- Japan

- /

- Telecom Services and Carriers

- /

- TSE:4439

Market Participants Recognise Toumei Co.,Ltd.'s (TSE:4439) Earnings Pushing Shares 37% Higher

Despite an already strong run, Toumei Co.,Ltd. (TSE:4439) shares have been powering on, with a gain of 37% in the last thirty days. The annual gain comes to 169% following the latest surge, making investors sit up and take notice.

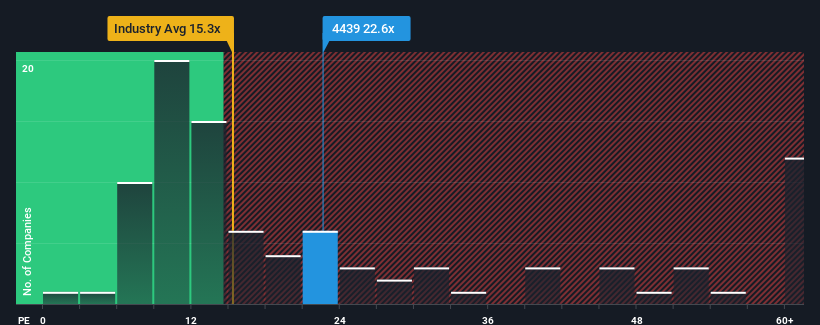

After such a large jump in price, ToumeiLtd may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 22.6x, since almost half of all companies in Japan have P/E ratios under 13x and even P/E's lower than 9x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With earnings growth that's superior to most other companies of late, ToumeiLtd has been doing relatively well. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for ToumeiLtd

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like ToumeiLtd's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 34% gain to the company's bottom line. Pleasingly, EPS has also lifted 452% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 20% per annum during the coming three years according to the sole analyst following the company. With the market only predicted to deliver 10% per year, the company is positioned for a stronger earnings result.

With this information, we can see why ToumeiLtd is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

ToumeiLtd's P/E is flying high just like its stock has during the last month. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that ToumeiLtd maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 1 warning sign for ToumeiLtd that we have uncovered.

You might be able to find a better investment than ToumeiLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if ToumeiLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4439

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026