- Japan

- /

- Telecom Services and Carriers

- /

- TSE:9432

Does NTT's (TSE:9432) Modest Dividend Hike Reflect Strategic Confidence or Conservative Capital Allocation?

Reviewed by Sasha Jovanovic

- NTT, Inc. recently announced an increase in its second quarter dividend to ¥2.65 per share for the fiscal year ending March 31, 2026, compared to ¥2.60 a year earlier, with payments scheduled for November 28, 2025.

- This incremental dividend hike highlights management's confidence in NTT's financial position and signals a focus on rewarding shareholders through steady capital returns.

- We'll examine how NTT's decision to raise its dividend payout may influence its investment narrative and perceived financial strength.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

NTT Investment Narrative Recap

To be a shareholder in NTT, you generally need to believe in the company’s ability to capture long-term growth from digital infrastructure expansion, technology innovation, and operational streamlining, all while overcoming headwinds in its mature domestic telecom businesses. The recent dividend increase, while signaling steady management confidence, is minor and does not appear to alter the most important short-term catalyst: capturing profit growth from data center and high-value service expansion. The biggest risk remains persistent margin pressure in the core DOCOMO mobile business, and the dividend change does not materially affect this issue.

Among its recent moves, NTT’s large-scale share buyback program, completed in October 2025 and accounting for 0.27% of shares outstanding, stands out due to its relevance to capital returns and investor sentiment. Like the dividend hike, buybacks can support shareholder value, but both are only sustainable if underlying cash flows remain healthy and margin compression is contained, especially amid rising capital expenditures required for next-generation network investments.

In contrast, investors should be aware that pressures from DOCOMO’s declining service revenues and rising costs could ultimately put dividend growth at...

Read the full narrative on NTT (it's free!)

NTT's narrative projects ¥15,111.0 billion revenue and ¥1,245.9 billion earnings by 2028. This requires 3.3% yearly revenue growth and an earnings increase of ¥260.3 billion from ¥985.6 billion today.

Uncover how NTT's forecasts yield a ¥179 fair value, a 17% upside to its current price.

Exploring Other Perspectives

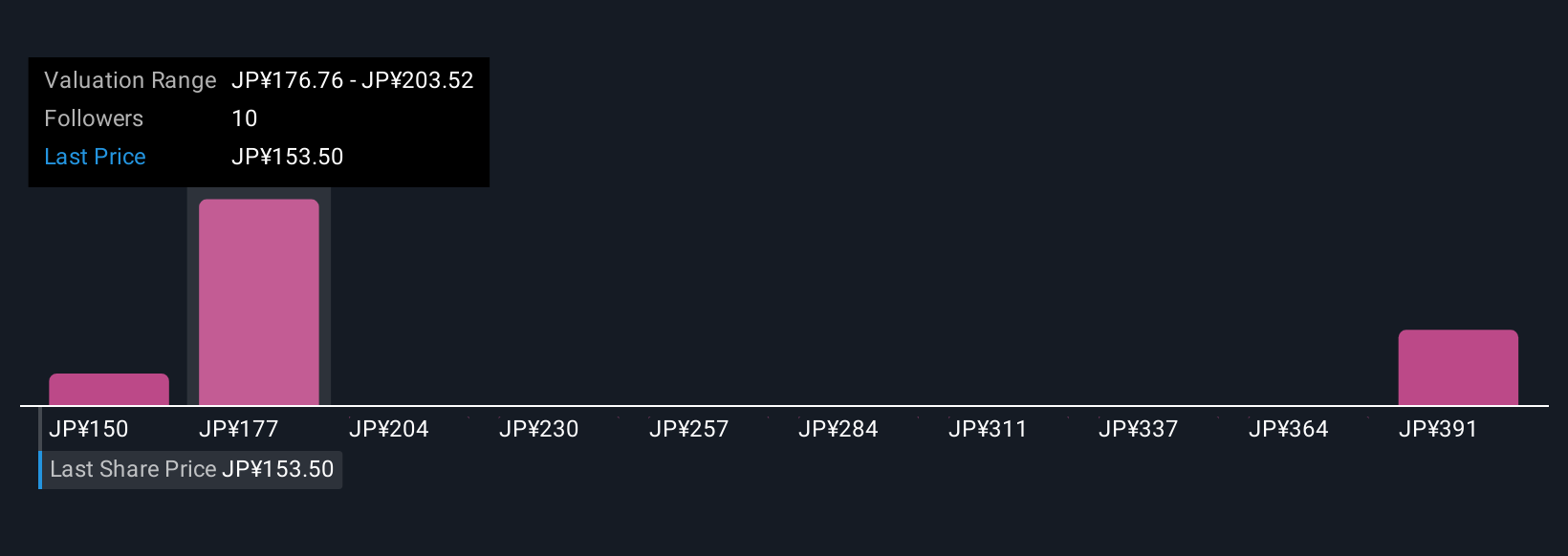

Four fair value estimates from the Simply Wall St Community for NTT stock span from ¥150 to ¥322,294, highlighting wide differences in outlook. With margin pressure in DOCOMO as a key risk, consider how different market participants view the financial strength required for future shareholder payouts.

Explore 4 other fair value estimates on NTT - why the stock might be worth just ¥150!

Build Your Own NTT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NTT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NTT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NTT's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NTT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9432

NTT

Operates as a telecommunications company in Japan and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives