- Japan

- /

- Telecom Services and Carriers

- /

- TSE:9432

Will NTT’s (TSE:9432) Major Buyback and Mobility Launch Shift Its Strategic Direction?

Reviewed by Sasha Jovanovic

- NTT recently announced a share repurchase of 325,895,400 shares during October 2025 and a second-quarter dividend increase to ¥2.65 per share, scheduled for payment on November 28, 2025.

- NTT also plans to launch a new entity, NTT Mobility, in December, marking its entry into autonomous driving services as it expands its integrated ICT business.

- We'll explore how NTT’s major share buyback program could influence its investment outlook amid moves into new technology sectors.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

NTT Investment Narrative Recap

To own NTT stock, you have to believe its transition into higher-growth technology sectors, like data centers and integrated ICT, is strong enough to offset persistent pressure in legacy and mobile communication revenues. The recent announcement of another major share repurchase and a modest dividend hike is supportive for shareholder returns, but does not meaningfully change the immediate risk that ongoing margin compression in the core telecom segment could cap near-term earnings momentum.

Among this week’s developments, NTT’s planned launch of NTT Mobility stands out. It signals continued expansion beyond legacy telecoms and provides another potential avenue for long-term diversification, but the most important short-term catalyst remains the company’s ability to stabilize profitability in its core Japanese mobile business amid intense competition.

In contrast, while the story is shifting toward innovation, investors should also be aware of how sustained declines in DOCOMO’s mobile revenues could...

Read the full narrative on NTT (it's free!)

NTT's narrative projects ¥15,111.0 billion in revenue and ¥1,245.9 billion in earnings by 2028. This requires 3.3% annual revenue growth and a ¥260.3 billion earnings increase from the current ¥985.6 billion.

Uncover how NTT's forecasts yield a ¥179 fair value, a 19% upside to its current price.

Exploring Other Perspectives

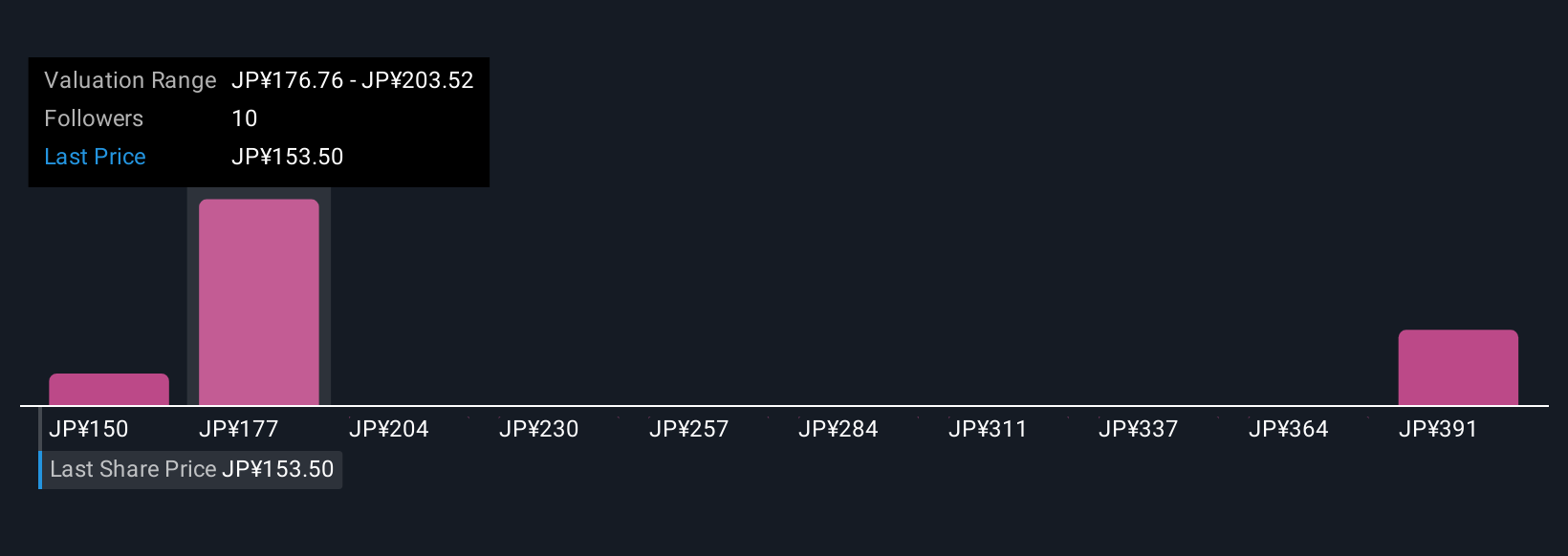

Four members of the Simply Wall St Community estimate NTT’s fair value between ¥150 and ¥328, reflecting a wide range of private investor outlooks. While you consider these differing perspectives, keep in mind that continued margin pressure in NTT’s core operations could influence outcomes for both current and future shareholders.

Explore 4 other fair value estimates on NTT - why the stock might be worth over 2x more than the current price!

Build Your Own NTT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NTT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NTT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NTT's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NTT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9432

NTT

Operates as a telecommunications company in Japan and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives