- Japan

- /

- Transportation

- /

- TSE:9020

Upward Guidance Revision Could Be a Game Changer for East Japan Railway (TSE:9020)

Reviewed by Sasha Jovanovic

- In late October 2025, East Japan Railway announced an upward revision of its earnings and dividend guidance for the fiscal year ending March 2026, now expecting operating revenues of ¥3.06 trillion, profits attributable to owners of ¥237.0 billion, and a second-quarter dividend of ¥35 per share.

- The company cited increased passenger revenues and other positive operational factors as key reasons for this updated outlook, signaling stronger-than-anticipated performance across its core and ancillary businesses.

- With improved forecasts driven by higher passenger revenues, we'll examine how this guidance revision may influence East Japan Railway's investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

East Japan Railway Investment Narrative Recap

To be a shareholder in East Japan Railway, you need to believe in the ongoing recovery and resilience of passenger revenues, especially in Japan's core urban corridors, and the company's ability to manage costs as rail and non-rail segments rebound. The recent upward revision of earnings guidance highlights short-term strength in passenger growth, but the key catalyst, Tokyo commuter and Shinkansen recovery, remains dominant, while persistent fixed cost pressures still pose the biggest risk to margins. For now, this revised outlook signals incremental rather than transformational change.

Among the company's latest announcements, the increase in the second-quarter dividend to ¥35 per share reflects management's confidence in near-term cash flow and operational results. This boost aligns with the stronger passenger revenue backdrop and should interest investors tracking income sustainability, especially when paired with improved earnings guidance and ongoing non-rail diversification.

By contrast, even as recent results show improvement, investors should be aware of fixed cost growth continuing to...

Read the full narrative on East Japan Railway (it's free!)

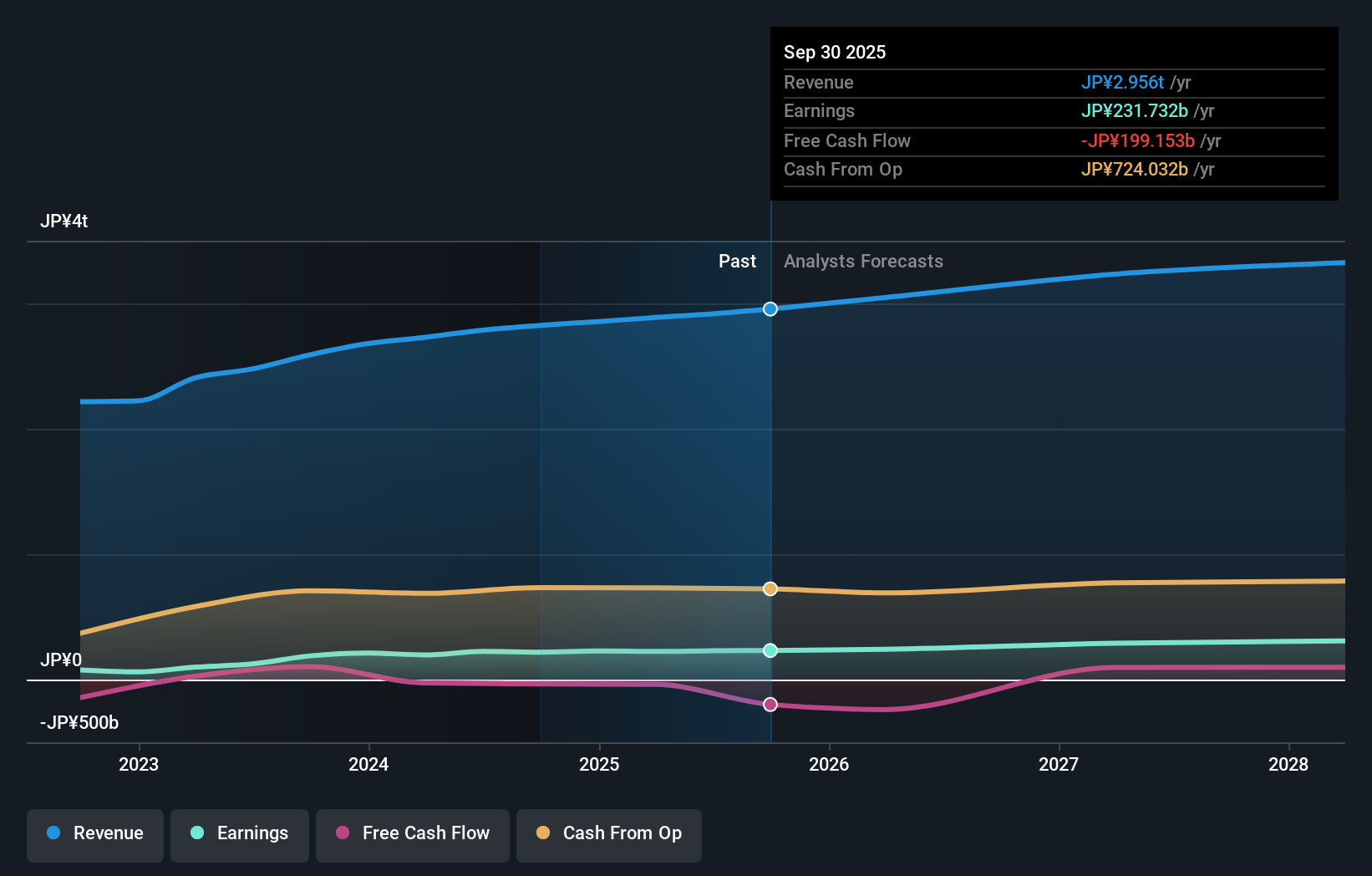

East Japan Railway's narrative projects ¥3,318.3 billion revenue and ¥298.0 billion earnings by 2028. This requires 4.4% yearly revenue growth and a ¥68.3 billion earnings increase from ¥229.7 billion today.

Uncover how East Japan Railway's forecasts yield a ¥3748 fair value, in line with its current price.

Exploring Other Perspectives

Two retail members of the Simply Wall St Community estimate East Japan Railway’s fair value between ¥1,383 and ¥1,798 per share. While rising passenger revenues support higher corporate forecasts, opinions on future earnings and risks remain widely spread so consider a range of viewpoints before making up your mind.

Explore 2 other fair value estimates on East Japan Railway - why the stock might be worth less than half the current price!

Build Your Own East Japan Railway Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your East Japan Railway research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free East Japan Railway research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate East Japan Railway's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if East Japan Railway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9020

East Japan Railway

Operates as a passenger railway company in Japan and internationally.

Acceptable track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives