- Japan

- /

- Telecom Services and Carriers

- /

- TSE:5580

Prodelight Co.,Ltd. (TSE:5580) Shares May Have Slumped 31% But Getting In Cheap Is Still Unlikely

Prodelight Co.,Ltd. (TSE:5580) shares have had a horrible month, losing 31% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 36% in that time.

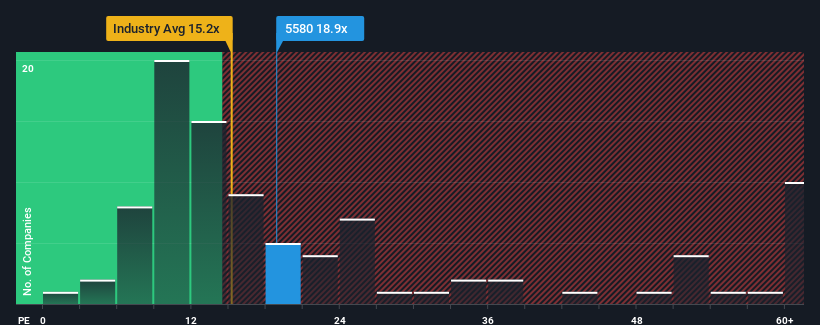

In spite of the heavy fall in price, ProdelightLtd's price-to-earnings (or "P/E") ratio of 18.9x might still make it look like a sell right now compared to the market in Japan, where around half of the companies have P/E ratios below 13x and even P/E's below 9x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

For instance, ProdelightLtd's receding earnings in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for ProdelightLtd

Is There Enough Growth For ProdelightLtd?

The only time you'd be truly comfortable seeing a P/E as high as ProdelightLtd's is when the company's growth is on track to outshine the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 9.5%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 22% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 10% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that ProdelightLtd is trading at a P/E higher than the market. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

Despite the recent share price weakness, ProdelightLtd's P/E remains higher than most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that ProdelightLtd currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you settle on your opinion, we've discovered 2 warning signs for ProdelightLtd (1 is a bit concerning!) that you should be aware of.

If you're unsure about the strength of ProdelightLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5580

Adequate balance sheet with low risk.

Market Insights

Community Narratives