- Japan

- /

- Wireless Telecom

- /

- TSE:9984

SoftBank Group Corp. (TSE:9984) Stocks Pounded By 27% But Not Lagging Industry On Growth Or Pricing

To the annoyance of some shareholders, SoftBank Group Corp. (TSE:9984) shares are down a considerable 27% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 32% in that time.

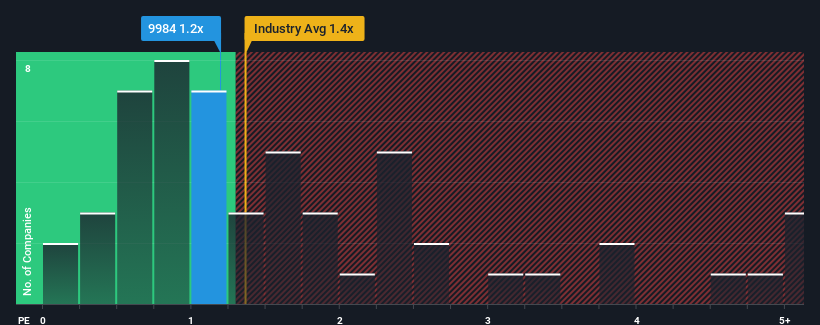

Although its price has dipped substantially, there still wouldn't be many who think SoftBank Group's price-to-sales (or "P/S") ratio of 1.2x is worth a mention when the median P/S in Japan's Wireless Telecom industry is similar at about 1.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for SoftBank Group

What Does SoftBank Group's Recent Performance Look Like?

There hasn't been much to differentiate SoftBank Group's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

Keen to find out how analysts think SoftBank Group's future stacks up against the industry? In that case, our free report is a great place to start .How Is SoftBank Group's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like SoftBank Group's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 5.4%. Revenue has also lifted 16% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue should grow by 4.6% each year over the next three years. That's shaping up to be similar to the 6.1% each year growth forecast for the broader industry.

In light of this, it's understandable that SoftBank Group's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From SoftBank Group's P/S?

SoftBank Group's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that SoftBank Group maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Having said that, be aware SoftBank Group is showing 4 warning signs in our investment analysis, and 3 of those are a bit unpleasant.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9984

SoftBank Group

Provides telecommunication services in Japan and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success