- Japan

- /

- Transportation

- /

- TSE:9048

A Look at Nagoya Railroad (TSE:9048) Valuation Following New FY2026 Financial Guidance

Reviewed by Simply Wall St

Nagoya Railroad (TSE:9048) has just released its financial guidance for the fiscal year ending March 2026. The company has outlined new targets for operating revenues, income, and net profit. These updates often shape how investors view the company’s prospects.

See our latest analysis for Nagoya Railroad.

Nagoya Railroad’s updated guidance follows a year where momentum has been decidedly mixed. While the stock saw a 2.37% share price jump in the last day, the year-to-date share price return remains at -7.14%, and the total shareholder return over three and five years stands at -25.6% and -42.9% respectively. This signals that investors remain cautious about the long-term trajectory despite signs of near-term optimism.

If you’re weighing fresh opportunities as Nagoya Railroad sets its new financial course, it could be the perfect time to broaden your outlook and discover fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst price targets and signs of improving profitability, is Nagoya Railroad a hidden value play waiting to be discovered? Or is the market already factoring in its future growth potential?

Price-to-Earnings of 11.6x: Is it justified?

Nagoya Railroad trades at a price-to-earnings (P/E) ratio of 11.6x, which matches the average for Japan’s transportation sector but remains below its peer group average. With recent performance lagging and profit growth forecasts positive but not extraordinary, the market appears to be weighing the company’s steady earnings outlook against lingering sector uncertainties.

The P/E ratio compares a company’s share price to its earnings per share, providing investors with a common yardstick for valuation in capital-intensive sectors like transportation. For Nagoya Railroad, this figure suggests that investors are not pricing in significant future earnings acceleration at this time.

Relative to the broader transportation industry, Nagoya Railroad looks fairly valued. However, against its peers (who have a peer average P/E of 13.5x) and its own estimated fair P/E of 15.3x, the company appears attractively priced. This suggests that if market sentiment improves or profitability outpaces expectations, the stock price could move higher toward these comparative benchmarks.

Explore the SWS fair ratio for Nagoya Railroad

Result: Price-to-Earnings of 11.6x (UNDERVALUED)

However, persistent sector headwinds and the company's recent lackluster share price performance could limit upside, even if underlying fundamentals improve.

Find out about the key risks to this Nagoya Railroad narrative.

Another View: Discounted Cash Flow Tells a Different Story

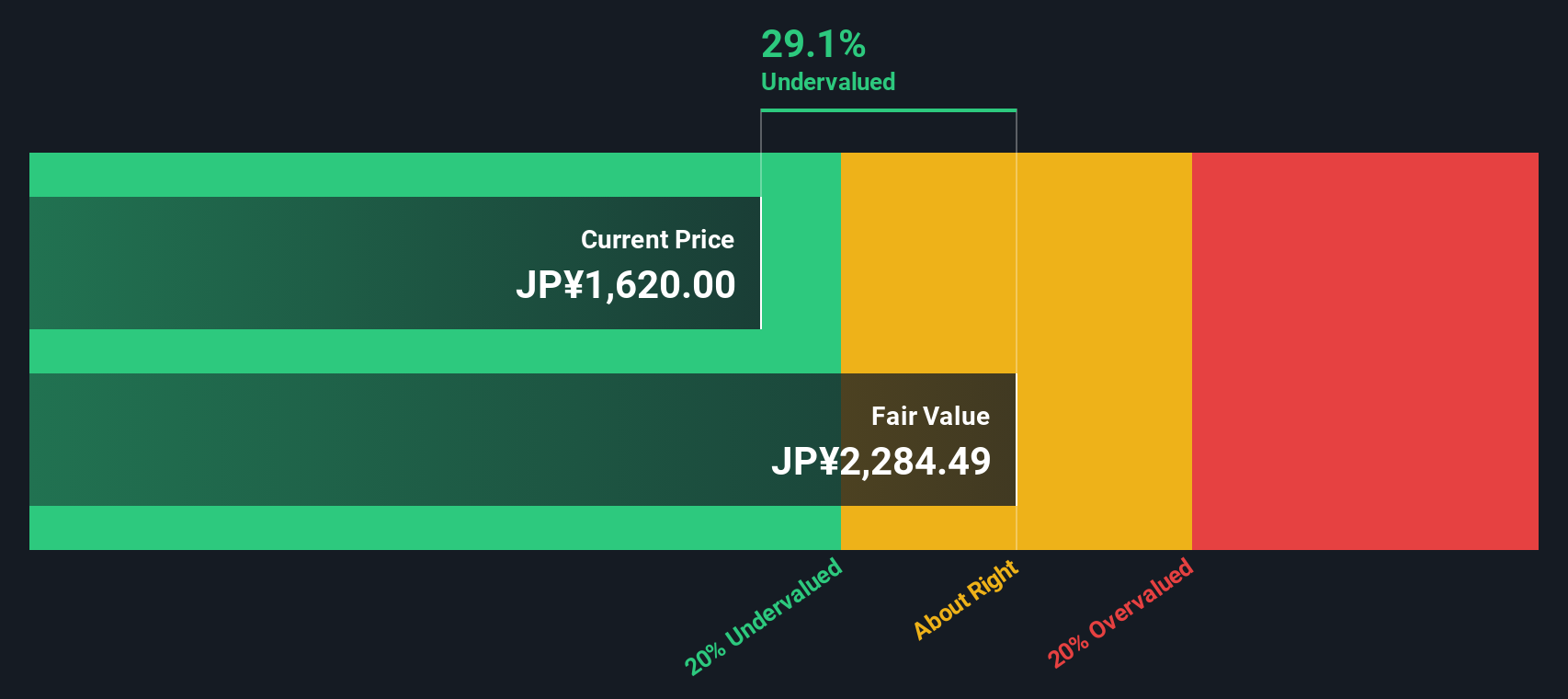

Looking from a different angle, the SWS DCF model suggests Nagoya Railroad shares are actually trading well below intrinsic value. At their current price, they sit around 29% under what our DCF analysis estimates as fair value. Could this signal deeper upside potential, or does it point to market skepticism for good reason?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nagoya Railroad for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 919 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nagoya Railroad Narrative

If you see things differently or want to dig deeper, you can explore the data and craft your own view in just a few minutes with Do it your way

A great starting point for your Nagoya Railroad research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Investment Opportunities?

Let your next winning idea find you. Expand your research and unlock smarter investment options with powerful screeners designed to identify tomorrow’s outliers before the crowd.

- Tap into rising market trends and access major returns with these 919 undervalued stocks based on cash flows, which spotlights companies priced below their cash flow potential.

- Get ahead of the curve by following innovation leaders. Select these 25 AI penny stocks to see which businesses are defining the future of artificial intelligence.

- Maximize your income by taking advantage of these 16 dividend stocks with yields > 3%, focused on stocks with proven yields above 3% for steady portfolio growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nagoya Railroad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9048

Good value second-rate dividend payer.

Market Insights

Community Narratives