- Japan

- /

- Transportation

- /

- TSE:9029

Higashi Holdings (TSE:9029) Profit Growth Surges 61%, Challenging Dividend Risk Concerns

Reviewed by Simply Wall St

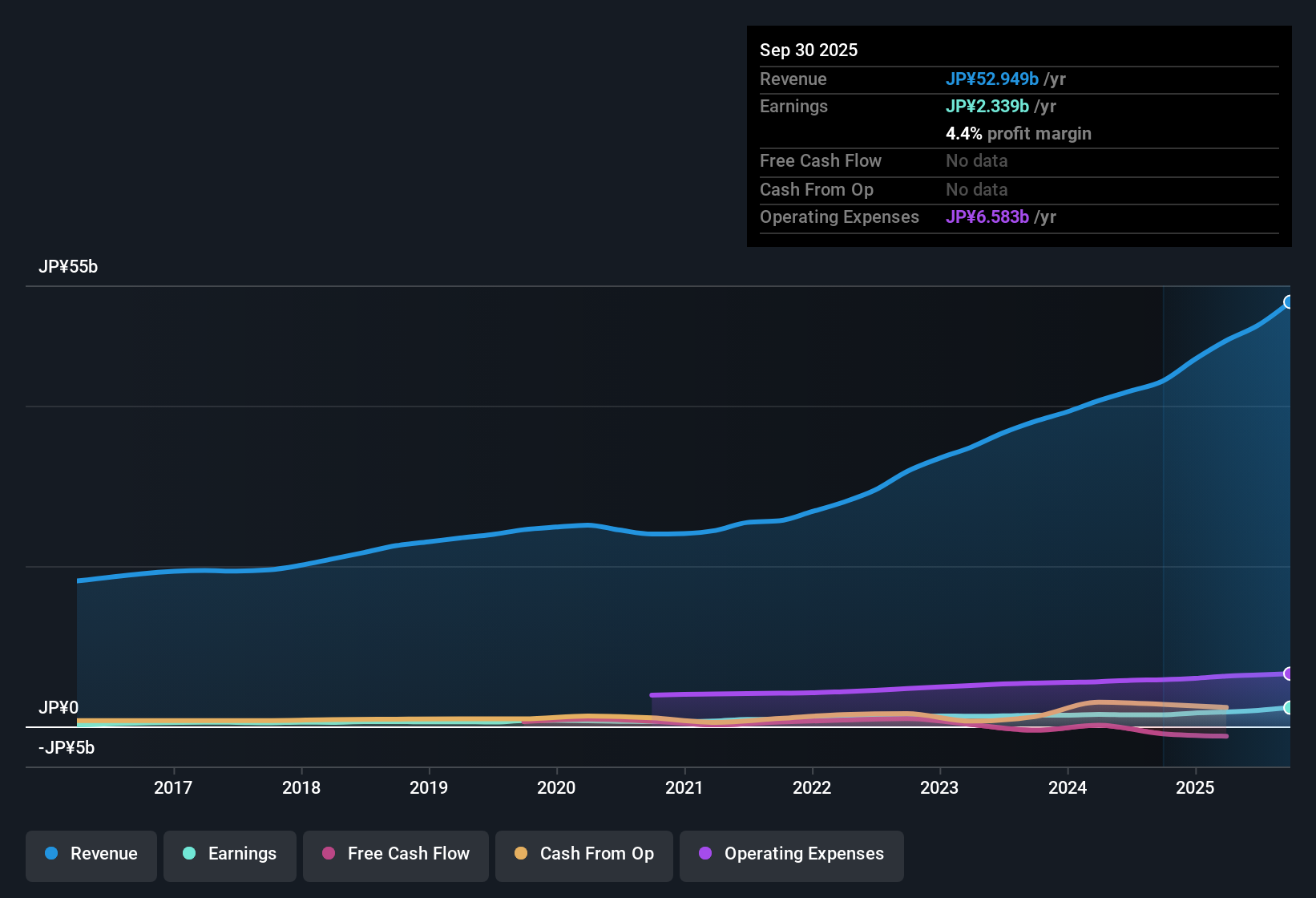

Higashi Holdings (TSE:9029) has posted standout earnings, with net profit rising by 61% in the past year and five-year profit growth averaging 21.8% per year. Net margins improved to 4.4%, up from last year's 3.4%, and high quality earnings underpin the results. With the current share price at ¥1,772 and profit growth outpacing historic averages, investors are watching closely to see if the momentum can continue in spite of some concerns about dividend sustainability.

See our full analysis for Higashi Holdings.Next, we will see how these numbers measure up against the widely held narratives and whether the latest results reinforce or challenge popular market views.

Curious how numbers become stories that shape markets? Explore Community Narratives

DCF Fair Value Sits Far Below Share Price

- Higashi Holdings’ current share price is ¥1,772, which is well above the DCF fair value estimate of ¥727.94. The company’s Price-to-Earnings ratio is 9.9x, below the industry average of 12.9x and peer average of 11.2x.

- Heavily supporting the view that Higashi is attractively valued versus its sector, bulls point to the below-average P/E ratio and strong five-year profit growth.

- The sizable DCF fair value gap, however, will likely draw debate over whether the premium to fair value is justified based on recent results.

- What is surprising is that even with double-digit annual profit growth, the market price still commands a major premium over intrinsic value. Bears may argue momentum is getting ahead of fundamentals.

Profit Margins Expand Despite Dividend Risk

- Net profit margins have risen year-on-year to 4.4%, up from 3.4% last year according to the latest results, a notable improvement even as concerns about future dividend sustainability persist.

- Bulls highlight the rapid acceleration in bottom-line performance, noting that margin expansion this year outpaces the multi-year average and underscores the quality of recent earnings.

- Critics highlight that the risk flagged on dividend sustainability now stands in greater contrast to the company’s robust operating improvements, an uncommon mix that complicates the positive narrative.

- Consensus narrative argues that while dividend concerns matter for income-focused investors, most will remain focused on the sustaining high profit growth and underlying margin trends.

Earnings Quality Holds Firm Over Five Years

- Profits have grown an average of 21.8% per year over the past five years, with high quality earnings reported in the latest period, extending a durable track record.

- Consensus narrative notes that consistent profit growth at this pace, together with quality metrics, is unusual even among peers. This suggests Higashi’s operational execution stands out.

- What is less clear is if momentum can be maintained as dividend risks create new tension with the company’s historic strengths. This indicates investors must weigh growth durability against payout uncertainty.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Higashi Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite impressive profit growth, Higashi Holdings faces ongoing doubts about the sustainability of its dividend. This presents risk for income-focused investors.

If dependable income is a priority, check out these 1995 dividend stocks with yields > 3% to identify companies with stronger, more reliable dividend yields and a better balance between growth and payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Higashi Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9029

Solid track record with excellent balance sheet.

Market Insights

Community Narratives