,898 against a narrative fair value of about ¥5,270, the current price sits below the long term earnings roadmap implied by consensus assumptions.

The analysts have a consensus price target of ¥5,339.091 for Nippon Yusen Kabushiki Kaisha based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥6,900.0, and the most bearish reporting a price target of just ¥3,530.0.

Want to know why a business with shrinking earnings and softer margins still earns an upgraded fair value and higher future multiple assumptions? The tension between declining top line expectations and a leaner, more profitable core drives this narrative. Curious which segment level shifts and buyback driven share count changes are doing the heavy lifting here? Dive in to see how modest revenue erosion can still translate into surprisingly resilient earnings power under a 5.74 percent discount rate.

Result: Fair Value of ¥5,270.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unusually resilient segment profits or stronger than expected buyback support could keep earnings and valuation multiples higher than this underappreciated narrative implies.

Find out about the key risks to this Nippon Yusen Kabushiki Kaisha narrative.

Another View: Multiples Send a Different Signal

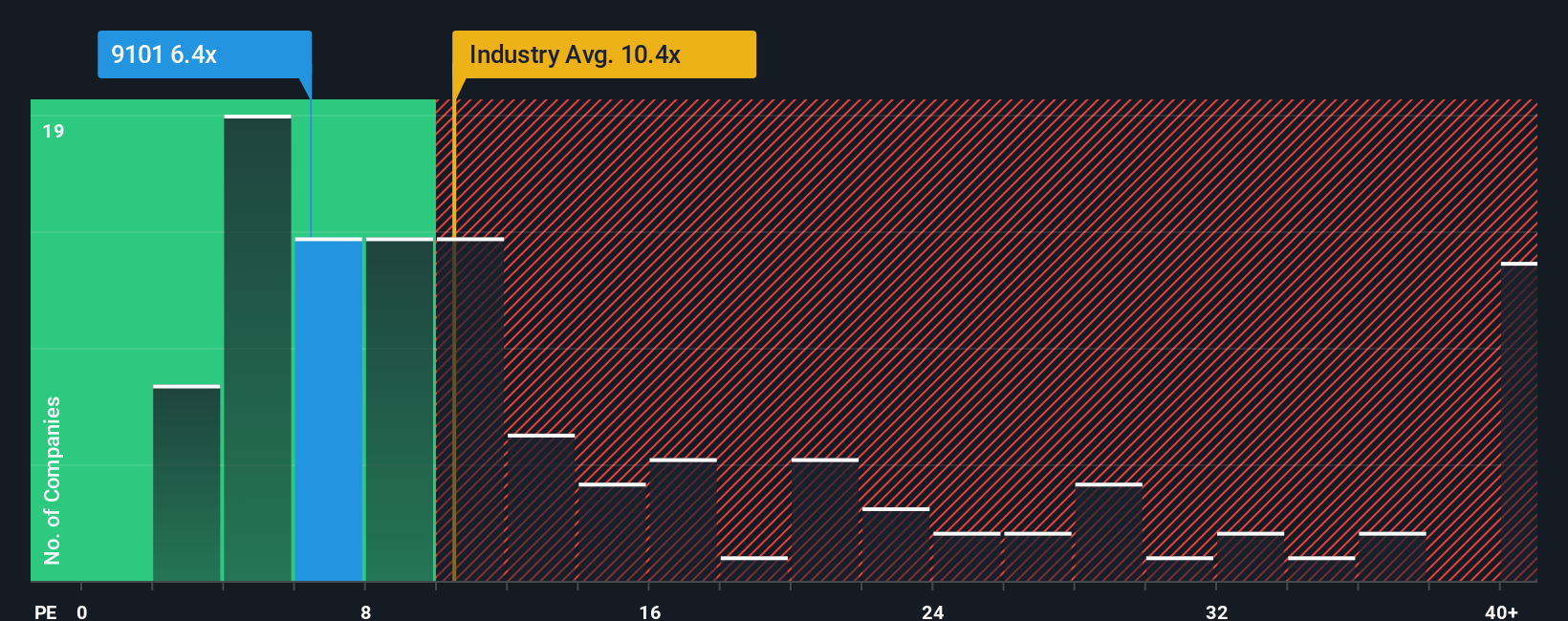

While the narrative model hints at upside, the plain P/E picture is less generous. At 6.4x earnings versus an industry 10.4x and a fair ratio of 12.2x, the gap suggests meaningful value but also raises questions about why the market remains this cautious.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nippon Yusen Kabushiki Kaisha for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nippon Yusen Kabushiki Kaisha Narrative

If you see the story differently or want to stress test the assumptions yourself, you can build a personalised view in just a few minutes: Do it your way.

A great starting point for your Nippon Yusen Kabushiki Kaisha research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before markets move without you, use the Simply Wall St Screener to line up your next opportunities and keep your watchlist packed with high conviction picks.

- Capture income potential by reviewing these 12 dividend stocks with yields > 3% to explore investments that can strengthen your portfolio with reliable cash flow.

- Position yourself for the next wave of innovation by scanning these 24 AI penny stocks shaping breakthroughs in automation and intelligent software.

- Capitalize on mispriced opportunities by checking these 914 undervalued stocks based on cash flows where market pessimism may have gone too far.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nippon Yusen Kabushiki Kaisha might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9101

Nippon Yusen Kabushiki Kaisha

Provides logistics services in Japan, North America, Asia, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion