- Japan

- /

- Wireless Telecom

- /

- TSE:9984

SoftBank Group (TSE:9984): Examining Valuation After Recent Share Price Decline

Reviewed by Simply Wall St

See our latest analysis for SoftBank Group.

This latest slide in SoftBank Group’s share price, now down over 18% for the past month, puts a dent in the year’s strong run. Yet, it is important to remember the longer-term story: momentum is still impressive, with the 1-year total shareholder return topping 117%. Short-term volatility is apparent, but the broader picture continues to capture investors’ attention.

If SoftBank’s recent swing has you curious about broader opportunities, now is a good moment to discover fast growing stocks with high insider ownership.

With such swings in performance and the stock still trading nearly 20% below analyst price targets, the key question is whether SoftBank Group is undervalued at current levels or if the market has already accounted for future growth.

Most Popular Narrative: 16% Undervalued

SoftBank Group's most followed narrative pegs its fair value well above the last close, pointing to substantial upside potential from today’s share price. With only a modest gap between the recent market volatility and this calculated target, investors are watching the growth story closely for confirmation.

The prevailing narrative centers on AI adoption as an unstoppable growth engine across industries, but high valuations now may ignore the risk that normalization of interest rates and tighter funding could compress multiples for high-growth, capital-intensive private tech ventures. This could lead to lower Vision Fund investment returns and potential write-downs, reducing net margins and earnings stability.

Want to know the formula behind this aggressive price target? The narrative banks on a future profit multiple and a financial runway that’s rare for most telecoms. Curious what bold projections are baked in? The big numbers fuelling this view might surprise you.

Result: Fair Value of ¥22,477 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, SoftBank's reliance on AI hype and heavy leverage means that regulatory changes or slow IPO markets could quickly undercut these optimistic projections.

Find out about the key risks to this SoftBank Group narrative.

Another View: What Does the SWS DCF Model Suggest?

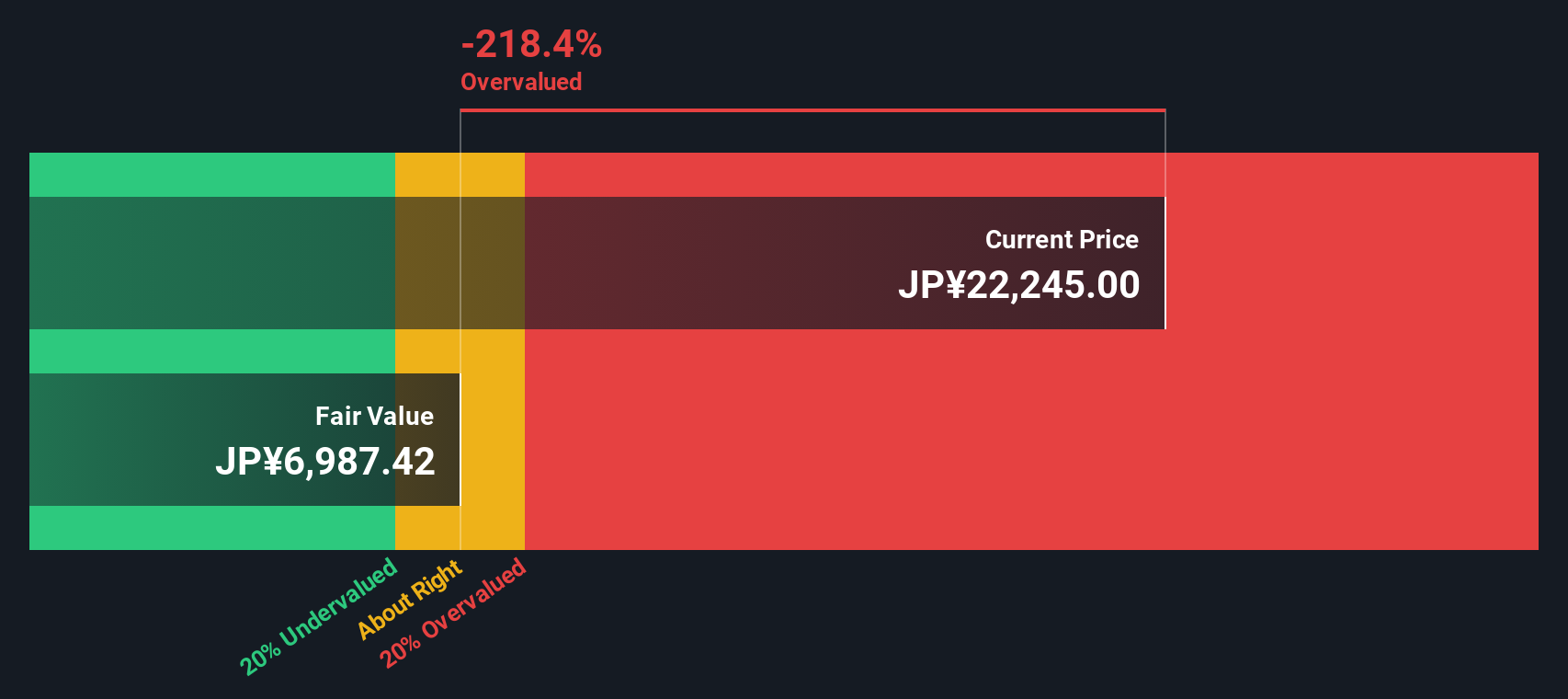

Taking a step back from analyst targets, our DCF model suggests a fair value of ¥18,307 for SoftBank Group. This price is notably lower than the current share price and the consensus estimate. This raises a big question: Is the market factoring in more growth than what fundamentals predict?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SoftBank Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 894 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SoftBank Group Narrative

If the numbers or forecasts here don't quite match your outlook, you can dive into the details yourself and shape your own view in just a few minutes with Do it your way.

A great starting point for your SoftBank Group research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let a single stock define your portfolio. Use these tailored screeners to open the door to untapped opportunities and sharpen your investing strategy right now.

- Capture reliable income potential by checking out these 18 dividend stocks with yields > 3%, where leading companies deliver consistent yields above 3%.

- Ride the artificial intelligence wave by seeing these 27 AI penny stocks, with growth stories that could transform entire industries.

- Position yourself for the next market breakthrough by targeting value with these 894 undervalued stocks based on cash flows, which are priced below their cash flow expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9984

SoftBank Group

Provides telecommunication services in Japan and internationally.

Proven track record with slight risk.

Similar Companies

Market Insights

Community Narratives