- Japan

- /

- Transportation

- /

- TSE:9001

There Is A Reason Tobu Railway Co., Ltd.'s (TSE:9001) Price Is Undemanding

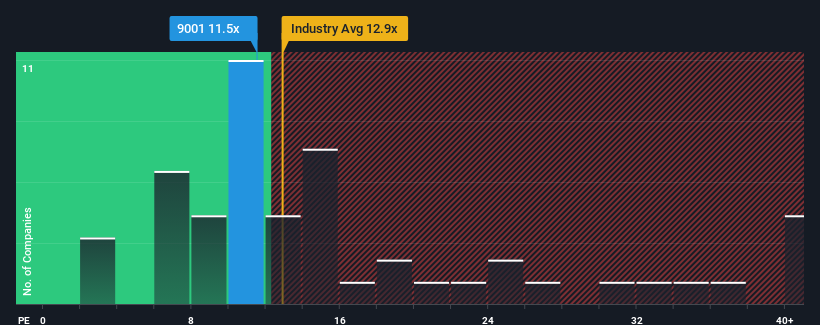

With a price-to-earnings (or "P/E") ratio of 11.5x Tobu Railway Co., Ltd. (TSE:9001) may be sending bullish signals at the moment, given that almost half of all companies in Japan have P/E ratios greater than 15x and even P/E's higher than 22x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings growth that's superior to most other companies of late, Tobu Railway has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Tobu Railway

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Tobu Railway's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 66% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 0.6% each year as estimated by the four analysts watching the company. Meanwhile, the broader market is forecast to expand by 9.5% each year, which paints a poor picture.

With this information, we are not surprised that Tobu Railway is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Tobu Railway's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Tobu Railway's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 3 warning signs for Tobu Railway (2 are concerning!) that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Tobu Railway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9001

Good value with proven track record.

Market Insights

Community Narratives